By Elliot WILLIAMS

Insurance companies in Ghana remain pivotal in the delivery of tailor-made products to financially support the needs of individuals and corporate entities in the event of insured risks crystallising.

Indeed, insurance is the backbone of many economies in the world. The growth of insurance companies in Ghana has since been plagued by a stagnant penetration rate, which stands at about 1%.

The insurance penetration rate is a measure of the industry’s life and non-life contributions to the country’s GDP. This has become a major concern for key stakeholders. As renewed efforts are being made to drive the rate higher, Dr. Abiba Zakariah , the Commissioner of Insurance (ag.) has taken a firm lead at ensuring that all major stakeholders are part of the product design, distribution and claims processes.

Courtesy Calls on National Executives of the major Transport Unions

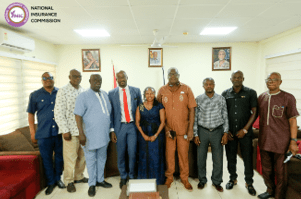

In her quest to draw closer to some of these stakeholders, the Commissioner of Insurance (ag.) paid a courtesy call on the leaderships of the National Executives of the General Transport, Petroleum and Chemical Union (GTPCWU) and the National Executives of the Ghana Private Roads Transport Union (GPRTU) of the Ghana Trades Union Congress (TUC).

Dr. Zakariah together with her Deputy Commissioner of Insurance, Mr Bernard Ohemeng Baah expressed gratitude to the two major transport unions for their continuous strategic support to the industry over the years.

The initial deliberations touched briefly, on how the industry has resolved to work with these Unions for a more productive approach.

Dr. Zakariah announced to the leadership of the Unions that each one would have a Representative on a recently constituted Committee on Insurance Penetration. These, among others would not only synergise the way the parties would work together but would also present them with an opportunity to share each other’s expectations with the view to growing insurance in Ghana and improving the insurance penetration in the long run.

In his response, the 1st Trustee of the GPRTU, Dr. Jacob Odae who spoke on behalf of the National Chairman thanked the Commission for visiting. This gesture, they saw as an indication of how much regard and recognition the Commission has for the transport unions as major stakeholders.

Dr. Odae explained that a collective approach of this nature would not only be a matter of offering products on sale but also present them the opportunity of being part of the process in fine-tuning the products to meet their specific and peculiar needs. This will at the same time make insurance companies understand better the public expectations of their products and services instead of the traditional practice of applying the rule books in the events of insured events occurring.

Meanwhile the Chairman of the General Transport, Petroleum and Chemical Workers Union (GPTPCWU), Mr Bernard Owusu shared same sentiments and made a clarion call on the NIC to let their regulated entities include in all policy documents contacts of the regulator. This would allow disgruntled members of the insuring public have immediate responses to their concerns on the settlement and payment of insurance claims.

The NIC Executives met the following: Mr Bernard Owusu, Chairman of the GTPCWU, Mr Francis Sallah, Deputy General Secretary and Alhaji Seidu, General Secretary among other key officials.

In the second meeting, the regulator had met with Dr. Jacob Odae, 1st National Trustee, Alhaji Abass, the Public Relations Officer of the GPRTU among other top notch National Executives of the GPRTU.

Preparations towards the Training of Trainers sessions for the two groups have kick-started and scheduled to commence at the beginning of the 2nd quarter for the National and Regional Executives.

The NIC remains committed to working together with all stakeholders to support the insuring public and the economy.