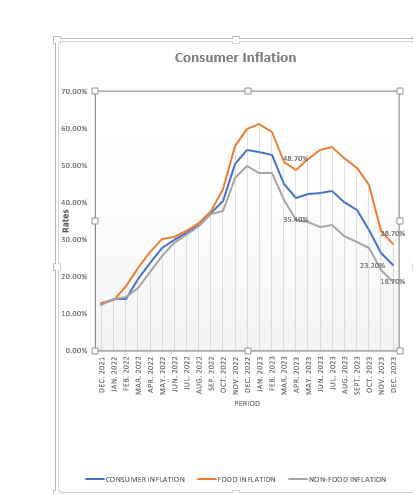

Consumer inflation eased further in December 2023 – closing at 23.2 percent, down from November’s 26.4 percent per data from the Ghana Statistical Service (GSS).

This 3.2 percentage point decline aligns with forecasts, providing relief from the previously higher and persistent inflation.

Cumulatively, inflation dropped 30.4 percent during 2023 while average inflation was 39.91 percent. The year-end inflation rate outperforms government’s 31.3 percent target for end-2023 outlined in the 2024 budget, as well as the IMF’s 29.4 percent central forecast.

The significant decrease mainly results from favourable base effects relative to the heightened Consumer Price Index levels in 2022. The sustained downward trend signals continued disinflation after 30 percent inflation persisted for two consecutive months.

Disinflation began in July 2023 when the rate declined from 43.1 to 40.1 percent in August after peaking at 54.1 percent in December 2022, then gradually easing to 41.2 percent by April 2023. However, inflation briefly rose in May before the overall downward trend set in.

Since the 54.1 percent peak, headline inflation cumulatively dropped to 30.4 percent in 2023 from 53.6 percent at the start of the year. Both food and non-food inflation have markedly decreased – by 32.2 percent and 29.2 percent respectively. Currently, food inflation and non-food are 28.7 percent and 18.7 percent, down from 61 percent and 47.9 percent at the start of 2023.

On a month-on-month basis, December 2023 inflation print went up by 1.2 percent relative to 1.5 percent that was recorded for November 2023; indicating continued increase on a month-on-month basis for the second consecutive month.

Market impact

Largely, the market has priced in disinflation expectations – visible in the easing Treasury bill rates at recent auctions, ranging from 29.19 to 32.32 percent across 91-day to 364-day maturities. This affirms positive sentiments that nominal yields may have peaked between 29.97 to 33.70 percent. Expectations for a yield correction are high as inflation falls sufficiently to restore a positive real policy rate.

The favourable return bodes well for the Treasury’s domestic financing plans. However, some expect T-bill yields will elevate in early 2024 amid high gross borrowing pressure. With a GH¢61.9billion target for deficit financing solely via T-bills against maturities, plus a GH¢31.8billion buffer accumulation, substantial pressure partly impedes the yield decline despite falling inflation.

The Treasury issued GH¢150.28billion on the money market in 2023, surpassing its GH¢135.88billion target. Investors tendered GH¢154.44billion – of which GH¢31.47 billion constituted new debt supporting the 2023 budget, given the unavailability of international capital financing.

Disaggregation of Inflation

From a locally produced and imported items perspective, the data revealed the dominance of locally produced items for the first time in the last couple of months; with inflation for locally produced items standing at 23.8 percent while inflation for imported items was at 21.9 percent.

Disaggregating the 13 divisions, Government Statistician Prof. Samuel Kobina Annim observed that six of them recorded inflation rates higher than the national average of 23.2 percent. This was led by alcoholic beverages, tobacco and narcotics which recorded the highest divisional rate of 38.2 percent, while transport (4.4 percent) recorded the lowest rate of inflation on the list.

On a regional basis, Eastern Region recorded the highest food inflation rate of 51.3 percent while the Upper East recorded the lowest food inflation rate of 18.8 percent. Greater Accra placed 14th among the 16 regions, recording a food inflation rate of 22.2 percent.