By Francis OSEI-KUFFOUR(Dr), Isaac NYAME(Dr), &Richard Ofosu Acheampong3

Sunyani Municipality tops all! Congratulations to Sunyani Municipal Assembly for emerging as the best district in the 2023 Ghana District League Table (GDLT) as revealed by the National Development Planning Commission (2024), overpowering other Municipal giants.

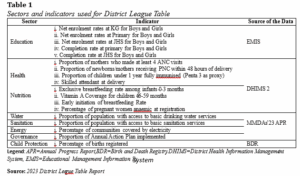

The Assembly scored 94.2 percent when the 261 districts were assessed based on eighteen (18) indicators across eight (8) sectors, which comprised education, health, child protection, nutrition, water, sanitation, energy and governance as tools for tracking national development at the districts (Adejoke, 2023; Ghana News Agency, 2023; Ngnenbe, 2023).

Central Gonja was the least performed Assembly with a score of 31.2 percent. Details of the assessment criteria are as shown in the table below.

According to the National Development Planning Commission (NDPC), United Nations Children’s Fund (UNICEF), and the Ghana Center for Democratic Development (CDD-Ghana), the GDLT highlights progresses and inequalities in social development among districts and provides stakeholders the basis for achieving better outcomes through the generation of appropriate district level data and analysis (NDPC, 2024, 2023, 2022, 2021; UNICEF & CDD-G, 2020).

Though the GDLT is seen as a catalyst for national and local development and aids the identification of gaps in the progress towards sustainable development goals (SDGs), the assessment criteria seemed to be missing one major ingredient; revenue mobilization performance data among the MMDAs.

The 2022 GDLT report recommended an increase in the proportion of the District Assembly Common Fund (DACF) and regular release of same to facilitate the delivery of Assemblies’ mandate and development programmes.

The report was, however, silent on how much each Assembly generated to supplement their share of the DACF.

Osei-Kuffour et al (2023) published ‘Property Valuation, Rate Imposition and Rate Collection: A symbiosistical indispensability of GRA, MMDAs and LVD in property rate revenue mobilization’ in the 3904 edition of the Business and Financial Times.

In discussing property rate valuation, imposition and collection in Ghana, the article highlighted the limitation in accessing local-governments revenue mobilization data in many African countries including Ghana.

The Authors, therefore, recommended the collation and publication of year-on-year property rate revenue performance statistics from all the 261 Assemblies to aid future research and facilitate insightful analysis and sustainable recommendations from experts.

A cursory look at the GDLT’s performance indicators, on which the Assemblies were assessed and ranked, depicts the absence of local-governments’ revenue mobilization performance, resonating the challenge in the production of revenue generation data among the Assemblies.

Various national budgets, as published for stakeholders’ consumption, do not disclose Assembly-by-Assembly revenue mobilization. The 2022 annual report of the Ghana Revenue Authority (GRA, 2023) made no mention of revenues generated by MMDAs, perhaps due to jurisdictional mandate.

The 2023 Local Government Services (LGS) report indicated total MMDAs revenue of GH₵2.457trillion (LGS, 2024). The 2019 report cited lack of revenue mobilization database as one of LGS numerous challenges. This challenge did not appear in the 2024 report, suggesting that revenue mobilization databases have been established at the MMDAs.

However, detailed revenues mobilized by each Assembly were not provided, perhaps reiterating the limitation in accessing local governments’ financial data in terms of revenue mobilization. According to the Auditor-General’s report for 2022, MMDAs mobilized internally generated non-tax funds of GH₵536.44million in 2022 (A-G, 2023).

The highest classification of non-tax revenue for local governments came from the Kumasi Metropolitan Assembly (GH₵23.77million) and the lowest from Yunyoo Nasuan District Assembly (GH₵0.047million).

A recent social media post on Chartered Institute of Taxation Ghana (CITG) Members’ Whatsapp Platform from Information Services Department indicated that the Government of Ghana has directed that GRA will no longer be responsible for collecting property tax because the function will return to MMDAs to strengthen fiscal decentralization and improve local revenue mobilization.

Graphic Online confirmed the post (Ngnenbe, 2025). Some revenue and tax professionals hailed this initiative with the believe that MMDAs are better placed to value, impose and collect property rates in Ghana.

A revenue performance report from City of Cape Town Metropolitan Municipality in South Africa quickly surfaced on the platform, indicating that in 2023/24, the Municipality collected R11,976 trillion from property rates.

Members envisaged seeing such performance reports from our MMDAs to reduce their overreliance on the insufficient District Assembly Common Fund (DACF).

Successful improvements and removal of inequalities in social development among MMDAs for better outcomes depend, to a large extent, on IGFs which, according to LGS, constitute a critical revenue source for MMDAs in cases of delayed Central Government transfers (LGS, 2020).

In a bid to enable governments gain better understanding of wellbeing across MMDAs and provide evidence and basis for more equitable resource allocation and social investment to reduce disparities (GDLT, 2022), embedding revenue mobilization performances across MMDAs as part of a holistic assessment for ranking on the district league table, will be helpful.

Conclusion

The goal to generate appropriate district level data and make recommendations with key messages to engender policy dialogue and actions towards reducing inequalities and leaving no child behind in achieving the sustainable development goals is highly appreciated. The authors fully support the league table system in evaluating the performance of MMDAs.

However, embedding MMDAs revenue mobilization performance as one of the indicators (by increasing the indicators to 19) will help provide financial data which will equally engender policy dialogue in resource mobilization and usage in meeting various SDGs.

It is believed that adequate revenue mobilization will help reduce resource allocation inequalities and no child will be left behind.

Improved economic growth depends on available and accurate revenue mobilization figures and performances as recorded in MMDAs’ books and verified by the Auditor General.

God Bless Our Homeland Ghana!

References

Auditor-General Report (2023). Report of the Auditor-General on the public accounts of Ghana (General Government) for the year ended 31 December 2022. https://audit.gov.gh/files/ audit_ reports/Report_ of_the_Auditor-General_on_the_public_ accounts_of_Ghana_ (General_ Government)_for_the_year_ended_31_December_2022.pdf

Ghana Revenue Authority (2023). GRA 2022 annual report. https://www.gra.gov.gh

Local Government Services (2024). 2023 annual progressive report. https://lgs.gov.gh/reports/

National Development Planning Commission (2023). 2022 District League Table Report. https://www.ndpc.gov.gh

National Development Planning Commission (2022). 2021 District League Table Report. https://www.ndpc.gov.gh

National Development Planning Commission (2021). 2020 District League Table Report. https://www.ndpc.gov.gh

Ngnenbe, T. (2025, May 20). Collection of property tax to be decentralised – Minister.

https://www.graphic.com.gh/news/general-news/ghana-news-collection-of-property-tax-to-be-decentralised-minister.htm

Ngnenbe, T. (2023, December 15). 2022 District League Table – Korle-Klottey tops all. https://www.graphic.com.gh/news/general-news/ghana-news-2022-district-league-table-korle-klottey-tops-all.html

Osei-Kuffour, F., Nyame, I., & Acheampong, O.R. (2023, September 19). Property valuation, rate imposition and collection. https://thebftonline.com/2023/09/19/property-valuation-rate-imposition-and-collection/

UNICEF., &CDD-G. (2020). 2018/2019 District League Table Report. https://www.unicef.org/ ghana

Dr. Francis Osei-Kuffour is the Director of Internal Audit, Valley View University. Dr. Isaac Nyame is the Managing Partner, Ikern & Associates and Mr. Richard Ofosu Acheampong is a Partner, Ikern & Associates