By Dela Herman AGBO

In a remarkable display of market resilience and strategic positioning, Benso Oil Palm Plantation PLC (BOPP), Ghana’s leading agribusiness player, has seen its shares skyrocket over the past 18 months.

The company, which specializes in the cultivation, processing, and marketing of palm oil and palm kernel oil, has become a beacon of growth in Ghana’s agricultural sector, defying global economic uncertainties.

BOPP’s share price trajectory tells a compelling story of success. Opening at a modest GHS 7.65 at the start of 2023, the company’s stocks closed the year at an impressive GHS 22.00.

The upward trend continued into 2024, with shares reaching GHS 23.00 by mid-July. This represents a staggering 200% increase in just a year and a half, outperforming many of its local and international counterparts.

At a conference held at Labadi Beach Hotel, BOPP’s General Manager, Mr. Awonnea, described the company as the “moving taxi” that all should jump onboard now, highlighting the company’s growth potential.

The factors behind BOPP’s surge are multifaceted, intertwining global market dynamics with local operational efficiencies. On the international front, export restrictions imposed by palm oil giants Indonesia and Malaysia have created a supply vacuum that BOPP has been quick to exploit.

These constraints, coupled with rising global demand for palm oil in various industries including food, cosmetics, and biofuels, have driven prices upward, benefiting agile players like BOPP.

Locally, the company has leveraged its strong market position and operational efficiencies to capitalize on these favorable conditions. Improved farming practices and technological advancements have likely boosted plantation yields, while effective cost management strategies have maintained healthy profit margins.

The Ghanaian government’s supportive policies towards agricultural businesses have provided an additional tailwind for BOPP’s growth.

When compared to its peers, BOPP’s performance stands out. Locally, Wilmar Africa, another significant player in Ghana’s edible oils market, has also seen an upward trend in its share price, riding the same wave of global palm oil dynamics. However, BOPP’s focused approach on palm oil production gives it an edge in terms of specialization and market positioning.

On the global stage, industry giants like Malaysia’s Sime Darby Plantation and Indonesia’s Golden Agri-Resources have faced challenges due to export restrictions in their home countries. While these companies benefit from their vast scale and advanced technologies, BOPP’s ability to operate unrestricted has allowed it to capture market share and boost its stock value more dramatically.

Looking ahead, industry analysts are optimistic about BOPP’s prospects. The company is well-positioned to continue its growth trajectory, benefiting from the ongoing high global prices driven by export restrictions in major producing countries.

Moreover, the increasing global emphasis on sustainable and ethically produced palm oil presents an opportunity for BOPP to differentiate itself and potentially command premium prices for its products.

Given the current market conditions and BOPP’s strong performance, we predict the company’s share price could reach between GHS 24.50 to GHS 26.00 by the end of 2024. This projection represents a potential further increase of 6.5% to 13% from the mid-July 2024 price.

However, investors are advised to exercise caution. The palm oil industry is subject to various risks, including weather conditions, potential changes in global trade policies, and shifting consumer preferences. Additionally, as a commodity-based business, BOPP’s fortunes are tied to global palm oil prices, which can be volatile.

Despite these potential challenges, BOPP’s recent performance has undoubtedly caught the attention of both local and international investors. The company’s ability to leverage global market dynamics while maintaining operational efficiency has set it apart in Ghana’s agricultural sector.

As Ghana continues to position itself as a key player in Africa’s agricultural landscape, BOPP’s success story serves as a testament to the potential of well-managed agribusinesses in the country. Whether BOPP can maintain its impressive growth trajectory remains to be seen, but for now, it stands as a shining example of how local companies can thrive in the face of global market shifts.

With its shares continuing to climb, BOPP is indeed proving to be the “moving taxi” that Mr. Awonnea described. As the global palm oil market evolves, all eyes will be on this Ghanaian success story, watching to see just how far this journey can go.

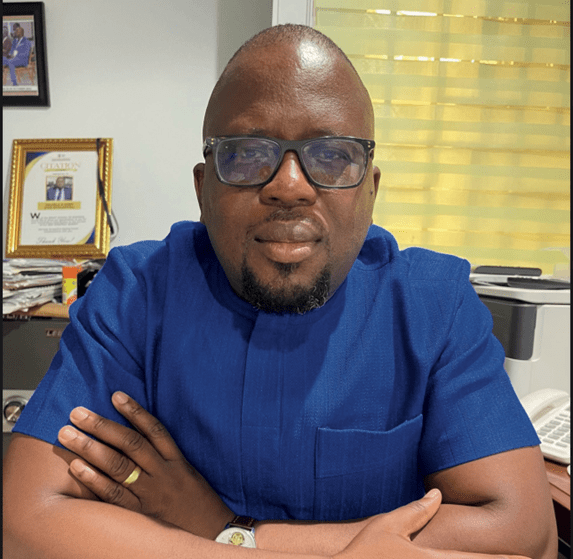

Dela is the Chief Executive Officer EcoCapital Investment Management Ltd.