By Anita NKRUMAH& Rachel DAMPSON

Ghana’s pharmaceutical market is one of the most promising sectors in Sub-Saharan Africa experiencing a noticeable evolution in the past three years. As of 2021, the market’s value reached $433 million and it is projected to witness substantial growth in subsequent years. Approximately, 70% of the market is reliant on foreign medicines and raw materials.

However, in recent times, local production of pharmaceuticals has seen a major boost owing to sector interventions as well as an improvement in domestic herbal medicine. Increasingly, new entrants are joining the pharmaceutical market in the areas of manufacturing and distribution. This has not only strengthened the local market but has also had a noticeable impact on the export market, marked by a significant increase in exports since 2020.

Competitive landscape of the pharmaceutical market

The pharmaceutical market comprises stakeholders that specialize in research, manufacturing, and distribution of pharmaceutical products. For the manufacturing segment, domestic production makes up about 30% of the market share. As of July 2022, there were 32 licensed local manufacturing facilities in the country specializing in the production of prescribed and over-the-counter drugs such as analgesics, anti-malarial, anti-biotics, antiretrovirals, antacids, antihistamines, dewormers, nutritional supplements, etc. catering to both the local and export markets.

Notable manufacturers include Ayrton Drug Manufacturing Company, Letap Pharmaceutical Limited, M& G Pharmaceuticals, Kinapharma, Danadams, Entrance Pharmaceutical and Research Center, and Alhaji Yakubu Herbal Company. Some of these players have over 40 pharmaceutical product lines with several retail and distribution outlets nationwide. Aside from manufacturing, some of the local manufacturers are also involved in the importation of pharmaceutical products.

The import market plays a key role in supplementing the pharmaceutical market with varied brands of pharmaceutical products. In 2022, total import volumes for pharmaceuticals reached 21 million kg. India, China, the United Kingdom, France, and Germany are the top 5 import countries collectively controlling about 90% of total import volumes. Currently, the distribution of pharmaceutical products is facilitated by over 600 pharmaceutical importers including domestic manufacturers, public and private Institutions, Logistics and trading companies, and pharmacies. The charts below provide an overview of Ghana’s pharmaceutical import market.

Source: Ministry of Trade (MOTI)

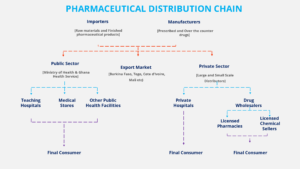

DISTRIBUTION CHAIN

Distribution of pharmaceutical products is an important activity within the pharmaceutical market. There are appropriate guidelines to ensure the quality of pharmaceutical products from the premises of the manufacturer to the final consumer. The figure below represents an overview of the distribution landscape for the pharmaceutical market.

Domestic importers and manufacturers serve as the main sources of pharmaceutical products in the market. As of 2022, the pharmaceutical sector could boast 32 registered pharmaceutical manufacturing facilities and over 600 importers of pharmaceutical products in Ghana. The distribution of medicines from these manufacturers and importers to end consumers is channeled through two main avenues: the public sector and the private sector.

In the public sector, pharmaceutical products are distributed to Teaching Hospitals, Government Medical Stores, and Other Public health facilities through the Ministry of Health (MoH) and Ghana Health Service (GHS) acting as key regulators in the sector. The Ghana Health Service and the Ministry of Health follow distinct processes for procuring and distributing pharmaceutical products.

The Ghana Health Service procures pharmaceutical products through an annual National Competitive Tendering system. In this tendering process, the service publishes a list of pharmaceutical products with specific requirements for potential bidding by suppliers. Interested suppliers submit their bids and quotations and the Ghana Health Service selects the most suitable supplier for further contractual agreements.

Additionally, the Ghana Health Service occasionally issues tenders for specific pharmaceutical products as the need arises. Similarly, the Ministry of Health (MoH) utilizes a centralized procurement system known as Framework contracting. Framework Contracting is usually a long-term agreement between the MoH and suppliers, outlining the general terms such as price and quantity for smaller recurrent purchasing orders over a specified period.

Pharmaceutical suppliers express their interest by submitting bids for consideration, and the MoH reviews these bids, often sharing the contract among bidders to encourage competitive pricing. Framework Contracting is typically renewed annually. However, in cases of shortages within the public sector, Teaching hospitals, medical stores, and other public health facilities are permitted to procure drugs from the private sector. They do so by issuing tenders for bidding, bypassing the Ministry of Health and Ghana Health Service.

For the private sector, the distribution of pharmaceutical products is controlled by both large- and small-scale distributors. These distributors source domestically approved medicines directly from domestic manufacturers or external markets. They facilitate access to pharmaceutical products for private hospitals and drug wholesalers and ultimately reach the final consumer.

Regarding the supply of pharmaceutical products to private hospitals, distributors either apply for tenders issued by various private health facilities or engage directly with these facilities to introduce their stock for consideration. Distributors are also responsible for supplying to wholesalers at bulk prices. These wholesalers, in turn, serve as the primary distributors to licensed pharmacies and licensed chemical sellers who retail their products to the final consumer at retail prices.

Pharmaceutical export market

Ghana’s pharmaceutical export market can be broadly categorized into medication and biological substances. In 2022, Ghana exported over 42 million kg worth of pharmaceutical products with biological substances constituting the greatest share of exports.

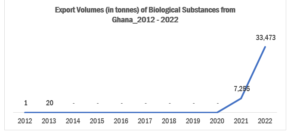

Export of Biological Substances

Biological substances specifically, blood and blood samples constituted about 78% of Ghana’s export market in 2022. The majority of these biological substances were exported to neighboring West African countries including Cote d’Ivoire, Togo, Burkina Faso, Mali, and Nigeria. Since 2021, biological substances have contributed substantially to the overall quantity of Ghana’s pharmaceutical exports. The chart below highlights export trends for biological substances;

Export of Medication

Since 2020, there has been a substantial improvement in the export activities for medication. Particularly, in 2021, the pharmaceutical market witnessed a drastic surge in export volumes. The total number of exporters increased significantly, rising from approximately 40 players in 2018 to over 150 players in 2021 and 2022. Existing players and new entrants also found new export markets within neighboring countries. For instance, companies like HomePro Company Limited have increased their export volumes by over 10X since 2021, now exporting a diverse range of medication to neighboring countries. Furthermore, there has been a broadening of the types of medicines exported from the country. Currently, Ghana exports over 80 different types of medication, primarily to West African markets. The chart below highlights the historical export trend for medications from Ghana.

Exported pharmaceutical products encompass both locally manufactured medicines and imported pharmaceutical products obtained from various countries. Notably, appetite stimulants like Amphetamine, Dynewell, Super Apetit, etc., dominate the export market. Other popular categories of exported medicines include cough medicine, antibiotics, nutrient supplements, and antimalarials, among others.

Cote d’Ivoire receives the largest share (28%) of exported pharmaceutical drugs from Ghana. The West African market, comprising countries such as Cote d’Ivoire, Togo, Burkina Faso, Benin, and Mali, serves as the primary destination for pharmaceutical exports from Ghana. The figure below illustrates the dominant exported pharmaceutical products from Ghana and the top pharmaceutical export destinations from the country.

Source: Ministry of Trade

Conclusion

The pharmaceutical market in Ghana is undergoing notable growth and displaying promising prospects, owing to collaborative efforts from various stakeholders aimed at improving domestic manufacturing and the distribution of pharmaceutical products. Notable interventions in the sector include the expansion of the list of raw materials exempt from VAT to boost the local industry, the imposition of a ban on over 40 medicines (such as aluminum hydroxide, aspirin, folic acid, amoxicillin, paracetamol, Ibru fen tablets, multivitamin tablets, etc.) to exclusively reserve production for local manufacturers.

Further initiatives involving the allocation of funds to domestic pharmaceutical manufacturers for the establishment of facilities adhering to good manufacturing practices, and the creation of a pharmaceutical industrial park to facilitate large-scale production by pharmaceutical companies is expected to boost activities in the pharmaceutical sector.

For entrepreneurs seeking to invest in the country’s pharmaceutical sector, establishing or expanding domestic pharmaceutical facilities can be a potentially lucrative opportunity given the increasing demand for locally manufactured pharmaceuticals both domestically and in international markets. Companies can take advantage of Ghana’s favorable export terms within the Free Zones policy to supply pharmaceutical products to international markets.

Additionally, there are opportunities to invest in the distribution networks and supply chain for pharmaceutical products. Entrepreneurs can explore avenues in logistics, distribution, and wholesale businesses to ensure the timely and widespread availability of medicines.

About Firmus Advisory Limited

Firmus Advisory offers a comprehensive range of market research services including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’s particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to several local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights, and brand tracking studies across multiple sectors.

About the Authors

Anita is the Head, Research and Trade Development Firmus Advisory

Rachel is a Senior Research Executive Firmus Advisory