The Bank of Ghana’s (BoG) recent decision to implement a 15 percent unified Cash Reserve Ratio (CRR) on both local and foreign currency bank deposits is poised to intensify pressure on the already strained Treasury market.

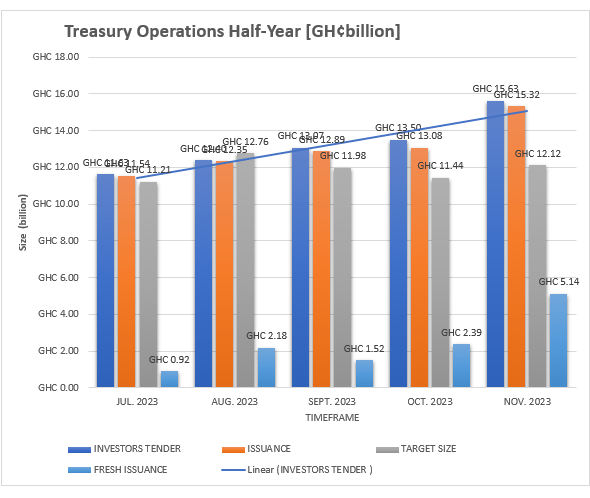

Last week’s auction results revealed such fears as there was a liquidity squeeze following the new CRR directive. The Treasury’s target of over GH¢5billion was undersubscribed by GH¢1.7billion, as the new directive drained excess liquidity on the interbank market while commercial banks raced to meet the regulatory requirement.

Since November 30, the new unified CRR mandates a 15 percent reserve requirement on both cedi accounts and foreign currency holdings at domestic banks, to be held in local currency. Previously, the CRR on local cedi deposits stood at 14 percent while foreign currency deposits were subject to a 12 percent reserve requirement, which was reduced from 13 percent. These foreign currency reserves were held in the respective currencies.

The rationale behind this move was the banking sector’s surplus liquidity amid decreasing credit issuance and lending growth. The Bank of Ghana’s (BoG) decision to increase and standardise the CRR aims to tighten monetary conditions further and assist in the ongoing fight against high inflation. However, concerns have been raised regarding the potential escalation of government borrowing costs on the Treasury market as a consequence of this reserve hike.

According to GCB Capital, a market watcher, given the deposit numbers at the end of October 2023, the new CRR directive should drain about GH¢11billion in cedi liquidity from the interbank market.

Evidently, the Treasury’s target size suffered an undersubscription of 30 percent at the auction’s close last week. This marks the first time in eight weeks that government has missed its auction target. Investors tendered GH¢3.92billion across the 91-to-364-day bills, compared to the target size of GH¢5.62billion.

The Treasury accepted all the bids, sufficient to cover a sum maturing face value (FV) of GH¢3.45billion due on Monday, December 4, 2023 across all the bills, reflecting a maturity cover of 1.13x.

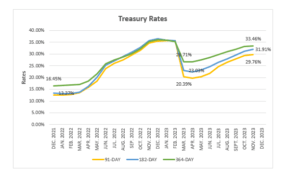

Consequently, yields reversed the trend, recording a mixed performance, with the 91-day bill increasing by 7bps to 29.57 percent. In contrast, the 182-day bill remained the same at 31.76 percent, while the 364-day bill increased by 21bps to 33.44 percent.

Reviewing last week’s Treasury market performance, GCB Capital said: “We expect the reversal in yield to be temporary as the continuous decline in inflation and normalisation of GH¢ liquidity conditions after the initial shock from the CRR directive reinforce the anticipated yield correction cycle”.

The unification and upward adjustment of the CRR have been portrayed as a timely intervention aiming to mitigate the costs associated with BoG’s OMO operations, and facilitate liquidity withdrawal from the cash-rich banking system without a corresponding increase in expenses. Additionally, this move seeks to reintroduce FX liquidity held in reserves back into the economy to maintain continuous cedi stability.

“Largely, banks have directed their deposits into high-yielding T-bills and the BoG’s open market operation (OMO) bills due to the lack of other credible investment alternatives in the market, resulting in a 7.5 percent y/y contraction in total credit and advances,” stated GCB Capital in its review of the central bank’s liquidity management measures.

Amid government’s significant domestic financing requirements for 2024, concerns have surfaced regarding potential limitations on yield correction across the spectrum of Treasury bills spanning from 91-days to 364-days.

The Treasury, as of November 30, 2023, had exceeded its money market issuance target – issuing GH¢137.86billion against a GH¢125.39billion target. Notably, GH¢28.43billion of the total issuances represented net new debts, aimed at supporting the 2023 budget due to government’s inability to access international capital markets.

The imposition of this liquidity squeeze, following the 15 percent unified CRR, implies government might have to persist with offering higher interest rates to sustain domestic investor participation in financing its substantial borrowing needs for 2023 and 2024.

T-bill yields and market expectations

The recent surge in yields on the 91-day, 182-day, and 364-day Treasury bills – ranging from 300 to 400 basis points this year – appears to be showing signs of nearing a peak. However, concerns have arisen that the new 15 percent unified CRR could potentially stall any significant decline or relief rally in yields.

While there’s optimism regarding the near-term inflation outlook pressuring yields lower, the imposed CRR hike now restricts the potential downside as government contends for an even smaller pool of available investable funds in the market.

Market sentiments suggest that nominal yields might have reached a peak, ranging between 29.97 percent to 33.70 percent along the T-bill curve. Expectations for a yield correction are prevalent, especially with adjustments in the T-bill auction process – including pre-auction price guidance by the Treasury through Primary Dealers (PDs).

The BoG’s move to unify and raise the CRR also aims to uphold local cedi stability, assisting in liquidity withdrawal from banks without incurring additional costs while reinjecting FX liquidity to support continuous stability.