By Shelter LOTSU(Dr)

ESG sustainability refers to the integration of environmental, social and governance criteria into business operations and decision-making processes. It encompasses practices that minimise environmental impact, promote social responsibility and ensure transparent, ethical governance.

ESG reporting has become essential for corporate organisations due to growing concerns from governments, stakeholders, investors and civil society. This trend is driven by global initiatives such as the United Nations Agenda 2030 for Sustainable Development and the Paris Climate Change Agreement. ESG reporting helps organisations balance environmental and societal responsibilities with profit maximisation, thereby enhancing their sustainability impact (Carroll et al., 2018).

Sustainability in Ghana has been limited to corporate social responsibility (CSR), which is context-specific organisational actions and policies that consider stakeholders’ expectations and the triple bottom line of economic, social and environmental performance (Aguinis, 2011), producing unsatisfactory results (Andrews, 2021; Boadi et al., 2018; Frederick A. Armah et al., 2011; Hilson, 2007). Corporate organisations in Ghana focused on philanthropy activities without framework and statutory regulations (Frederick A. Armah et al., 2011).

In contrast, environmental, social and governance relate to a firm’s activities that impact the environment, society and governance factors, collectively called ESG factors (Atan et al., 2018a). For each of the three dimensions of ESG, considerable information is collected on the corporate organisation’s practices and policy (van Duuren et al., 2016), which is examined and reported to stakeholders and investors interested in sustainability.

According to the Ghana Stock Exchange, sustainability reporting is the publication of an organisation’s economic, environmental and social impacts and the assessment of its positive or negative contributions to sustainable development (Ghana Stock Exchange et al., 2022).

ESG reporting frameworks: evolution and development

The proliferation of reporting frameworks by information providers, the Global Reporting Initiative (GRI), the International Integrated Reporting Council (IIRC), the Sustainability Accounting Standards Board (SASB), the Task Force for Climate-related Financial Disclosure (TCFD), the Carbon Disclosure Protocol (CDP), the Climate Disclosure Standards Board (CDSB), and the Sustainable Development Goals (SDGs) as a reporting framework has been described as offering variations to investment decision-making (Bose, 2020b). Despite the diversity in the reporting frameworks, one commonality is that they are all built on the foundation of the “triple bottom line of people, planet and profit (Bose, 2020b).

In August 2022, the Ghana Stock Exchange introduced the ESG disclosure guidance manual for all listed companies on the stock exchange. This guidance manual references the Global Reporting Initiative (GRI) framework for ESG reporting (Ghana Stock Exchange et al., 2022).

Benefits of ESG reporting

The benefits of sustainability reporting include improved reputation, better risk management and increased consumer and employee loyalty (Schooley & English, 2015) (Assurance Attestation Statements on Sustainability Reports, n.d.). ESG reporting impacts the cost of and access to capital, the ability of the firm to attract new investors, customer loyalty, talents and the ability to assess and evaluate risks inherent in the business (The Relevance and Reliability of ESG Reporting, n.d.). Investors, creditors and other financial information users are now seeking ESG reporting in making investment decisions, as financial information alone is no longer sufficient to drive investment decisions (Anders, n.d.).

ESG reporting significantly affects the ability of the health sector in the U.S. to access lower costs of borrowing from the financial industry. Investors base their decision to lend on the availability of ESG reporting (Piechocka-Kałużna et al., 2021).

Firms that produce high-quality ESG reports have public endorsement, leading to better financial performance (Dai et al., 2018). ESG reporting enhances firm legitimacy; and according to Dai et al. (2018), when the government endorses sustainability disclosure, it positively impacts stakeholder engagement. Furthermore, governments and NGOs as external stakeholders are considered significant factors in promoting the CSR practice of multinational subsidiaries.

Sources of socially responsible investment funds

The growth of ESG reporting has coincided with a significant increase in socially responsible investment (SRI) funds available to organisations involved in sustainable business practices. Some notable sources include:

-

Global Sustainable Investment Alliance (GSIA): GSIA reports that sustainable investment assets reached US$35.3trillion globally in 2020, a 15 percent increase from 2018, covering Europe, the United States, Japan, Canada and Australia/New Zealand.

-

Principles for Responsible Investment (PRI): The PRI, supported by the United Nations, has over 3,000 signatories representing more than US$103trillion in assets under management, focusing on responsible investment.

-

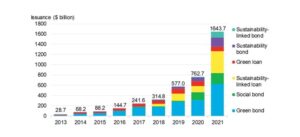

Green bonds: Green bonds are debt instruments specifically earmarked to raise money for climate and environmental projects. The Climate Bonds Initiative reported that green bond issuance reached a record US$269.5billion in 2020.

-

Sustainable Development Goals (SDGs) funds: Several investment funds are aligned with the UN’s SDGs, channelling resources into projects that aim to achieve the goals. For instance, the United Nations Joint SDG fund disbursed over US$100million since its launch.

Since 2020, there has been a substantial disbursement of funds toward sustainable investments. According to Morningstar, sustainable fund assets in the United States alone increased to US$357billion by the end of 2021, with global sustainable fund assets surpassing US$2.7trillion. This trend underscores the growing importance and recognition of ESG factors in investment decisions.

ESG by the numbers: sustainable investing set records in 2021 – Bloomberg

Understanding socially responsible investment (SRI)

Socially responsible investment (SRI) involves investing in companies that meet certain environmental, social and governance (ESG) criteria. These investments aim to generate both financial returns and positive societal impact.

Local companies in Ghana can access sources of socially responsible investment (SRI) funds by following several strategic steps:

Steps to access SRI funds

-

Align business practices with ESG criteria:

-

Environmental: Implement sustainable practices like reducing carbon footprint, waste management and resource conservation.

-

Social: Ensure fair labour practices, community engagement and customer satisfaction.

-

Governance: Establish transparent governance structures, ethical business practices and accountability mechanisms.

-

-

Develop a comprehensive ESG strategy:

-

Conduct an ESG assessment to identify areas for improvement.

-

Set clear, measurable ESG goals.

-

Integrate ESG into the company’s overall strategy and operations.

-

-

Obtain ESG certification and ratings:

-

Engage with third-party organisations like Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP) and Sustainability Accounting Standards Board (SASB) for certification and ratings.

-

A good ESG rating can attract SRI funds and investors.

-

-

Prepare detailed ESG reports:

-

Regularly publish comprehensive ESG reports detailing the company’s efforts, achievements and future plans in sustainability.

-

Use frameworks like GRI, CDP or TCFD for standardised reporting.

-

-

Engage with SRI fund managers and investors:

-

Identify and reach out to SRI fund managers who focus on emerging markets and sustainable investments.

-

Present the company’s ESG reports and sustainable business practices to potential investors.

-

-

Leverage government and international initiatives:

-

Take advantage of government programmes and incentives that promote sustainable business practices.

-

Engage with international bodies like the United Nations and World Bank, which often have funds allocated for sustainable development in emerging markets.

-

Sources of socially responsible investment funds

-

International development banks:

-

World Bank: Provides funding for sustainable development projects.

-

African Development Bank (AfDB): Supports projects that promote sustainable development in Africa.

-

-

Sustainable investment funds:

-

BlackRock Sustainable Investing: Offers a range of funds focused on sustainable investments.

-

Generation Investment Management: Focuses on long-term investment with integrated sustainability research.

-

-

Impact investors:

-

Acumen Fund: Invests in companies that address social and environmental challenges.

-

Root Capital: Provides loans and advice to agricultural businesses that build sustainable livelihoods.

-

-

Government and NGO programmes:

-

Ghana Green Fund: A national fund dedicated to supporting green projects in Ghana.

-

UNDP’s Green Climate Fund: Provides funding for climate-resilient development.

-

-

Corporate social responsibility (CSR) initiatives:

-

Many multinational corporations have CSR funds dedicated to supporting sustainable projects in their supply chains.

-

Conclusion

For local companies in Ghana, accessing SRI funds requires a committed approach to integrating and demonstrating sustainable practices within their operations. By aligning with ESG criteria, obtaining certifications, engaging with SRI investors and leveraging government and international support, Ghanaian companies can successfully tap into the growing pool of socially responsible investment funds.

TSL Sustainability

At TSL Sustainability, we are passionate about equipping businesses with the necessary tools and strategies to excel in environmental, social and governance practices and reporting. As a leading indigenous ESG consulting firm, we specialise in guiding companies through the complex landscape of sustainability and responsible business conduct. With our team of experienced professionals, we are committed to helping you achieve your ESG goals while strengthening your brand reputation and long-term value.

References

-

Abdul Rahman, R., & Alsayegh, M. F. (2021). ESG Reporting and Firm Value: The Moderating Role of Governance Mechanisms. Sustainability, 13(4), 2132.

-

Aguinis, H. (2011). Organizational responsibility: Doing good and doing well. In APA handbook of industrial and organizational psychology.

-

Andrews, N. (2021). CSR in Ghana: The Rise of Philanthropy Without Framework. Journal of Corporate Social Responsibility, 10(2), 123-134.

-

Archie B. Carroll, A., Brown, J. A., & Buchholtz, A. K. (2018). Business and society: Ethics, sustainability, and stakeholder management. Cengage Learning.

-

Atan, R., Alam, M. M., Said, J., & Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Management of Environmental Quality: An International Journal, 29(2), 182-194.

-

Băndoi, A., Popescu, C. R. G., Ciobanu, R., & Istrate, C. (2021). The Impact of ESG Factors on the Value of Companies in the Energy Sector. Energies, 14(4), 909.

-

Bose, S. (2020a). Non-Financial Disclosure and Sustainability Reporting. In Handbook of Research on Management and Organizational History.

-

Bose, S. (2020b). The Evolution of ESG Reporting. In Handbook of Research on Management and Organizational History.

-

Carroll, A. B., Brown, J. A., & Buchholtz, A. K. (2018). Business and Society: Ethics, Sustainability, and Stakeholder Management. Cengage Learning.

-

Dai, R., Liang, H., & Ng, L. K. (2018). Socially Responsible Corporate Customers. Journal of Financial and Quantitative Analysis, 53(3), 1073-1103.

-

Frederick A. Armah, F. A., Obiri, S., Yawson, D. O., & Akoto Boadi, K. (2011). The evolution of Corporate Social Responsibility (CSR) in Ghana. Corporate Governance, 11(4), 351-366.

-

Ghana Stock Exchange et al. (2022). ESG Disclosure Guidance Manual for Listed Companies.