By Joshua Worlasi AMLANU

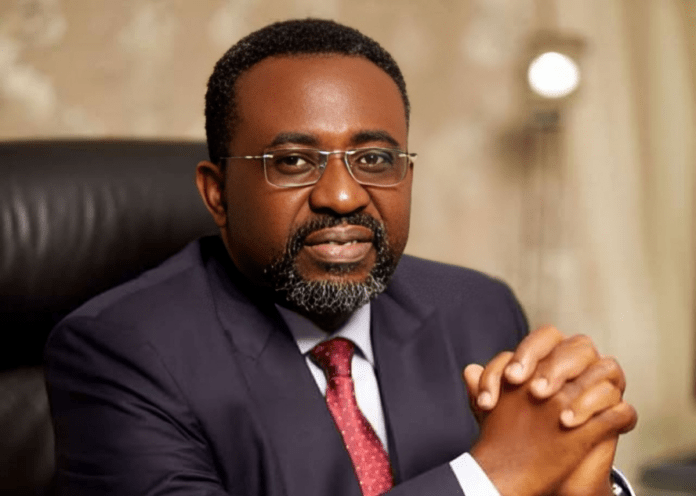

Dr. Johnson Pandit Asiama, the newly sworn-in Bank of Ghana Governor, outlined an ambitious agenda focused on monetary policy reforms, exchange rate stability and financial sector resilience.

During his inauguration ceremony on February 25, 2025, Dr. Asiama noted the need for decisive leadership to address the country’s macroeconomic challenges, including high inflation, fiscal deficits and debt levels, as the country embarks on an economic reset.

“The challenges before us require prudent macroeconomic policies to reset the economy,” Dr. Asiama stated. “The Bank of Ghana must remain steadfast in its mission to maintain price stability, ensure a sound financial system and support economic growth.”

Dr. Asiama outlined six priority areas to guide his tenure. At the top of his agenda is recalibration of monetary policy to enhance transparency and efficiency.

He pledged to adopt a proactive approach to inflation management, leveraging advanced data analytics and artificial intelligence.

Inflation remained elevated in 2024, driven by a dry spell-induced higher food costs. Ghana’s inflationary profile in 2024 posted a mixed performance as price pressures in second half of the year erased disinflationary gains from first half of the year.

Food inflation ended the year at 27.80% vs. 27.10% in Dec-2023, while non-food inflation settled at 20.30% vs. 20.50% in Dec-2023. Consequently, the annual inflation rate end-2024 printed at 23.80%, exceeding the 22.0% target outer upper band under the IMF programme by 180bps.

Inflation print for January 2025 still remains elevated at 23.5 percent.

Additionally, the central bank will discontinue the use of differentiated cash reserve requirements, opting instead for open market operations to manage liquidity.

“We shall be consistent in our policy actions to avoid sending conflicting signals, as happened in the recent past. Our policies will be clear, predictable and responsive to emerging threats,” he said.

Taming forex volatility

Exchange rate stability emerged as a key focus, with Dr. Asiama vowing to curb currency speculation and excessive volatility.

The Bank of Ghana plans to implement strategic interventions, including a new foreign exchange law to replace the 2006 Foreign Exchange Act. The central bank will also deepen its participation in the Pan African Payment and Settlement System (PAPSS), enabling Ghanaian businesses to trade across Africa using local currencies instead of the US dollar.

“The days of currency speculation and exchange rate instability must come to an end. We will engineer a well-functioning and stable foreign exchange market to support economic activity,” Dr. Asiama declared.

To bolster Ghana’s foreign reserves, the central bank will reform its Domestic Gold Purchase Programme and leverage strategic foreign assets more effectively.

Dr. Asiama also highlighted plans to collaborate with fintech and remittance agencies to harness remittances as a major source of foreign exchange.

Banking sector revamp and digital finance push

On the regulatory front, the new Governor emphasised a need to address legacy challenges in the banking sector, including high non-performing loans and weak risk management practices.

He pledged to update the Banks and Specialized Deposit-Taking Institutions Act, 2016 to enhance the resolution framework for distressed institutions while maintaining financial stability.

Dr. Asiama also underscored the importance of financial inclusion and innovation, noting Ghana’s potential to become a regional hub for financial technology and digital assets.

“We will work toward a clear regulatory framework for digital assets, ensuring that new financial innovations are introduced in a safe and structured manner,” he said.

Fiscal alignment and institutional recovery

The Governor further called for greater fiscal and monetary policy coordination while maintaining the central bank’s operational independence.

He vowed to strengthen the Bank of Ghana’s institutional autonomy through amendments to the Bank of Ghana Act, 2002.

Finally, Dr. Asiama committed to reversing the central bank’s negative equity position, which has raised concerns about its financial stability and credibility. He announced plans to implement austere measures to reduce operational costs and achieve cost efficiency.

“The reset path we have embarked on is more than mere sloganeering,” Dr. Asiama concluded. “It is about restoring public trust, rebuilding confidence and ensuring that Ghana’s economy is stable, innovative and ready for the future.”