Introduction

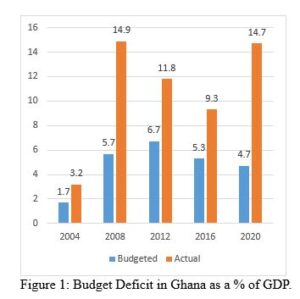

In accordance with Article 179 of the 1992 Constitution and section 21 of the Public Financial Management Act, 2016 (Act 921), the Minister for Finance presented the budget statement on behalf of the President on Wednesday, 15th November 2023. The 2024 budget is critical for the country as it tries to navigate the desire to meet societal needs and wants against a fiscal tightening requirement by the IMF. This is even more challenging given the desire for ruling parties to spend more in an election year with or without an IMF programme as evident in Figure 1.

The government is projecting a budget deficit of 5.9% of GDP for 2024 as against the budgeted 4.6% for 2023, comprising GHS226.7 billion expenditure and a total revenue and grants of GHS176.4 billion. The size of the economy is expected to reach GHS1 trillion.

The IMF backed Post COVID-19 Programme for Economic Growth (PC-PEG) budget is anchored on the following objectives: Restoring Fiscal and Debt Sustainability, Deep and Wide-Ranging Structural Reforms, Stable Inflation and Exchange Rate, Preserve Financial Stability, Entrepreneurship, Growth and Job Creation and Protecting the Vulnerable and the Poor.

The performance of the budget will largely depend on the success or otherwise of the external debt restructuring programme (external debt was US$ 29.4 billion (57.6% of the total debt) as of September 2023), the effectiveness of the revenue mobilisation measures and above all the discipline for government to stay within the expenditure.

Revenue side:

The government sets a more ambitious target to mobilise a total revenue of GHS 176.4 billion, which is about 22% higher than the 2023 target. From the 2024 budget, tax revenue will comprise 81.1% of the total government revenue. An examination of the tax buoyancy for 2024 yields a value of 1.39. The historical tax buoyancies for 2022 and 2023 have been estimated at 1.44 and 1.29, respectively. Even though the values of the tax buoyancies are largely homogeneous, the marginal rise in the tax buoyancy in 2024 leads to a number of questions regarding the credibility of the budget:

- What additional taxes is the government introducing to change the buoyancy?

- Is the government increasing the statutory tax rates, and will the targeted increased tax collections be realised?

- How is the government broadening the tax base to elicit acceptance?

- What is the government doing differently to increase tax revenues above the historical norm?

- What will be the impact on tax morale?

On the domestic side, these questions are particularly critical given that the government is abolishing a number of taxes and granting import duty exemptions that would have otherwise spurred domestic tax revenue mobilisation.

On the external side, the country’s lack of market access coupled with its graduation to a middle-income country status implies that external financial resources, including grants, will be constrained.

Expenditure side:

The expenditure items have also increased, suggesting that the government’s fiscal policy stance will be expansionary. Debt financing will increase by at least 25% in 2024, inhibiting the government’s social and capital expenditures. Given the current constrained fiscal space, financing the primary expenditure in addition to interest payments will be a challenge. It is, therefore, crucial for the government to re-anchor fiscal policy through a credible medium-term strategy.

Overall impression of the budget:

To the extent that the country is under the IMF programme, which requires the adoption of a less expansionary fiscal stance, evidence from the expenditure patterns and the tax buoyancy suggests that the budget is less credible. The knock-on effects of these above-the-line budget items will result in a higher budget deficit, outstripping the deficit reported in the budget.

Other key observations are as follows:

Key Observations

- Although inflation has dropped to around 35.4% in October 2023 from 54.1% in December 2022, the decline is largely driven by non-food inflation which fell by 22.2% point compared to 14.9% point for food inflation.

- The rate of the cedis’ depreciation has slowed. The cedi has only depreciated by 6.4 % on a cumulative basis since February 2023 compared to 53.9 % over the same period in 2022.

- Total public debt has declined from 73.1% of GDP at the end of 2022 to 66.4% as of September 2023. It is refreshing to note that the government will not undertake any new non-concessional borrowing in 2024.

- The growth in real GDP of 3.2% in the first half of 2023 was driven by growth in the Services and Agriculture sectors. However, it is worrying to note that the manufacturing sector experienced declines in all its sub-sectors, notwithstanding the one-district-one factory policy.

- The gains in inflation and exchange rate have not translated into interest rate decline as the average lending rates of banks increased to 32.48% in September 2023 from 29.81% recorded in the corresponding period of 2022.

- Consequently, there has been a dramatic decline in credit to the private sector in real terms by 25.5% as of September 2023 compared with a 3.0% growth in the same period last year. This depicts a tightening financing environment for businesses in the country which is translating into lacklustre economic growth in 2023.

- Although there has been an increase in total assets of the banking industry to GH¢250.7 billion as of the end of September 2023, representing a year-on-year growth of 14.9%. There are still some teething problems with the banking industry as asset quality weakened due to an increase in the Non-Performing Loans (NPL) to 18.0% in September 2023, as against 14.1% in September 2022.

- There has been an increase in domestic investor participation in the equity market as the GSE-CI moved from 35.9% recorded in 2022 to 46.4%, backed by an increase in Pension Funds allocation to equities.

- The government has met major requirements to access the second trench of the IMF $3 billion Extended Credit Facility (ECF). This could provide some support in the budget financing.

- The Treasury market will be active and functional in 2024 as it represents the primary domestic financing strategy of the government, while funds from the IMF-ECF and World Bank Development Policy Objective will support the external financing for the budget in 2024. Given the domestic debt structuring programme, the government should be cognisant of a possible low rollover risk in the domestic markets.

- Government intends to undertake external debt restructuring to complement the DDEP as part of efforts to achieve sustainable debt level.

- Tax incentives such as import duty waiver on importing raw materials for local production of sanitary pads and the VAT zero-rating on made-in-Ghana sanitary pads could significantly impact the domestic sanitary pads manufacturing industry. The government must ensure that these tax incentives are reflected in the final prices consumers pay for sanitary pads as pledged in the 2024 budget.

- Other tax incentives, such as import duty exemptions for investors to assemble electric vehicles in Ghana and for commercial electric buses for public transportation, though well intended, may have a minuscule impact on the automobile industry and the Ghanaian economy. This is because challenges to electric vehicle use, such as the high cost of enabling infrastructure and inadequate charging stations, have not been addressed.

- GRA is to collaborate with the District Assemblies to utilise the property rate database and Digital Address System to identify houses and their usage for purposes of property rate assessment. This creates a good opportunity for revenue mobilisation at the local level.

Recommendations

- Government should ensure fiscal discipline and wade off the pressure to unbridled spending during election years. This could help in achieving the budget objective of restoring fiscal and debt sustainability. In addition to re-anchoring fiscal policy through a credible medium-term strategy, the government must undertake a comprehensive fiscal adjustment. It is also critical for the government to mobilise domestic revenue by curbing corruption in revenue collections and digitalising payment points.

- Government should adopt proactive fiscal rules while strengthening budget institutions to improve the implementation of the fiscal plan. In addition, the government must adopt a strong and transparent communications strategy that promotes the long-term benefits of reforms.

- To transform the economy’s structure, there is a need to pay attention to the manufacturing sector to maximise the backward and forward linkages associated with the sector’s growth. The AfCFTA provides an excellent opportunity for the government to focus on the small-scale manufacturing industry, given the nature of the economy. As specified in the budget, this could be a game changer in achieving entrepreneurship growth and job creation.

- Agricultural financing needs to be given a top priority as the sector has the potential to reduce the country’s import bill and help achieve a stable exchange rate, which is one of the budget’s objectives. It has been estimated that the country spends about US$2.0 billion to import poultry, rice, sugar, vegetables, and other food products annually.

- The implementation of the second phase of planting for food and jobs provides an opportunity to address critical challenges facing the sector. The programme can potentially drive down food inflation, which is a major contributor to overall inflation, and consequently bring inflation back towards the target. This potential can be actualised if lessons are drawn from the challenges faced by the first phase of the planting for food and jobs in the implementation process.

- Government’s activity on the domestic market could have a crowding effect on the private sector. Given that it is the primary option open to the government, it has to be done with some moderation to minimise its effect on the interest rate and private borrowing.

- The measures to intensify property rate collection are laudable. However, there is a need for a proper analysis of the implementation strategy and its possible effect on private rents, given that landlords will likely pass on the cost to tenants.

- Government must work to ensure that the tax incentives extended to local sanitary pad manufacturing are reflected in the final prices consumers pay for sanitary pads.

- Government should work to address challenges to electric vehicle use, such as the high cost of enabling infrastructure and inadequate charging stations to encourage the use of electric vehicles in Ghana.

- In order to successfully restructure external debt within the Common Framework, the government must implement prudent debt management strategies, including limiting creditor recoveries, introducing most favoured creditor clauses, immunising the sovereign assets from seizure and moving towards an aggregate collective action into existing debts and debt-like instruments.

References

Ministry of Finance (2023). The Budget Statement and Economic Policy of the Government of Ghana for the 2023 Financial Year, Ministry of Finance.

Ministry of Finance (2024). The Budget Statement and Economic Policy of the Government of Ghana for the 2024 Financial Year, Ministry of Finance.

Presented By:

Prof. Issahaku Haruna

Dr. Yazidu Ustarz

Dr. Ibrahim Muazu

Dr. Ibrahim Nandom Yakubu

The authors are with the University For Development Studies,UDS School Of Business ,Department of Finance