By Ernest Bako WUBONTO

Access Bank (Ghana) Plc, in partnership with the International Finance Corporation (IFC), has created a US$10million credit facility to support small and medium-scale enterprises (SMEs) in business sustainability, economic growth and job creation.

Under the partnership, IFC – a member of the World Bank Group – will invest up to US$10million local currency equivalent in an unfunded Risk Sharing Facility (RSF) with Access Bank to increase lending for SMEs in Ghana, especially women-owned businesses.

The RSF will target entrepreneurs in the agriculture, health, education and green sectors, including waste reduction, energy saving and sustainable building practices.

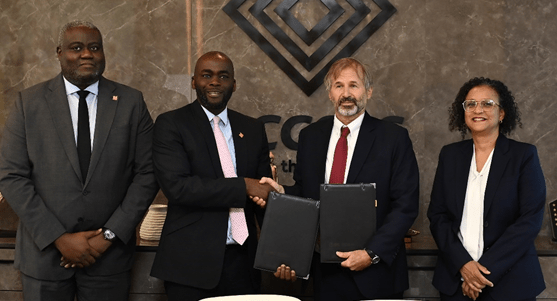

Managing Director-Access Bank, Olumide Olatunji – in his remarks during the signing ceremony at the bank’s head office in Accra – stressed that SMEs constitute over 75 percent of the local economy, represent the vast majority of businesses in Ghana and are the most important source of job creation; hence the reason any responsible business committed to impact creation must pay critical attention to their needs.

The bank, he said, has over the years created numerous opportunities for SMEs’ growth and sustainability; and through this partnership will deepen its impact in that sector.

“We love SMEs and this is evident in our support to them. As we celebrate our 15th anniversary, this partnership further deepens our unflinching commitment to SMEs. We believe that empowering micro, small and medium enterprises is crucial to promoting economic growth and development.

“Our partnership with IFC is a major step toward enhancing financial access for these businesses while giving them the financial push to thrive and contribute meaningfully to the country’s economy.

We believe in the power of partnerships to drive meaningful and sustainable impacts for the communities we serve. I have no doubt that this partnership will unlock new opportunities for MSMEs, fostering innovation and driving sustainable development,” he said.

IFC Senior Country Manager for Ghana, Kyle F. Kelhofer, highlighted that in the last decade IFC has provided close to US$2billion in financing and advisory services to the Ghanaian economy. Last year, for instance, the IFC-funded support amounted to US$400million – investing in key sectors such as healthcare, energy, agribusiness, financial services, infrastructure, manufacturing, retail, education and tourism.

He is optimistic that this year IFC will do a little above that as a means of supporting businesses to rebound after the economy’s recent headwinds.

“IFC’s commitment to supporting small businesses reflects our dedication to driving economic growth and job creation in Ghana. With both financial and advisory support, IFC will continue to empower small businesses and women entrepreneurs in fostering a more inclusive and resilient economy,” he said

IFC Regional Industry Manager-Central Africa and Anglophone West Africa, Alexandra Celestin, added that the RSF will also provide a 50 percent guarantee on a portfolio of eligible loans to SMEs of up to US$20million equivalent – eliminating the risk of currency fluctuations.

Although financial inclusion has improved in sub-Saharan Africa over recent years, small and medium businesses still identify access to finance as a key constraint. According to the Global Findex Database, the credit gap for women-owned SMEs in Ghana was estimated at US$213million in 2021.

IFC’s support will help Access Bank Ghana increase its reach to key segments that remain traditionally underserved by financial institutions – through tripling the bank’s women small-scale enterprises (WSME) loan portfolio to US$60million by 2028.