By Kizito CUDJOE

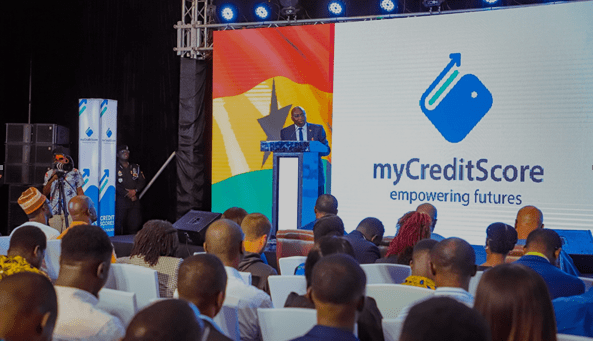

The Vice President, Dr. Mahamudu Bawumia, has introduced ‘MyCredit Score’ – a pioneering credit score system designed to enhance access to credit while promoting responsible financial behaviour – as part of efforts to enhance economic resilience and inclusivity.

The new initiative aims to modernise the country’s financial ecosystem, targetting financial stability and economic growth for stakeholders across the board.

According to Dr. Bawumia, the MyCredit Score system is set to strengthen trust between financial institutions and borrowers by enabling a more consistent and transparent assessment of creditworthiness.

This, he explained, is expected to lower loan defaults and increase lending confidence in Ghana’s banking sector.

“This system is designed to reward financial responsibility,” Dr. Bawumia stated. “If you have good credit, the banks will be looking for you and designing products for you. They’ll be chasing after you to lend to you, and that is exactly how we want it to be.”

The MyCredit Score system allows individuals to build and access credit histories in ways that have previously been limited in Ghana, providing them with improved financing options. “For the first time, Ghanaians will have access to a credit score that can open doors to enhanced financing options; helping them realise their goals and contribute to economic growth,” Dr. Bawumia added.

With expanded access to credit scoring, this initiative reflects Ghana’s broader commitment to sustainable economic growth. By integrating multiple national databases, Ghana’s credit scores are expected to carry an unprecedented level of detail – possibly even exceeding data quality often available in more advanced economies.

The MyCredit Score initiative is expected to support Ghana’s transition toward a financial ecosystem that promotes responsible borrowing and lending practices. According to officials, this development is crucial for building a financially resilient society where every citizen can confidently demonstrate their creditworthiness and secure better access to financial resources.

MyCreditScore’s Board Chairman, Augustine Adjei Gyadu, speaking at the launch emphasised that “without accessible credit, our economy remains alive in name only”.

He added that credit access is essential for growth and financial empowerment, particularly in light of Ghana’s digital transformation. “The time has come to focus on the microeconomy, leveraging technology to make supportive policies and services more accessible than ever.”

However, Adjei Gyadu highlighted non-performing loans (NPLs) as a primary concern for the financial sector, pointing out that NPLs hinder growth and introduce volatility. “In Ghana, of the 27 percent loan interest rate we observe, a staggering 12 percent is attributed to a risk premium—the cost of borrowers who default on their loans,” he noted.

To address this issue, he said that MyCreditScore aims to reduce the NPL rate to levels seen in OECD countries, where they are below 4 percent. “We are committed to creating an environment where Ghanaians can access and repay loans, ultimately strengthening our financial ecosystem.”

Mr. Adjei Gyadu expressed optimism about MyCreditScore’s future, citing encouraging results from the pilot programme launched in April. To date, he said “we have extended 40,791 credits, totalling GH¢637,799.82, to 4,262 borrowers. Remarkably, our default rate stands at just 2.51 percent, a significant improvement compared to the market default rate of 4 percent”.

Additionally, while Ghana’s NPL ratio was 24.3 percent in August 2024, the pilot programme’s NPL ratio is just 3.44 percent – illustrating the potential for responsible lending driven by data insights.

He also welcomed the Bank of Ghana’s (BoG) recent decision to reduce the key lending rate by 200 basis points to 27 percent, ensuring a more accommodative monetary environment that is expected to stimulate credit growth and provide better terms for borrowers.

“These positive indicators affirm our commitment to reshaping Ghana’s credit landscape and advancing sustainable financial empowerment,” he stated.

Also, Chief Executive Officer (CEO)-Ghana Association of Banks (GAB), John Awuah, recognised that credit scoring is a necessity and baseline screening tool in today’s financial ecosystem.

“They help banks make lending-decisions, identify the right products for client, and ensure that credit is extended responsibly. By understanding a customer’s credit profile, banks can offer more accurate, personalised financial solutions.”

For banks, this means improved risk management and, consequently, low distress in credit exposures. For customers, it means access to loans, mortgages and other financial services that are tailored to their needs.

He said: “Small business owners can obtain loans to scale their operations and grow their businesses; families can secure mortgages for their first homes; and young professionals can establish their financial independence.

“These are some of the many benefits that a robust, transparent credit scoring brings, helping banks to empower individuals financially while managing risks effectively.