The Social Security and National Insurance Trust (SSNIT), in Ghana, is at a crossroads. The Social Security and National Insurance Trust in Ghana plays a crucial role in providing retirement benefits and social security to workers. The last major changes in the industry introduced private participation in the investment of contributors’ funds.

Those changes also made contributors responsible for choosing private sector pension fund managers to manage their Tier 2 pension – about a third of their compulsory pension funds. Despite the introduction of private participation in managing contributors’ funds, concerns persist about the transparency, efficiency, and management of the pension funds SSNIT oversees.

Proposal for comprehensive reforms

As Ghana progresses towards greater modernisation and accountability, comprehensive reforms for SSNIT are essential. We propose that thorough reform is necessary to transform SSNIT into a more accountable and streamlined institution working in collaboration with private sector partners. We advocate for a new round of reforms that will elevate the role of the private sector in Ghana’s pensions industry, ensuring pensions are underwritten by the State.

Research from other jurisdictions like the United States and Australia indicates that this is achievable through dual regulation by a securities commission and a national pensions regulatory authority to ensure the highest levels of legal and regulatory compliance as well as confidence among contributors.

Proposed vision and principles for reform

Our vision is for SSNIT to be regulated by both the SEC and the National Pensions Regulatory Authority (NPRA), with the Government of Ghana as its underwriter and sole shareholder. In this model, SSNIT would only make placements with listed private investment firms managing long-term (Tier 1) and medium-term (Tier 2) funds.

Contributors would no longer choose the destination of their Tier 2 funds. Instead, SSNIT would develop a weighted ranking based on the size and profitability of listed private investment firms, which would then be assigned Tier 1 and Tier 2 funds to invest. Contributors would continue to place their Tier 3 funds but would have a choice between investment and/or life insurance products offered by licensed, listed firms.

Risk management and governance

Certainly, such significant change introduces several risks that must be modelled, anticipated, and proactively managed within a comprehensive risk management framework anchored on effective coordination between regulators and robust governance practices. This approach aims to ensure that SSNIT, as a Fund Manager working with licensed, listed private sector investment firms, can deliver sustainability and reliability to the pension system.

Supporting poll evidence

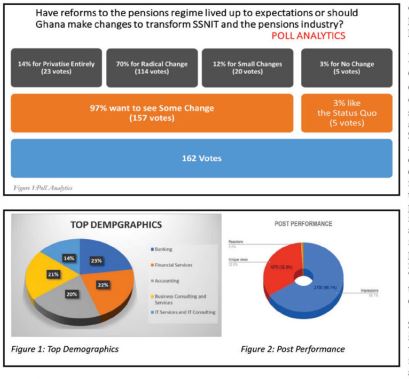

To better understand public opinion on the topic, Ishmael Yamson & Associates (IY&A) conducted a LinkedIn poll asking, “Have reforms to the pensions regime lived up to expectations, or should Ghana make changes to transform SSNIT and the pensions industry?” Although the sample size was small (162 Respondents), the conclusions appear to be directionally robust. The public provided candid responses, which are analysed below.

IY&A recognises ongoing efforts to reform SSNIT and adds its voice to the discourse. The poll only strengthens our view that what is needed now is a major change, not mere tinkering that essentially maintains the status quo.

This thought leadership paper aims to address the change and propose improvements to the system

Proposed principles for reform

SSNIT is at an inflection point: it can either remain a trusted and relevant institution or lose its purpose and the confidence of contributors. If the latter happens, the road to recovery may be hard to find and even harder to travel with all stakeholders. The following principles may help lay the foundation for transforming SSNIT into a more viable, accountable, efficient, and transparent institution.

Principle 1: SSNIT acting solely as a pension fund manager

First and foremost, SSNIT should be re-envisioned as an expert pensions fund manager regulated by the Ghana Securities Exchange Commission (SEC). The SEC regulates the activities of those who facilitate and participate in the buying and selling of securities in Ghana. This helps protect investors and promotes a healthy market environment. This change would subject SSNIT to the same strict guidelines as other fund managers across the nation, fostering accountability and transparency through SEC supervision. By enforcing compliance with best practices in investment management, SEC supervision would foster accountability and openness.

Enhanced regulatory monitoring would ensure that SSNIT upholds strict guidelines for responsibility and compliance, safeguarding the interests of donors. Additionally, by integrating investment strategies with long-term development and risk management objectives, this move would professionalise SSNIT’s operations. Consequently, SSNIT’s function would shift from providing direct investments to placing clients with:

- Listed investment firms for Tier 1 & Tier 2

- Listed investment firms for Tier 3

- Listed life insurance firms for Tier 3

The listed investment firms (category a) would manage both Tier 1 and Tier 2 pensions, following clear guidelines to avoid over-exposure to government entities, over-concentration in any sector, and excessive risk-taking. This strategic shift would leverage private listed investment and life insurance firms to reduce operational complexities and risks. By placing funds with listed investment and life insurance firms specialising in long and medium-term investments, SSNIT could benefit from professional management and expertise, potentially leading to higher returns on investments. This change would allow SSNIT to focus on strategic oversight, policy formulation, and performance monitoring.

Principle 2: centralised placement decisions

Generally, individuals and small businesses lack the actuarial expertise of SSNIT. Allowing SSNIT to act as the expert manager for contributors’ funds can enhance efficiency. This framework should be transparent and robust, preventing political interference. By developing a weighted performance matrix to track the size and profitability of managed funds, SSNIT can direct Tier 1 and Tier 2 funds to the most resilient and effective partners.

Transitioning SSNIT’s role from direct investments to placements with professional fund managers will mitigate risks and improve efficiency. Current Tier 2 firms will manage Tier 1 and Tier 2 pensions, while Tier 3 pensions will be managed by life insurance companies and Tier 3 investment firms. SSNIT will pay these companies based on the returns they generate.

Criteria for managing Tier 1 and Tier 2 investments will ensure performance standards, allowing SSNIT to cease partnerships with underperforming firms and reallocate funds. New fund managers can join periodically, enabling better risk management and diversification, optimizing returns while mitigating potential losses.

This strategic shift will reduce government influence and operational complexities within SSNIT, leveraging external expertise for investment decisions. SSNIT will benefit from professional managers’ market insights and specialized knowledge, ensuring prudent investment decisions. This change allows SSNIT to focus on strategic oversight, policy formulation, and performance monitoring, enhancing the overall efficiency and effectiveness of the pension system.

Principle 3: specialised management for Tier 1, 2, and 3 pension firms

Listed regulated firms will develop specialised investment portfolios to feed the SSNIT pension fund. Tier 3 pensions will offer investment products that reflect contributors’ risk appetites and/or preference for life insurance products. Overall, this specialisation should lead to higher returns on investments and better risk management, maximising stable and sustainable returns for both the State and private pensions of SSNIT contributors.

Principle 4: delegating Tier 3 pensions to specialists

The management of Tier 3 pensions, which are voluntary and personalised, should be delegated to listed regulated life insurance and/or investment firms. Life insurance firms excel in long-term financial planning and risk management, while investment firms offer diverse investment options and strategies. Entrusting Tier 3 pensions to these specialists will ensure that contributors’ funds are managed with professional diligence, enhancing social security goals and general economic growth.

Principle 5: empowering contributor choice

Contributors should have the option to directly mandate either a Tier 3 firm and/or a life insurance firm to administer their Tier 3 investments. This dual-option approach fosters a sense of ownership and control among contributors, enabling them to tailor their pension investments to their individual needs and preferences. Whether they choose the established infrastructure of SSNIT or explore different investment strategies directly with other firms, this flexibility promotes a competitive environment, driving better service and performance outcomes.

Conclusion: a future-ready SSNIT

These strategic changes promise a more robust and responsive pension system, securing a better retirement future for all Ghanaians. Centralizing investment decisions, focusing on professional fund management, and fostering transparency are essential steps towards building a sustainable pension system that meets the needs of Ghana’s workforce now and in the future. The time for reform is now, and the benefits will be far-reaching for generations to come.

>>>this article is written by Ishmael Yamson & Associates, a management consultants & investor advisors