By Ebenezer Chike Adjei NJOKU

The nation continues solidifying its position as a leader in African digital financial services, leveraging its advanced instant payment systems to drive financial inclusion and economic growth.

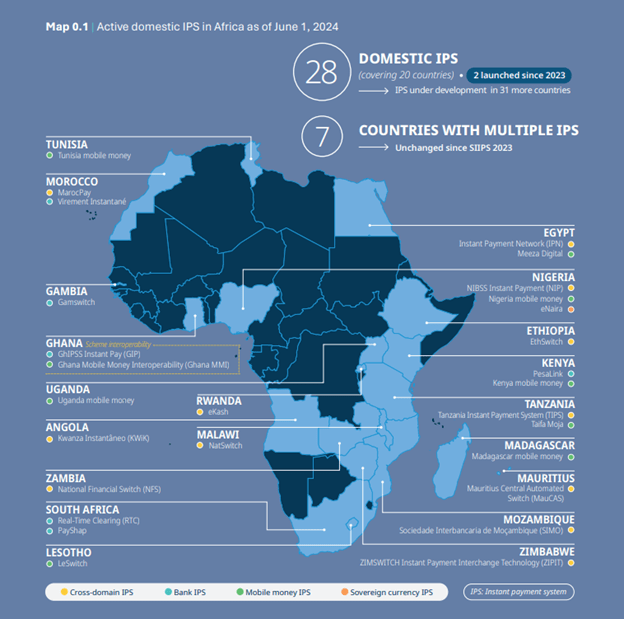

According to the recently published State of Inclusive Instant Payment Systems (SIIPS) in Africa 2024 report, co-authored by AfricaNenda’s Sabine Mensah and Jacqueline Jumah, the nation stands out as the only country on the continent where domestic payment schemes are fully interoperable.

The SIIPS report, developed by AfricaNenda in partnership with the World Bank and the United Nations Economic Commission for Africa (UNECA), assesses the inclusivity of instant payment systems (IPS) across the continent.

Inclusivity is defined by the accessibility of these systems to all licensed providers, their ability to serve diverse use cases and governance structures that ensure equitable participation.

Interoperability as benchmark for progress

The nation’s dual systems, the GhIPSS Instant Pay (GIP) and Mobile Money Interoperability (MMI), were highlighted for achieving a “progressed” level of inclusivity. According to the report, this level is characterised by systems that “allow all licensed Payment Service Providers (PSPs) to utilise the system”, while ensuring central bank involvement in governance and promoting “pro-poor” decision-making structures.

Although no IPS in Africa has reached the “mature” inclusivity level, Ghana’s interoperability between domestic schemes was described as a model for the continent.

“Ghana is still the only country where the domestic schemes are interoperable with one another,” a portion of the report read, adding that this level of integration is critical for fostering broader financial inclusion.

The nation’s dual systems processed the highest interoperability transaction values relative to Gross National Income (GNI) in the region – between 15 percent and 23 percent – in 2023.

Challenges remain

Despite this progress, the SIIPS report underscored that significant barriers remain in extending access to underserved populations. Across Africa, over 400 million adults, representing 45 percent of the continent’s population, are excluded from digital payments.

“Digital payments cannot be limited to the 55 percent of Africans who are financially included, but must also be available to the 45 percent who currently are not,” the report stated.

Locally, affordability and trust issues remain barriers to adoption, especially for lower-income and rural populations. The report notes that challenges such as “high perceived financial services costs” and “a lack of mobile phone and/or Internet access” disproportionately affect vulnerable groups, including women.

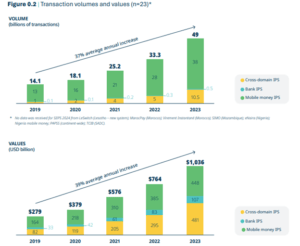

Nonetheless, much progress was recorded as live payment systems in Africa experienced significant growth in 2023. They processed an unprecedented 49 billion transactions, worth over US$1trillion. This marks a substantial increase from 2019, with an average annual growth rate of 39 percent.

Pathways to enhanced financial inclusion

The SIIPS report calls for a concerted effort to address these challenges and ensure that payment systems are true enablers of financial inclusion. The report emphasised the importance of regulatory reforms, particularly in licensing and digital onboarding processes, to foster inclusivity.

“Regulators may apply direct licensing, indirect licensing…or a complementary mix of these approaches,” the report states, highlighting the country’s potential to lead these reforms through its ongoing efforts in financial consumer protection and Know Your Customer (KYC) innovations.

Moreover, the nation’s leadership in interoperability sets the stage for broader regional integration. The Pan-African Payment and Settlement System (PAPSS), which is live in the West African Monetary Zone (WAMZ) pilot countries – including Ghana – is poised to enhance cross-border payments and facilitate intra-African trade.

Role of stakeholders

For the nation to maintain its leadership position, stakeholders must align their efforts to address the persistent gaps in IPS. The report recommends that operators “pursue a not-for-loss or cost-recovery IPS business model” while enhancing user recourse mechanisms.

Policy-makers are urged to “develop and implement infrastructure reforms and introduce innovation-friendly regulations” to keep pace with technological advancements.

Speaking at the launch in Accra, the Director of Fintech and Innovation at the Bank of Ghana (BoG) pointed out the strategic importance of digital financial infrastructure, describing payment systems as “a powerful equaliser” with the potential to “connect people, bridge distances, enable opportunities and empower communities”.

He added that the continent has shown the world possibilities in evolving digital payment systems despite existing challenges.

Critical to the vision are five fundamental criteria for effective payment systems: they must be “instant, accessible, interoperable, secure and frictionless”.

He also stressed the urgency to deepen the inclusive financial ecosystem by leveraging technology as a mechanism for broader economic development.

“Africa, as a pioneer in financial technology, has shown the world possibilities in evolving digital payment systems. Yet, in spite of our agility and capacity to leapfrog, we know that for an impact to be truly widespread, payment systems must not only be instant but also accessible, interoperable, secure and frictionless,” Mr. Oppong explained.

“Let us be open, collaborative and, most of all, bold as we pursue the noble and necessary cause of financial inclusion,” he added.

In his remarks, Chief Executive Officer at AfricaNenda, Dr. Robert Ochola, reaffirmed his outfit’s commitment to supporting stakeholders in Ghana and beyond.

“Together with the World Bank and the United Nations Economic Commission for Africa, we are ready to further support relevant stakeholders in the IPS ecosystem,” he said.