Every year, I write articles on this topic and amend it to suit the situation on hand. After last week’s publication, I have had some feedback from some bank executives who felt the issues resonates well with them. Let me share some extracts of their feedback.

The first executive said:

“Your writeup summarizes the practical emotional and physical dilemmas of today’s executive officers. In many ways;

- How do I practically get staff and management adaptation to the changing landscape. For so long have we approached work in a certain way…. Will communication be the sole panacea?

- The biggest threat is the conceptual reality of disruptors! Could we just wake up some day to a revolution in the banking scene? Our market intelligence system must be up to date on new developments and innovations.

- Meeting the expectations of the stakeholders in a VUCA environment requires lots of balancing.

God be our help. I believe that His wisdom provides all the answers daily. I wish you all the best for the day. And I look forward to reading the part 2”

The second executive wrote:

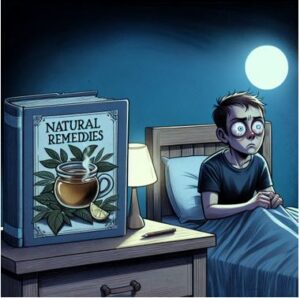

“ I just read your article “why are CEOs and executives lying awake at night. It’s very educative and thanks for broadening my mind with this powerful article. With the issue of digitalization and AI, I am also anxious to upgrade my skills. I also get sleepless nights when I am to present a paper to a committee and the deadlines are tight. I can’t wait for part 2”

Many factors create a high-pressure environment that can significantly impact the sleep patterns of bank CEOs and executives. Let me continue from there:

The loneliness at the top and the need to share

You can’t sleep! Sound familiar? Rather than viewing it as a burden, you should see it as an honour, a privilege and a testament of the strong character of the person that you have become? Why do you carry the burden alone? Don’t you have one “trusted” executive to share your apprehensions with? Please be careful, that person can be a Judas Iscariot! Dear executive, have you ever thought of giving the opportunity to let some people take some of that responsibility? You never know, they may find a way to innovate if you give them some freedom and space.

Fear of Failure

The fear of not meeting expectations and the potential consequences of failure can keep CEOs awake at night. This fear is often compounded by self-doubt and the inner critic.

External Factors: Issues such as regulatory changes, economic instability, and competition can add to the stress. CEOs need to stay vigilant and adapt to these external challenges.

Pressure

Internal Forces That Impose Pressure

Internal forces that apply pressure to the CEO include compensation structure and firm performance as well as pressure exerted by the board of directors. Compensation structure can drive the CEO to misbehavior because of the pressure it applies (S. A. Johnson, Ryan, & Tian, 2009; Shi et al., 2016). This constitutes a pressure brought about by greed.

This literature argues that the CEO is incentivized to commit wrongdoing to inflate the stock price so as to increase his or her compensation. Research focuses on the role that options play in influencing CEOs’ behavior. Scholarship consistently finds that options are associated with a greater likelihood of fraudulent financial reporting (Burns & Kedia, 2006; Donoher, Reed, & Storrud-Barnes, 2007; Harris & Bromiley, 2007; O’Connor et al., 2006; Zhang, Bartol, Smith, Pfarrer, & Khanin, 2008). Wowak, Mannor, and Wowak (2015) find that stock options are even related to product safety problems.

Relatedly, finance scholarship provides evidence that executives of firms likely to have deliberately adopted aggressive accounting practices that increase the stock price of the firm exercise significantly more options (Burns & Kedia, 2008).

However, other scholars find that some stock options, especially in a loss context, induce less risk-taking behavior, highlighting the importance of “decision-relevant factors” (Sawers, Wright, & Zamora, 2011).

According to these authors, this research moves beyond agency theory and supports a behavioral agency model wherein problem framing and risk bearing in combination impact risk-taking behavior. Beyond absolute values of compensation, Shi et al. (2016) uncover evidence to support that relative levels of compensation also influence wrongdoing, where an increase in the vertical pay gap results in a greater likelihood of securities lawsuits.

Organizational characteristics can increase pressure such that the CEO believes that he or she must engage in wrongdoing. Even “good” firms facilitate bad behavior due to pressure stemming from firm performance. Both Harris and Bromiley (2007) and Mishina, Dykes, Block, and Pollock (2010) find that high-performing firms engage in misconduct.

Firm per- formance, according to Chen (2010), also has the ability to impact CEO confidence and, in turn, increases the “need” to misreport performance as more positive than it really was to “feed an ever increasing ego” (p. 47).

CEO Wrongdoing: A Review of Pressure,

Opportunity, and Rationalization

CEO Wrongdoing

Some leaders are unable to withstand the pressure from some stakeholders. This includes pressure from friends, family members, politically exposed persons and even from some state institutions! Shall I succumb or not? Telephone calls can even make the most feared CEOs shake in his or her seat especially when their appointments were not based on political affiliations. I have witnessed a CEO salute while talking to a top influential person on the phone!.

Preventive Measures

Hold it dear Executive. Be still. You cannot know everything. Your family needs you alive. Here are a few tips to reduce your stress levels

- Get your top management involved in your strategies at all levels, monitor and let them be more accountable for their roles. You cannot be everywhere. Let the structures in the institution work.

- Please share some of your Responsibility. Perhaps then, your people can share the pressure that leaders take upon ourselves. Perhaps then you could turn that burden into an opportunity and a blessing.

- Leadership by example. Integrity counts. If your position did not come by merit, then be prepared for any surprise.

- Unfortunately we see some CEOs of state banks doing well, but have to move on with the election of new political leaders who replace all them whether they are doing well or not, to allow their members take over! Naturally, these go hand in hand with sleepless nights during the transition periods.

- Avoid being intimidated to recruit family members, friends and staff who do not qualify for the job. Read the two books of Prince Amoabeng, former CEO of the erstwhile UT Bank.

- The loans saga! Some CEOs are pushed to grant loans to undeserving persons. Unforgettable regrets.

Back biters and back stabbers are always around, but if you treat your staff well, no one will wish your downfall. Enjoy your career as you reduce sleepless nights.

ABOUT THE AUTHOR

Alberta Quarcoopome is a Fellow of the Institute of Bankers, and CEO of ALKAN Business Consult Ltd. She is the Author of Three books: “The 21st Century Bank Teller: A Strategic Partner” and “My Front Desk Experience: A Young Banker’s Story” and “The Modern Branch manager’s Companion”. She uses her experience and practical case studies, training young bankers in operational risk management, sales, customer service, banking operations and fraud.

CONTACT

Website www.alkanbiz.com

Email:alberta@alkanbiz.com or [email protected]

Tel: +233-0244333051/+233-0244611343