The summary of macroeconomic and financial data released by the Bank of Ghana (BoG) in January 2024 highlighted performance of the Ghanaian economy in key sectors. The summary shed significant light on real sector indicators; interest rates; price developments; external sector developments; prices for commodities; and monetary indicators. Others included relevant information on the fiscal operations of government; performance of the capital market; available data on Ghana’s developed and implementing payment system; and key indicators for the banking industry, which form the basis of discussion in the current publication.

The financial data released by the Bank of Ghana may fairly reflect aggregate figures collated from the universal banks; rural and community banks; microfinance institutions; other special deposit-taking institutions under the supervision of BoG; and those supervised by the Securities and Exchange Commission (SEC) during the period under review.

Dovetailing performance of banks and other financial institutions within the industry in 2023 was the lingering effects of COVID-19; Russia-Ukraine war; and recent debt restructuring programme by the government of Ghana. The latter required the commitment and co-operation of banks and other institutions in the financial sector; and demanded the concerted efforts of all key stakeholders to assure the programme’s success; and further, navigate the economy from near-recession to the path of recovery and sustained growth. Specifically, implementation of the domestic debt exchange programme (DDEP) reined severe financial consequences in most banks and other institutions in the financial sector.

In spite of the challenges emanating from both the external and internal economic shocks enumerated above, institutions in the banking industry kept their management composure; remained resolute in their day-to-day operations and investment decisions; practically affirmed their role in financial intermediation; and demonstrated their critical role in effective functioning of the financial system, a major requirement for economic stimulation.

This ‘hands-on’ strategy ensured Ghana ended 2023 financial year with banking industry that is characteristically robust and resilient to imminent economic threats. This assertion is buttressed with recent data shared by the Bank of Ghana on banks and other institutions in the industry for financial years, 2022 and 2023. The data are outlined in Figures 1 through 4.

At the end of December 2023, the industry’s aggregate balance sheet depicted impressive performance comparative to year-ended December 2022; total assets differential of GHȼ62.9 billion was recorded during the comparative period (2023 = GHȼ274.9 billion; and 2022 = GHȼ212.0 billion). The GHȼ274.9 billion recorded during year-ended December 2023 remained fair reflection of robust growth in total assets, which were integrally funded by sustained growth in deposits and increased capital levels.

The significant boost in total deposits (34.6% growth during the comparative period) is indicative of the myriad benefits banks and other financial institutions could potentially derive from strong investment in financial literacy campaigns and programmes. The surge in deposits is indicative of customers’ growing interest; and restoration of public (existing customers and prospects’) confidence in the banking and financial system. The year-on-year (YoY) growth in the industry’s total assets between December 2022 and December 2023 was encouragingly estimated at 29.7%.

Financial intermediation was enhanced by the boost in total advances, which increased from approximately GHȼ67.7 billion in 2022 to GHȼ77.0 billion in 2023, representing 13.8% growth during the period. In effect, institutions in the banking industry were not parsimonious in their lending to existing customers and prospects; this is in spite of the challenges (internal and external economic shocks) that they had to contend with during the financial year (that is. 2023).

The industry’s performance as measured by key indicators such as core liquid assets to short-term liabilities; and core liquid assets to total assets remained impressive in 2023. These indicators amply manifested the industry’s soundness and resistance to vulnerabilities inherent in the broader financial system.

The core liquid assets to total assets ratio surged from 27.3% in 2022 to 30.70% at year-ended December 2023. However, the industry’s performance was not quite distinct in the analysis of the core liquid assets to short-term liabilities ratio; the 37.10% recorded at year-ended December 2023 remained marginally superior to the 36.30% recorded at the end of December 2022.

Reiteratively, soundness of the foregoing key indicators is positively linked to significant improvement in the performance of the industry’s liquidity, profitability and balance sheet; it points to an industry that is characteristically resilient and stable; and has the capacity to absorb shocks while deepening financial intermediation and inclusion.

Trickle-down effects of the government’s debt restructuring programme on the larger economy reflected on the industry’s high non-performing loans’ (NPLs’) ratio in 2023 (20.7%) comparative to 2022 (16.0%). Even when the loss category is excluded, the NPL ratio for year-ended December 2023 (8.40%) remained higher than the ratio for the same period in 2022 (5.80%). The heightened risk aversion strategy implemented by banks in strategic response to surging credit risk coupled with tight monetary policy stance of the Monetary Policy Committee (MPC) of the Bank of Ghana generally impacted on total advances to businesses in 2023.

The implication is conscious efforts of government towards practical implementation of programmes that would enhance economic stimulation are needed to stem the tide of loan defaults. The foregoing would complement the risk management strategies of banks for recovery. This assertion lends strong credence to the practical need for implementation of the Ghana Financial Stability Fund; and supports the innovative steps taken by banks to restore their capital levels earlier than the 2026 window allowed by the Bank of Ghana.

The industry’s capital adequacy ratio in December 2022 (16.2%) remained higher than the ratio recorded during the same period in 2023 (13.9%). The ratio for 2023 (13.9%) was a far-cry of the Bank of Ghana’s regulatory requirement of 16.60% as at December 2022. However, it (13.9%) was in excess of the minimum capital adequacy ratio (8%) and capital conservation buffer (2.5%) requirements under Basel III (10.5%).

Economic essence of the capital adequacy ratio rests in its reflection of better capital-to-risk-weighted-assets ratio; and the ability to resonate strong capitalisation and improved financial resilience of institutions within the banking industry. The available data depict an industry with strong capital position; and the capital adequacy ratio suggests, in the event of any credit risk concentration shocks, institutions in the banking industry would still have the capacity to maintain capital adequacy ratios above the minimum regulatory capital requirement under Basel II and III.

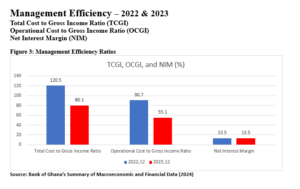

Performance of the industry’s income statement during the period under review remained very strong. To illustrate, the total cost to gross income ratio encouragingly dropped to 80.1% at the end of December 2023, from 120.5% during year-ended December 2022. Similarly, the industry’s operational cost to gross income ratio witnessed significant reduction to 55.1% at the end of December 2023, from 90.7% at year-ended December 2022. However, there was no difference in the net interest margin (NIM) recorded at the end of December 2023 (13.5%) and the ratio recorded at year-ended December 2022 (13.5%). This net interest margin ratio (13.5%) speaks enormously to the profitability and growth potential of banks in the comparative financial years.

Further, the foregoing developments are indicative of the positive strategic measures implemented by the various banks to control cost; maximise revenues and profits with the overarching aim of achieving set organisational targets and objectives. Overall, the industry’s strategies ensured considerable growth in revenues relative to operating expenses in 2023 comparative to 2022.

The general financial condition of the industry is exemplified in the quality of banks’ assets anchored by the quality of loan and investment portfolios; and efficient credit administration programmes. The foregoing is indicative of strong risk mitigation measures for capital and loan formation; and indicative of financial stability of the banking industry.

The average return on equity (ROE) (after tax) ratio for 2023 (34.2%) was significantly in excess of the negative ratio for 2022 (-34.4%); and indicative of how banks in the industry navigated the challenges experienced in 2022 to efficiently; and effectively derive profits from the investments of shareholders in 2023.

Similarly, the industry’s return on assets (ROA) (before tax) witnessed monumental increase during the comparative review; the ratio in 2023 (5.4%) remained very impressive comparative to the negative ratio recorded in 2022 (-3.8%). The higher return on assets ratio in 2023 (5.4%) attests to the productiveness and efficiency of banks in managing their respective balance sheets to ensure consistent and effective profit generation.

Core liquidity ratios of the industry during the period under review remained strong. This affirmed the availability of high-quality liquid assets to fund short-term cash outflows. The relatively high liquidity ratio in 2023 comparative to 2022 buttressed banks’ preparedness for potential market-wide shocks to avert any short-term liquidity disruptions that may wave the market.

Indicators of the industry’s profitability such as return on assets, return on equity and net interest margin, amongst others, showed significant improvement and high level of operational efficiency during 2023 relative to 2022. This is quite refreshing since investors generally perceive return on equity as better metric for effective assessment of the market value; and strong indicator of potential growth of institutions in the banking industry.

Impeccable performance of the banking industry including comparatively high return on equity during 2023 is envisaged to be sustained through 2024 and beyond. This growth potential is expected to serve as unique attractive tool for investors to the banking industry to shore up capital and investment in the financial sector; and attract investors to other sectors within the broader Ghanaian economy.

Conclusion

Establishment of the Ghana Financial Stability Fund is vital towards providing the requisite financial respite or safety net for banks and other financial institutions for their active participation in the recent domestic debt exchange programme in the country. Consistent with earlier submission by the Bank of Ghana, it is imperative to state, primary considerations for the GHȼ15 billion financial stability fund extend beyond universal banks to include rural and community banks; special deposit-taking institutions; collective investment schemes; broker-dealers; fund managers; and insurance companies. Disbursements, thus far, to institutions in the foregoing categories amount to GHȼ2.5 billion.

It is refreshing to state, banks in the industry have taken proactive steps to strengthen their risk management practices and internal control mechanisms. These initiatives have strategically positioned the industry towards containment and mitigation of potential solvency challenges that may emanate from loan concentration. Banks are not oblivious of their critical role in preserving stability of the country’s financial system; and therefore, are consistently partnering the Bank of Ghana (BoG) and other key stakeholders to ensure sustained stability of the banking industry and financial sector.

The industry projects positive outlook; and banks remain committed to deepening financial inclusiveness and credit growth by increasing loans to businesses in the small- and medium-sized enterprises’ (SMEs’) category. This financial support initiative which is nationally-focused would be concentrated in strategic sectors of the economy; and diligently advanced to minimise risk while increasing the rate of loan recovery; and restoring public confidence in the broader financial system in the immediate-, medium- and long-term.

Overall, the performance of banks and other related institutions reflects an industry that is responding meaningfully to novelty and innovation; emerging quickly from the claws of the recent domestic debt exchange programme with stronger initiatives that would perpetuate its assertiveness in the financial sector; affirming its dominance in financial inclusiveness; and positively driving the economy towards the path of recovery and steady growth in the immediate-, medium- and long-term.