Ghana’s oil and gas sector stands at a crossroads. Once viewed as a catalyst for economic transformation, the industry now grapples with multiple challenges that threaten its sustainability and long-term contribution to national development.

The sector, which significantly bolsters government revenue, employment, and foreign direct investment, is witnessing declining crude oil production, reduced exploration activities, and growing uncertainty among investors. These setbacks not only impact Ghana’s fiscal stability but also jeopardize the country’s ability to leverage its hydrocarbon resources for industrial growth and socio-economic progress.

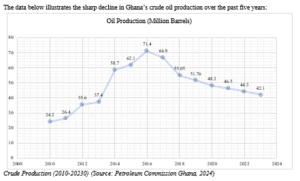

Between 2019 and 2023, Ghana’s crude oil production experienced a sharp decline of 32%, with output dropping from 71.4 million barrels to 48.2 million barrels (Petroleum Commission Ghana, 2024; Ministry of Finance Ghana, 2024). This decline translates into reduced government revenue, as the petroleum sector remains a key contributor to the nation’s GDP, public finances, and foreign exchange earnings.

The dwindling production trajectory is further exacerbated by the gradual exit of major international oil companies (IOCs) such as ExxonMobil, Anadarko, and AGM Petroleum, which have cited regulatory uncertainty, protracted contract negotiations, and uncompetitive fiscal regimes as key reasons for their departure (Ghana Upstream Petroleum Chamber, 2024). As a result, investor confidence in Ghana’s upstream oil and gas industry has been significantly eroded.

The challenges confronting the industry extend beyond declining production figures. Regulatory inefficiencies, protracted licensing approvals, ambiguous unitization policies, and a burdensome tax regime have made Ghana less attractive compared to other hydrocarbon-producing nations in the region. The delayed resolution of the 2018 Licensing Round, coupled with legal disputes over field unitization and creeping tax policies, has created an unpredictable business environment that disincentivizes both existing and potential investors. Without swift and strategic policy interventions, Ghana risks falling further behind in the highly competitive global petroleum market.

Recognizing these challenges, the Minister of Energy has announced the establishment of a consultative committee to review the overall petroleum sector and propose necessary reforms. However, this article specifically focuses on the upstream petroleum sector (exploration and production), as it remains the foundation of Ghana’s oil and gas industry.

Through an in-depth analysis, this article examines Ghana’s oil production and revenue trends, highlights the barriers to investment, and proposes targeted amendments to key legislative frameworks, including the Petroleum (Exploration and Production) Act, 2016 (Act 919), Petroleum (Exploration and Production) Regulations, 2018 (L.I. 2359), and the Corporate Income Tax regime.

By addressing these structural challenges, Ghana can reposition itself as an attractive investment destination and ensure the sustainable development of its petroleum resources for the benefit of present and future generation.

Current trends in Ghana’s oil and gas sector

The data below illustrates the sharp decline in Ghana’s crude oil production over the past five years:

Crude Production (2010-20230) (Source: Petroleum Commission Ghana, 2024)

Key Observations:

- Production peaked in 2019 at 71.4 million barrels but has declined significantly since then.

- No new oil fields have been added since the commissioning of the Sankofa-Gye Nyame field in 2017. Limited new discoveries, as Ghana has failed to attract major exploration investments

- Maturing oil fields (Jubilee, TEN, and Sankofa) which are Ghana’s primary oil-producing assets, are experiencing natural declines in output due to aging reservoirs.

- The prolonged Eni/Vitol and Springfield arbitration case has stalled the development of new oil fields, further compounding production challenges.

- Investor exits (ExxonMobil, Anadarko, AGM Petroleum) and reduced exploration commitments (GUPC, 2024) have contributed to the sector’s decline.

Petroleum revenue breakdown (2010-2023)

Petroleum revenues remain an important pillar of Ghana’s economy. The table below shows the revenue sources and their contributions:

Petroleum Revenue Breakdown (2010-2023) (Source: Ministry of Finance Ghana, 2024)

Key Observations:

- A declining trend in total petroleum revenue, with a drop from ₵12 billion in 2022 to ₵10.7 billion in 2023.

- Corporate tax revenues are falling, indicating reduced profitability of oil companies.

- GNPC’s share has dropped, reflecting its limited financial capacity to fund exploration.

- Declining production has led to lower royalties and corporate taxes.

- Investor tax disputes with the Ghana Revenue Authority (GRA) have caused delays in revenue collection.

- GNPC’s share of petroleum revenues has reduced due to lower investment in exploration.

Barriers to growth and investment in the oil industry

- High Taxes and Uncertain Fiscal Policies: Ghana’s corporate tax (35%) and royalties (5–12.5%) are higher than in other oil-producing countries like Guyana (2%) and Nigeria (30%), making investment less attractive. Unclear tax policies and unexpected new taxes create uncertainty for oil companies, discouraging long-term investment.

- Slow Licensing and Contract Approvals: The 2018 Licensing Round is still unresolved, delaying new investments. Long approval processes and bureaucratic delays have stopped the government from awarding new exploration blocks since 2018.

- Limited Exploration and Growth: Ghana’s Voltaian Basin is still unexplored, despite its potential. Strict rules, like a maximum 7-year exploration period, discourage companies from taking on big projects, especially in deepwater areas.

- Legal Disputes and Investor Uncertainty: Legal battles, such as the Eni/Vitol vs. Springfield unitization case, has the potential of stalling oil production. Tax disputes, like the GRA-Tullow case, have also created concerns about how stable and fair Ghana’s investment environment is.

Policy reforms: Revisiting Act 919 for a competitive petroleum sector

To attract new investment and sustain production, key amendments to the Petroleum (Exploration and Production) Act, 2016 (Act 919).

Fiscal terms and taxation

Issue: Uncompetitive Fiscal Regime

- Ghana’s corporate tax rate (35%) discourages investment when compared to competitor nations (Nigeria: 30%, Guyana: 0%).

- Royalty rates (5-12.5%) are higher than in competing oil jurisdictions like Guyana 2% and Nigeria 5%.

- Additional Oil Entitlement (AOE) under Section 89 introduces fiscal instability.

Relevant Sections in Act 919

- Section 85: Payment of Royalties: Determines how royalties are assessed.

- Section 87: Taxation: Outlines the taxation framework for petroleum operations.

- Section 89: Additional Oil Entitlement: Allows the government to take an extra share of oil revenue.

Proposed Reforms

- Amend Section 85 to introduce progressive royalty rates (e.g., 2-5% for deepwater fields and 5-10% for shallow fields).

- Abolish or restructure Section 89 (AOE Clause) to ensure fiscal stability for long-term contracts.

- Revise Section 87 to reduce corporate tax from 35% to 25% for new petroleum investments.

Licensing and petroleum agreements

Issue: Slow and Bureaucratic Licensing Process

- The 2018 Licensing Round has not been concluded, deterring investors.

- Ghana’s lack of strict timelines for licensing approvals leads to uncertainty.

- Ministerial discretion slows contract approvals.

Relevant Sections in Act 919

- Section 10: Petroleum Agreement Approval: Specifies the terms under which petroleum agreements are granted.

- Section 14: Duration of Agreements: Determines the timeline for contracts.

- Section 19: Transfer of Assets to the Corporation: Governs changes to agreement terms.

Proposed Reforms

- Amend Section 10 to introduce a 12 to18 month maximum timeline for petroleum licensing approvals.

- Revise Section 14 to allow greater flexibility in contract duration for deepwater projects.

- Update Section 19 to require parliamentary ratification for major fiscal changes.

Exploration periods and extensions

Issue: Short Exploration Periods Limit Deepwater Investment

- Ghana’s 7-year maximum exploration period (Section 22) is insufficient for deepwater projects.

- There are no incentives for marginal field exploration.

Relevant Section in Act 919

- Section 22: Relinquishment of Contract Area: Determines the maximum duration for exploration licenses

Proposed Reforms

- Amend Section 22 to extend maximum exploration periods from 7 years to 10 years for deepwater projects.

- Introduce an Infrastructure-Led Exploration (ILX) model to incentivize further discoveries.

Unitization and investor dispute resolution

Issue: Lack of Clear Arbitration Process for Unitization Disputes

- The Eni/Vitol vs. Springfield arbitration case has created uncertainty in Ghana’s petroleum unitization framework.

- Government-mandated unitization lacks independent technical evaluation.

Relevant Section in Act 919

- Section 34: Coordination of Petroleum Activities and Unitization: Governs unitization of petroleum operations.

Proposed Reforms

- Amend Section 34 to mandate independent arbitration before government-imposed unitization.

- Require a technical review process by a Unitization Advisory Committee to ensure fair unitization decisions.

GNPC’s role and financial independence

Issue: GNPC Lacks Financial Autonomy

- GNPC relies on government funding, limiting its ability to engage in exploration.

- Section 57 requires ministerial approval for GNPC to mortgage its participating interest, restricting financing options.

Relevant Sections in Act 919

- Section 12: Contract Area: Defines GNPC’s functions in the oil sector.

- Section 57: Mortgaging of Participating Interest: Regulates how GNPC can leverage its assets.

Proposed Reforms

- Amend Section 12 to allow GNPC to directly acquire and explore petroleum blocks.

- Revise Section 57 to enable GNPC to raise capital through private bond markets, reducing reliance on government allocations.

Gas commercialization and midstream development

Issue: Gas Monetization and Payment Defaults

- Ghana’s gas-to-power sector struggles with payment defaults, discouraging further gas field development.

- Delayed payments from power producers threaten long-term gas commercialization.

Relevant Sections in Act 919

- Section 51: Supervision and Inspection: Governs transparency in petroleum agreements.

- Section 55: Information Concerning Petroleum Activities: Regulates payment guarantees for petroleum contracts.

Proposed Reforms

- Amend Section 51 to require greater transparency in gas commercialization agreements.

- Revise Section 55 to introduce a mandatory payment security mechanism for gas offtakes.

Ministerial oversight and decision-making powers

Issue: Excessive Ministerial Discretion

- The Minister of Energy has broad discretionary powers over petroleum licensing and agreements.

- There is no independent review of ministerial decisions, leading to inefficiencies.

Relevant Sections in Act 919

- Section 6: Opening of an Area for Petroleum Activities: Grants the Minister discretion to approve exploration areas.

- Section 16: Assignment: Regulates sub-contracting within petroleum agreements.

- Section 60: Employment and Training of Ghanaian Citizens: Governs local workforce participation in petroleum operations.

Proposed Reforms

- Amend Section 6 to establish an independent Petroleum Regulatory Authority for reviewing licensing decisions.

- Revise Section 16 to ensure that all major petroleum sub-contracts are published for transparency.

- Amend Section 60 to mandate independent oversight of GNPC’s employment policies to prevent political interference.

The Path Forward for Ghana’s Petroleum Exploration and Production.

Ghana’s oil and gas sector stands at a defining moment, one that requires decisive action to reverse its declining trajectory. The nation’s once-promising petroleum industry is now challenged by declining production, waning investor confidence, and an uncompetitive regulatory environment. Left unchecked, these challenges will not only erode government revenues but also limit the country’s ability to fully harness its petroleum resources for national development.

The reforms outlined in this article provide a clear roadmap for Revitalsing the sector. By adjusting fiscal policies, expediting licensing processes, and enhancing GNPC’s financial autonomy, Ghana can reignite exploration, attract investment, and sustain long-term production growth. Addressing unitization disputes through independent arbitration, strengthening gas commercialization mechanisms, and limiting ministerial discretion will further ensure a transparent, investor-friendly, and economically viable oil and gas sector.

However, policy reform alone is not enough, its success depends on strong political will, institutional commitment, and collaboration with industry stakeholders. Ghana must act swiftly and decisively to implement these changes, or risk falling behind emerging oil frontiers like Guyana and Nigeria. The country still holds vast untapped reserves, but unlocking their potential requires a modernized legal framework that fosters stability, transparency, and efficiency.

The choice is clear: embrace reform and reclaim Ghana’s position as a leading petroleum hub in Africa, or risk economic stagnation as production dwindles.

References

- Petroleum Commission Ghana. (2024). Field production data. Retrieved from https://petrocom.gov.gh/field-production-data

- Ministry of Finance Ghana. (2024). Petroleum receipts and distribution report. Retrieved from https://mofep.gov.gh/publications/petroleum-reports

- Ghana Upstream Petroleum Chamber. (2024). Oil and gas industry report. Retrieved from https://gupc.org/

- International Energy Agency (IEA). (2024). Global petroleum investment outlook. Retrieved from https://www.iea.org/reports/

- Government of Ghana. (2016). Petroleum (Exploration and Production) Act, 2016 (Act 919). Retrieved from https://petrocom.gov.gh/wp-content/uploads/2022/08/Act-9190001.pdf

- Ghana Revenue Authority. (2024). Corporate taxation in the petroleum sector. Retrieved from https://gra.gov.gh/

- (2021, September 3). The Norwegian Ministry of Petroleum and Energy (OED) -International Centre for Hydropower. International Centre for Hydropower. https://ich.no/the-norwegian-ministry-of-petroleum-and-energy-oed/

- Now, O. (2024, January 25). Competitive fiscal terms key to Guyana offshore growth; Suriname now being asked to provide more incentives. OilNOW. https://oilnow.gy/featured/competitive-fiscal-terms-key-to-guyana-offshore-growth-suriname-now-being-asked-to-provide-more-incentives/

- Nigeria National Petroleum Corporation (Petroleum Industry Act (PIA) 2021 implementation. Retrieved from https://pia.gov.ng/wp-content/uploads/2022/08/PIA-2021_compressed-1.pdf