The Bank of Ghana Monetary Policy Committee (MPC) has announced a cut in the key policy rate from 30 percent to 29 percent, offering businesses a much-needed respite.

This marks the first cut in two years. The previous policy rate of 30 percent had lasted a period of six months.

Speaking at a press briefing following the 116th MPC meeting in Accra, Dr. Ernest Addison, Governor-Bank of Ghana, explained that: “The Committee decided to reduce the Monetary Policy Rate by 100 basis points to 29 percent, noting the emerging recovery but emphasising the need to maintain a strong policy stance for disinflation gains consolidation”.

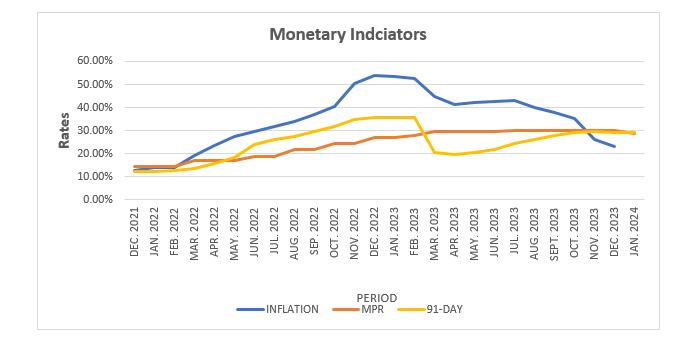

Headline inflation saw a substantial decline, by more than 30 percentage points in 2023, driven by factors such as tightened monetary policy, stable crude oil prices and relative exchange rate stability.

The Committee observed that inflation forecasts suggest continued disinflation, with inflation expected to ease to 13-17 percent by end-2024 and gradually return to the medium-term target of 6-10 percent by 2025. However, there are upside risks requiring strict 2024 budget implementation and a tight monetary policy stance.

“The disinflation process continued throughout the year, supported by strong policies, relative exchange rate stability and effective liquidity sterilisation efforts,” Dr. Addison stated.

In December 2023, headline inflation sharply decelerated to 23.2 percent. Both food and non-food prices eased, with food inflation dropping to 28.7 percent and non-food falling to 18.7 percent. Core inflation also halved to 24.2 percent in December 2023.

Cumulatively, inflation dropped 30.4 percent during 2023 while average inflation was 39.91 percent. The year-end inflation print outperforms government’s 31.3 percent target for end-2023 outlined in the 2024 budget, as well as the IMF’s 29.4 percent central forecast.

The significant decrease mainly results from favourable base effects relative to heightened consumer price index levels in 2022, signalling continued disinflation after 30 percent inflation persisted for two consecutive months.

Disinflation began in July 2023, when inflation declined from 43.1 to 40.1 percent in August after peaking at 54.1 percent in December 2022 then gradually easing to 41.2 percent by April 2023. However, inflation briefly rose in May before the overall downward trend resumed.

Since the 54.1 percent peak, headline inflation has cumulatively dropped 30.4 percent in 2023 from 53.6 percent at start of the year. Both food and non-food inflation have markedly decreased – by 32.2 percent and 29.2 percent, underscoring the disinflation. Currently, food inflation and non-food are 28.7 percent and 18.7 percent, down from 61 percent and 47.9 percent at the start of 2023.

On a month-on-month basis, December 2023 inflation print went up by 1.2 percent relative to the 1.5 percent recorded for November 2023 – indicating continued increase on a month-on-month basis for the second consecutive month.

“While there is a gradual recovery in economic activity, growth remains below potential. The latest Ghana Statistical Service data showed a 2.0 percent expansion in overall real GDP during Q3 2023, driven by the services and agriculture sectors. High-frequency real sector indicators, including the Composite Index of Economic Activity (CIEA), point to a significant pickup in activity with an annual growth of 9.6 percent in November 2023,” Dr. Addison noted.

The Bank’s surveys in December 2023 indicated a strong rebound in consumer and business sentiments, reflecting optimism about future economic conditions. Consumer confidence improved due to easing inflationary pressures while business confidence increased, signalling improving consumer demand. The Purchasing Managers’ Index (PMI) also improved to 51.8 in December 2023.