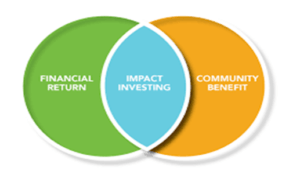

Impact investing is an investment approach that seeks to generate both financial returns and positive social or environmental impact. It aims to align financial objectives with the goal of contributing to sustainable development or addressing societal challenges. This approach goes beyond traditional investing, where the primary focus is solely on financial returns.

Key features of impact investing include:

- Dual Objectives

Impact investors aim to achieve a balance between financial returns and measurable positive social or environmental outcomes. The dual objectives are considered equally important.

- Measurable Impact

Unlike traditional investing, impact investing involves measuring and tracking the social or environmental impact of investments. Investors often use specific metrics and indicators to assess the success of their contributions to positive change.

3.Sectors and Themes

Impact investments span various sectors, including healthcare, education, renewable energy, affordable housing, and more. Investors often target specific themes aligned with their values and the global sustainable development agenda.

4.Risk and Return Trade-off

Impact investing recognizes that achieving social or environmental impact may involve accepting a certain level of risk or a potentially lower financial return compared to purely profit-driven investments. However, the goal is to find a balance that satisfies both criteria.

5.Collaboration

Impact investors often collaborate with non-profit organizations, governments, and other stakeholders to enhance the effectiveness of their initiatives. This collaborative approach can amplify the impact and address complex challenges.

6.Transparency and Reporting

Transparency is a crucial aspect of impact investing. Investors and organizations involved in impact initiatives typically provide clear and transparent reporting on financial returns as well as the social and environmental outcomes achieved.

7.Impact Measurement Standards

To enhance the credibility and comparability of impact investments, there is a growing effort to establish standardized measurement frameworks. These frameworks help ensure that impact is consistently assessed across different investments.

Advantages of Impact Investing

- Alignment of Values and Objectives:

- Impact investing allows investors to align their financial goals with their values and societal objectives. This alignment creates a sense of purpose and fulfillment as investments contribute to positive change in areas that investors care about.

- Sustainable Development:

- Impact investing plays a crucial role in promoting sustainable development by channeling funds towards projects and businesses that address social and environmental challenges. This contributes to long-term economic, social, and environmental sustainability.

- Risk Mitigation:

- Many impact investments involve long-term commitments to address complex challenges. By mitigating social and environmental risks, impact investors contribute to the overall stability and resilience of the communities and ecosystems in which they operate.

- Innovation and Entrepreneurship:

- Impact investing fosters innovation by supporting socially and environmentally conscious entrepreneurs. These investments can catalyze the development of new solutions and business models that address societal needs and contribute to positive change.

- Attracting Millennial Investors:

- The rising interest in impact investing is particularly significant among younger generations, such as millennials. Many investors are motivated by a desire to make a positive impact alongside financial gains, and impact investing provides a platform for them to express their values through their investment choices.

- Improved Corporate Practices:

- Impact investing encourages companies to adopt more sustainable and responsible practices. Businesses seeking impact investments often prioritize environmental, social, and governance (ESG) considerations, leading to positive changes in corporate behavior.

- Community Empowerment:

- Impact investing often involves working closely with local communities to address their specific needs. This collaborative approach empowers communities by providing them with resources, skills, and opportunities for economic development, leading to enhanced social well-being.

- Market Opportunities:

- As the impact investing space grows, it creates new market opportunities for businesses that are committed to sustainability and social responsibility. This can lead to the development of thriving industries focused on addressing global challenges.

- Financial Performance Potential:

- Contrary to the misconception that impact investing requires sacrificing financial returns, evidence suggests that impact investments can perform competitively or even outperform traditional investments over the long term. This challenges the notion that investors must choose between financial gains and social impact.

- Global Problem Solving:

- Impact investing has the potential to address global challenges such as poverty, climate change, and inequality. By leveraging private capital for public good, impact investors contribute to the collective effort to create a more sustainable and equitable world.

However, challenges exist, such as the need for clearer impact measurement standards, the potential for “impact washing” (where investments are marketed as more impactful than they are), and the difficulty in finding investments that align with both financial and impact objectives. Nonetheless, the growing interest in impact investing indicates a broader shift towards more socially and environmentally conscious investment practices. Here are some of the key challenges associated with impact investing:

- Measurement and Metrics:

- Establishing standardized and universally accepted metrics for measuring the social and environmental impact of investments is challenging. Impact varies across sectors, making it difficult to create a one-size-fits-all measurement system. This challenge can lead to subjective and inconsistent reporting.

- Impact Washing:

- Some organizations may engage in “impact washing,” where they exaggerate or falsely claim the positive outcomes of their investments to attract impact-minded investors. This undermines the credibility of impact investing and makes it challenging for investors to identify genuinely impactful opportunities.

- Financial Returns vs. Impact Goals:

- Balancing financial returns with impact objectives can be challenging. Investors may face difficult decisions when financial returns conflict with the desired social or environmental outcomes. Striking the right balance and managing trade-offs requires careful consideration.

- Lack of Clear Definition:

- The lack of a universally agreed-upon definition of impact investing can lead to confusion. Different investors and organizations may have varying interpretations of what constitutes impactful, making it challenging to assess the true impact of investments.

- Risk and Return Perceptions:

- There can be a perception that impact investments carry higher risks or lower financial returns compared to traditional investments. This perception may deter some mainstream investors from engaging in impact investing, despite evidence that dispels the notion of a trade-off.

- Limited Exit Strategies:

- Many impact investments are illiquid and have longer time horizons. Limited exit strategies can be a challenge for investors seeking liquidity and traditional exit routes, such as initial public offerings (IPOs) or acquisitions, may not always align with impact goals.

- Scale and Replicability:

- Achieving scale and replicating successful impact models can be difficult. Many impact initiatives start small and struggle to expand their reach. Scaling impact investments requires addressing various logistical, regulatory, and cultural barriers.

- Regulatory Environment:

- Inconsistent or unclear regulations related to impact investing can create challenges for investors and impact enterprises. A supportive regulatory environment that encourages impact investments and provides clarity on reporting requirements is essential for the growth of the sector.

- Short-Term Focus of Markets:

- Financial markets often prioritize short-term gains, which may not align with the longer-term nature of many impact investments. This focus on short-term returns can be a barrier to the successful implementation of impactful projects.

- Educational Barriers:

- There is a need for increased education and awareness about impact investing. Many investors and businesses may not fully understand the concept, potential benefits, or how to integrate impact considerations into their investment decisions.

Addressing these challenges requires collaboration among investors, policymakers, social enterprises, and other stakeholders. Efforts to develop common impact measurement standards, increase transparency, and educate the market can contribute to the continued growth and success of impact investing. As the field matures, it is likely that these challenges will be actively addressed to create a more robust and effective impact investing ecosystem.

In Ghana, there are several examples of impact investing initiatives that aim to generate positive social and environmental outcomes while also providing financial returns. Some notable examples include:

- MoringaConnect:

- Focus Area: Agriculture and Sustainable Farming

- Impact: MoringaConnect works with smallholder farmers to cultivate moringa trees, promoting sustainable farming practices. The company processes moringa into various products, including oil and powder, creating income opportunities for local farmers, and addressing malnutrition.

- Investors: MoringaConnect has received investment from impact-focused funds and investors interested in supporting sustainable agriculture and economic development.

- PEG Africa:

- Focus Area: Renewable Energy and Financial Inclusion

- Impact: PEG Africa provides affordable solar energy solutions to off-grid households in Ghana, improving access to clean and reliable electricity. This not only addresses energy poverty but also contributes to economic development by enabling small businesses to operate more efficiently.

- Investors: PEG Africa has attracted investment from impact investors and organizations dedicated to advancing clean energy access in emerging markets.

- Invest in Africa (IIA):

- Focus Area: SME Development and Capacity Building

- Impact: Invest in Africa works to strengthen small and medium-sized enterprises (SMEs) in Ghana by providing them with access to skills development, finance, and new markets. This initiative aims to foster economic growth, create jobs, and enhance the overall resilience of local businesses.

- Investors: IIA has received support from a range of development finance institutions, impact investors, and corporate partners committed to promoting sustainable economic development.

- Impact Hub Accra:

- Focus Area: Social Innovation and Entrepreneurship

- Impact: Impact Hub Accra serves as a collaborative workspace and innovation hub for social entrepreneurs. It provides a supportive environment for startups and enterprises addressing social and environmental challenges. Through mentorship, networking, and resources, Impact Hub Accra contributes to the growth of socially impactful businesses in the region.

- Investors: Support for Impact Hub Accra comes from a mix of international development agencies, impact investors, and corporate partners interested in fostering social entrepreneurship.

- Ashfield Investment Managers (Origen Private Debt Fund):

-

- Focus Area: Debt financing to projects in Ghana.

- Impact: Origen Private Debt and VC Fund is licensed by the Securities and Exchange Commission to make debt and quasi-equity investments into business generally, but with a bias towards private education, health services, renewable energy, transport, logistics and agribusiness as well as related value chain or support services for these sectors. The principal investment objective of the Fund is mobilising pension and other domestic sources of long-term funding into the real economy by providing debt and mezzanine financing to projects (infrastructure project finance) in Ghana within the target sectors. Up to 25% of their funding will be allocated to investees with majority women ownership or with women in key leadership positions and ensure that its investments lead to the creation of sustainable jobs.

- Investors: Public and Private Pension funds, Endowments, Trusts, DFI’s, and other institutional investors.

These examples illustrate the diversity of impact investing initiatives in Ghana, spanning various sectors and addressing a range of social and environmental challenges. They also highlight the importance of collaboration between impact investors, local communities, and other stakeholders to maximize positive outcomes and create sustainable change.

Conclusion:

Impact investing has gained traction in recent years as investors increasingly seek opportunities to make a positive difference in the world while achieving financial returns. It has the potential to mobilize capital toward addressing pressing global challenges and creating a more sustainable and equitable future.

Profile:

Grace Quaye

The writer is the Chief Marketing Officer (CMO) and Investment Advisor, Ashfield Investment Managers. She can be reached on +233246152750, E-mail [email protected] or [email protected]