…as banks continue deploying resources to short-term investments

Credit to the private sector has contracted significantly, reaching its lowest level in over four years according to newly released data from the Bank of Ghana.

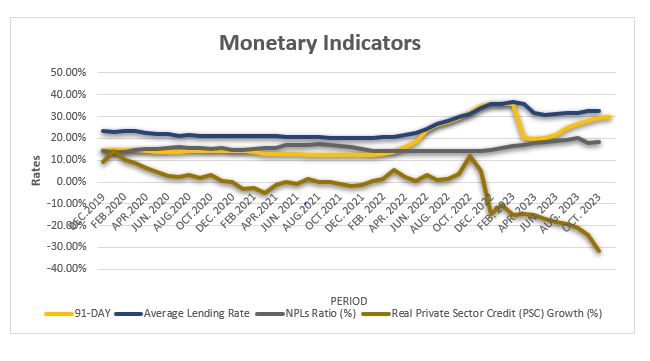

As of October 2023, private sector credit posted a contraction of 7.5 percent in nominal terms – a major reversal from the 57.3 percent growth seen in October 2022.

In real terms, the contraction is even more severe – private sector credit fell deeper into negative territories of 31.6 percent compared to positive growth of 12 percent the previous year. This downward trajectory highlights the continued risk aversion posture among banks, leading to substantially reduced lending for both businesses and individuals.

“Banks continue deploying their resources toward short-term investments as opposed to extending credit, in response to the increased risks associated with lending following the deteriorating macroeconomic conditions and impact of the Domestic Debt Exchange Programme,” said Dr. Ernest Addison, Bank of Ghana Governor, at a recent press briefing in Accra.

While the banking sector remains largely stable, sound, liquid and profitable, the industry’s non-performing loan (NPL) ratio climbed to 18.3 percent in October 2023. This reflects heightened credit risk connected to last year’s economic crisis. However, the Governor noted that profitability continues rising as banks invest in high-yield Bank of Ghana and government debt instruments.

The contracting private sector credit comes even as economic activity shows signs of recovery from a difficult 2022. Growth rebounded to an average 3.2 percent in the first half of 2023. High-frequency indicators point to continued momentum, albeit at a more moderate pace, in the third quarter.

However, the steep decline in lending to businesses and households raises red flags about future growth prospects. There is a risk of the trend worsening further, as the quantum of government borrowing in 2024 risks crowding out private sector investment critical for growth.

This could be tamed with the MPC’s additional measure to unify the currency holding for the Cash Reserve Ratio requirement on foreign currency denominated deposits and domestic currency deposits for banks – effectively resetting the CRR to 15 percent from November 30, 2023. This is to reinforce the Bank’s liquidity management operations to address excess structural liquidity conditions in the market, and provide additional impetus to the disinflation process.

Government’s proposed 2024 budget aims to raise GH¢61.4billion to fund the deficit almost entirely from domestic markets – over 99 percent of total financing needs. This would more than double 2023’s domestic financing. Heavy government borrowing risks soaking up available credit needed for private sector investment, key to the country’s growth goals.

As of November 20, 2023, Ghana’s Treasury had already issued GH¢128.93billion on the money market, surpassing its GH¢119.77billion target. A significant portion of GH¢22.95billion represents new debt taken on to finance 2023 expenditures.

With government increasingly relying on domestic markets due to its inability to tap international capital, less financing remains available for the private sector. The sharp contraction in credit access could negatively impact Ghana’s growth trajectory if the trend persists in the medium- to long-term.