By: Cindy Bempong ODAME

At the height of Ghana’s economic crisis in 2022, a grim reality loomed—debt had become an unbearable weight, threatening to crush the economy under its sheer magnitude.

The government faced a defining moment: restructure or collapse. With dwindling foreign reserves, surging inflation, and an economy teetering on the edge, Ghana took a bold but painful step—restructuring billions in debt to avoid default.

But was this the optimal path? Were there viable alternatives?

As the dust settles, one question remains—has Ghana truly bought time, or has it merely postponed the inevitable?

The origins of the debt crisis: how did we get here

For years, Ghana’s economic ambitions were fueled by borrowing. The country turned to international bond markets, secured loans from multilateral institutions, and depended on domestic debt instruments to finance its budgets.

At first, this seemed like a workable strategy—borrowing was cheap, and investors were willing to lend. But beneath the surface, trouble was brewing.

A Mountain of Debt & Rising Interest Payments

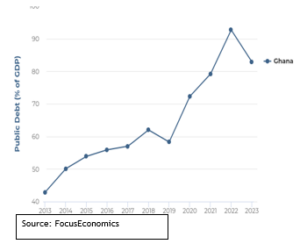

By 2022, Ghana’s debt had ballooned to GH¢467.4 billion ($48.87 billion), with interest payments consuming more than half of government revenue. The country was essentially borrowing to service old debts, creating a vicious cycle.

Eurobond Over-Reliance & A Sudden Shutout

Since 2007, Ghana had tapped into the Eurobond market several times to fund infrastructure projects and plug budget deficits. However, between 2021 and 2022, as global interest rates surged and investor confidence in Ghana waned, the country found itself locked out of the international capital markets in 2022. The lifeline it had counted on was suddenly gone.

Commodity Price Fluctuations & Fiscal Indiscipline

As a nation heavily dependent on gold, cocoa, and oil exports, Ghana was vulnerable to external shocks. Price drops in these commodities further strained government revenues, while large election-year spending and off-budget expenditures worsened the crisis.

Global Shocks: COVID-19 & Russia-Ukraine War

The pandemic drained reserves, while the war in Ukraine drove up the cost of essential imports like fuel and food, worsening inflation and pushing Ghana’s economy to the edge.

By mid-2022, the writing was on the wall: Ghana’s debt situation was unsustainable. Default was no longer a distant possibility—it was imminent.

The Debt Restructuring Gamble: A Painful but Inevitable Decision

With no access to new loans and an economy in freefall, Ghana had no choice but to turn to the International Monetary Fund (IMF) for a $3 billion bailout. But there was a catch—the IMF required Ghana to prove its debt was sustainable before any funds could be disbursed. This led to the most aggressive debt restructuring program in the country’s history.

Domestic Debt Exchange Programme (DDEP): A Hard Bargain

In December 2022, Ghana announced its Domestic Debt Exchange Programme (DDEP), asking bondholders to accept losses to help stabilize the economy. The proposal was straightforward but brutal:

Existing bonds maturing in 2023-2026 would be swapped for new bonds with extended maturities of 2027, 2029, 2032, and 2037.

Investors suffered significant losses on interest payments (haircuts) but avoided a full default.

The reaction was immediate and hostile. Pension funds, banks, and individual bondholders protested, arguing that the move would cripple their finances. After tense negotiations, the government softened some terms, exempting pension funds from the restructuring. Eventually, over GH¢87 billion ($8 billion) of local debt was restructured. It was a bitter pill, but one Ghana had to swallow.

External Debt Restructuring: High-Stakes Negotiations

To address its external debt, Ghana suspended $13 billion in Eurobond payments and entered negotiations with creditors.

In 2023, the country secured an agreement-in-principle with bilateral creditors under the G20 Common Framework, a mechanism designed to aid debt-distressed nations.

Private bondholder negotiations remained uncertain, with investors pushing back on Ghana’s proposed terms.

Pushing Maturities to 2027, 2029, 2032, 2037 – A smart move or delayed doom?

On paper, extending debt maturities provides short-term relief, easing the government’s cash flow constraints. But beneath the surface lies a bigger question—does it solve the crisis or simply delay the inevitable?

Imagine a homeowner with an unmanageable mortgage. Instead of defaulting, the bank offers a deal: extend the loan for another 10 years, reduce monthly payments, but in the end, pay even more in interest. This is essentially what Ghana did.

- Short-Term Relief: By pushing repayments to 2027, 2029, 2032, and 2037, Ghana reduced its immediate fiscal burden, allowing it to allocate funds for pressing national needs.

- Future Debt Pile-Up: Deferring debt repayments does not erase them, it simply shifts the load to future administrations, potentially leading to another crisis.

- Investor Uncertainty: Frequent restructuring weakens investor confidence. Ghana may find it difficult—and more expensive—to borrow in the future.

In essence, Ghana has bought time, but at a cost. The success of this strategy depends on whether the government can implement strong economic reforms before the next debt repayments come due.

A new government, a new path: what must be done to prevent another crisis?

Ghana’s 2024 elections ushered in a new government, inheriting both the gains and burdens of the debt restructuring program. Ghana’s economic recovery now hinges on bold, decisive action rather than short-term fixes. The new government must consider:

- Enhancing Revenue Collection – Expand the tax base, close loopholes, and improve efficiency in tax collection.

- Export Diversification – Reduce dependence on raw gold, cocoa, and oil by investing in value-added industries like agro-processing, petrochemical industry, and others

- Strict Fiscal Discipline – Eliminate wasteful spending and ensure government budgets are sustainable.

- Strengthening Financial Regulations – Protect domestic bondholders, pension funds, and banks from future shocks.

- Building Foreign Reserve Buffers – Reduce vulnerability to external shocks by maintaining a stronger reserve position.

Final Thoughts: Turning a Challenge into an Opportunity

Debt restructuring gave Ghana a much-needed lifeline, but what happens next is even more important. With disciplined fiscal management and strategic investments in key industries, Ghana can transform its economic landscape and build a future where financial stability is no longer a short-term goal, but a lasting reality.

The country now stands at a defining moment—one where the right policies and reforms can lay the foundation for sustainable growth, ensuring that the sacrifices made today lead to long-term prosperity.