The market anticipates an elevation in Treasury bill yields throughout Q1 and Q2 of 2024, with the Treasury market retaining its position as the primary commercial financing avenue for government.

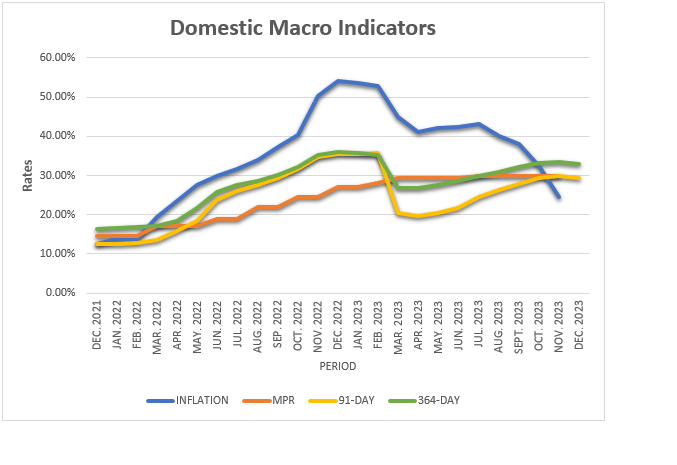

Consumer price inflation has notably decelerated – dropping to 26.4 percent as of November 2023 on the back of favourable base effects in recent times.

Despite the expected enhancement in liquidity conditions, investors grapple with the challenge of managing ‘excess cash’ and identifying promising assets following the Domestic Debt Exchange Programme’s (DDEP) conclusion.

IC Securities, a market watcher, highlighted this dilemma in its insights; anticipating a recurring scenario in 2024, especially during February and August when coupons on the New Bonds are paid – flooding the market with maturities.

“Our biggest headache since conclusion of the DDEP has been a twin dilemma of ‘excess cash’ and finding good assets to buy. We anticipate a similar theme playing out in 2024 as a cascade of maturities flood the market in February and August, when coupons on the New Bonds are paid,” IC Securities highlighted in its investment theme shaping the markets in 2024.

However, IC Securities foresees the pace of yield compression in 2024 as contingent on various factors – such as the speed of disinflation; risks to FX stability affecting policy rate positioning; and the public sector’s domestic borrowing requirements. With a target financing of GH¢61.9bn (5.9 percent of GDP) to cover the overall budget deficit solely through T-bill issuances, coupled with impending T-bill maturities, the pressure for higher gross public sector borrowing becomes evident.

This heightened borrowing pressure on T-bills is further exacerbated by the Treasury’s plan to accumulate a buffer of GH¢31.8bn (3 percent of GDP) primarily from excess uptakes at the weekly auctions.

Consequently, the projection is for substantial domestic borrowing pressure to partly slow the expected decline in T-bill yields in 2024, even amid a downward trend in inflation. This decline in nominal yields is expected due to a policy pivot, with the market anticipating a shift toward policy rate cuts after inflation sufficiently decreases to reestablish a positive and restrictive real policy rate.

The expectations include a cautious downward trajectory for the policy rate in 2024, potentially commencing with a cut in May 2024. However, potential seasonal FX pressure in 1Q 2024 – along with election-related uncertainties and external debt restructuring – might limit the pace of monetary easing in 2024.

IC Securities’ projection for inflation in 2024 suggests an average inflation of 24.6 percent in 1H 2024, moderating to 17.7 percent % in 2H 2024 (year-end: 16.1 percent ±1.0pp). Investors are likely to seek positive real returns between 3 percent – 6 percent in 2024, marking a shift from the negative real returns experienced since 2022. Consequently, average nominal T-bill interest rates are estimated to range between 27.6 percent – 30.6 percent in 1H 2024, with a further decline to between 20.7 percent – 23.7 percent in 2H 2024.

Secondary bond market expectations

The bond market is expected to be relatively quiet as signalled by the Treasury, indicating a lack of new issuances while existing restructured bonds grapple with price discovery and liquidity challenges.

IC Securities stated that repurchase agreements and ‘sell-buybacks’ are anticipated to dominate any deals involving restructured bonds throughout 2024.

“A subdued secondary bond market prompts a need for innovative approaches in seeking assets that yield competitive returns aligned with the economy’s broader risk profile. While the repo market has been a primary strategy in 2023, tightening money market spreads due to increased cash reserve ratios for banks suggest diminishing opportunities in this space. However, this spread tightening is expected to be temporary, with a surge in local market liquidity anticipated by 1Q 2024,” it said.