By Joshua Worlasi AMLANU [email protected]

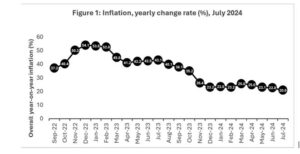

The year-on-year inflation rate dropped to 20.9 percent in July 2024, down from 22.8 percent in June according to latest data released by the Ghana Statistical Service (GSS).

This marks a continued easing of inflationary pressures, though prices remain significantly elevated compared to the previous year.

Food inflation, which has been a major driver of overall price increases, showed signs of moderation. The food and non-alcoholic beverages category recorded an inflation rate of 21.5 percent in July, down from 24.0 percent in June. Non-food inflation also eased slightly to 20.5 percent from 21.6 percent in the previous month.

“While inflation remains high, we’re seeing a gradual deceleration in the rate of price increases,” said Prof. Samuel Kobina Annim, Government Statistician, at the release of July 2024 data.

The monthly inflation rate, which measures the price change between June and July 2024, was 2.1 percent – indicating that prices continue to rise, albeit at a slower pace than earlier in the year.

Regional disparities in inflation rates persisted, with the Upper East Region experiencing the highest rate at 26.9 percent while North-East Region recorded the lowest at 10.6 percent. Seven out of Ghana’s sixteen regions reported inflation rates above the national average.

Imported items saw lower inflation (15.6 percent) compared to locally produced items (23.3 percent), possibly reflecting the impact of exchange rate stabilisation efforts by the central bank.

Among non-food categories, housing, water, electricity and gas saw the highest inflation at 44.7 percent, followed by furnishing and household equipment at 33.2 percent.

These figures highlight the ongoing challenges faced by Ghanaian households in managing basic living expenses.

In the food category, vegetables, tubers, plantains, cooking bananas and pulses experienced the highest price increases. The volatility in food prices continues to be a concern. Factors such as weather conditions, transportation costs and global supply chain issues are all contributing to these fluctuations.

The GSS report also highlighted several items that saw significant price changes over the past year. Locally produced maize recorded a price increase of over 100 percent, while imported rice saw a more modest rise of around 25 percent. These disparities underscore the complex dynamics affecting different segments of the consumer basket.

Economic analysts suggest that the gradual decline in inflation could provide some relief to businesses and consumers grappling with rising costs. However, they caution that inflation remains well above the central bank’s target range.

The Bank of Ghana Monetary Policy Committee during its 119TH meeting maintained the policy rate at 29 percent with the aim of further anchoring inflation expectations.

The Committee highlighted that regarding domestic price developments there is some uncertainty in the inflation path for the year, given recent exchange rate pressures, upward adjustment in utility tariffs and increases in ex-pump fuel prices.

These developments have resulted in a slightly elevated inflation profile for the year. Even though inflation is expected to remain within the target year band, risks are tilted slightly on the upside.

“This will require maintaining the strong monetary policy stance supported by strong fiscal consolidation efforts, including remaining vigilant to ensure that the end-year inflation objectives are achieved,” said Bank of Ghana Governor Dr. Ernest Addison.

The inflation data comes as Ghana continues to implement its economic recovery programme, supported by a US$3billion Extended Credit Facility from the International Monetary Fund (IMF). The programme aims to restore macroeconomic stability and lay the foundation for stronger and more inclusive growth.

Policymakers face a challenge in balancing inflation control with the need to stimulate economic growth. Government has emphasised its commitment to fiscal discipline and structural reforms to address underlying economic vulnerabilities.

Market watchers expect the disinflation process to continue, albeit amid some lingering risk.