The International Monetary Fund (IMF) executive board is due to meet on Friday to approve a US$600million rescue loan payout to Ghana, three sources have told Reuters, after the country reached a deal to restructure US$5.4billion of official creditor debt.

The board date is expected to be published in the IMF’s public calendar on Tuesday, one of the sources said. All the sources requested anonymity to speak on sensitive matters.

Ghana struck a deal with its bilateral lenders, including China and France, late last week – a key step to unlocking the second tranche of IMF funding under a US$3billion bailout.

Ghana’s finance ministry and the IMF did not immediately reply to a request for comment.

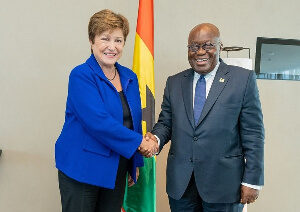

IMF Managing Director Kristalina Georgieva welcomed the debt deal agreement on Friday, saying it clears the path for the executive board’s first review of Ghana’s programme.

A sign-off by the board is usually seen as a formality once a date has been agreed.

The country defaulted on most external debt in December 2022 after servicing costs soared.

It also needs to reach a relief deal with private holders of about US$13billion in international bonds.

The bonds rose almost 1 cent on the dollar on Monday – with the 2042 maturity up the most, climbing 0.82 cents to 43.09 cents; its highest level since early November.

“Recently, China encouraged all parties to overcome technical difficulties and narrow differences, and finally led all parties to reach a basic consensus on Ghana’s debt settlement plan on January 8,” Chinese Foreign Ministry spokesperson Mao Ning said on Monday.

Some members of the Official Creditor Committee, which is co-chaired by China and France, are still “going through their internal procedures” she told reporters at a regular news briefing.

Ghana is aiming to restructure US$20billion of external debt, which totalled about US$30billion at the end of 2022 under the Common Framework – a debt restructuring process set up by the G20 countries during the COVID-19 pandemic. It has targetted cutting US$10.5billion from payments due between 2023-2026.

The IMF second tranche payout, once signed-off, should also trigger US$550million in additional World Bank funding, Ghana’s finance ministry said last week Friday.

Government reached an agreement with its Official Creditors, under the G20 Common Framework, on a comprehensive Debt Treatment Beyond the Debt Service Suspension Initiative. Following successful completion of the Domestic Debt Exchange Programme (DDEP) in 2023, this development constitutes a significant positive step toward restoring Ghana’s long-term debt sustainability said a Ministry of Finance statement on Saturday

This agreement with Official Creditors paves the way for IMF Executive Board approval of the first review of the Fund-supported programme – allowing for the next IMF financing tranche of US$600million to be disbursed. The IMF Board Approval should also trigger World Bank Board consideration of US$300million Development Policy Operation (DPO) financing. In addition, the World Bank is expected to support the Ghana Financial Stability Fund with US$250million to help address impacts of the Domestic Debt Exchange Programme (DDEP) on the financial sector. These disbursements are key for Ghana’s economic recovery and ambitious reform agenda.

The statement said Ghana has indeed turned the corner, as evidenced by:

i. The decline of inflation to 23.2% in December 2023 from 54.2% in December 2022;

ii. Relative strong performance of the Ghana cedi – which reported a marginal depreciation of 7.2% between February and December 2023, compared to 28.4% during the same period in 2022; iii. Overall real GDP growth of 2.8% for the first three quarters of 2023, higher than the 2023 initial GDP growth target of 1.5%.

The agreement with Official Creditors will support ongoing engagements with Ghana’s commercial creditors, including bondholders. Government remains committed to reaching an agreement with its commercial creditors as soon as possible, and takes this opportunity to thank all stakeholders. The Ministry of Finance hereby reiterates its commitment to restoring Ghana’s long-term debt sustainability and strengthening macroeconomic stability, the statement ended.