Petroleum receipts for the period January to September 2023 saw a significant decline of 35.72 percent compared to the same period OF 2022, impacting overall funds received into the Petroleum Holding Fund (PHF).

The receipts from crude oil liftings alone for the aforementioned period, according to finance minister Ken Ofori-Atta, totalled US$509.68million. When factoring in other petroleum receipts, the total amount received into the PHF amounted to US$751.32million. This marks a notable decrease from the US$1,168.99million received during the same period of 2022.

The minister, during his presentation of the 2024 Budget and Economic Policy on the floor of parliament, indicated that the report includes data from the 69th – 72nd Jubilee liftings, 22nd TEN lifting, and the 12th and 13th liftings from the Sankofa Gye-Nyame field, showing a shift in the petroleum landscape.

Of the total amount distributed (US$750.69million) he said state-owned Ghana National Petroleum Corporation (GNPC) received an amount of US$184.45million. This allocation to GNPC consists of an equity financing cost of US$117.63million and GNPC’s share of the net Carried and Participating Interest (CAPI), which amounted to US$66.82million.

The decline in petroleum receipts for the first nine months of 2023 has however raised concerns over the national oil company’s financial health. With a decrease in funds allocated to GNPC, there may be potential implications for ongoing projects and strategic initiatives within the oil and gas sector.

Already, the country has witnessed a 9.54 percent drop in crude oil production totalling 35.42 million barrels, compared to the same period of the preceding year, in the first three-quarters of 2023. Against this, there are fears that a potential drop in global oil prices could throw a spanner in the works of GNPC.

The decline is attributed to natural waning in the TEN field and escalated gas-to-oil ratio and water production in the Jubilee and Sankofa fields.

The minister said the Greater Jubilee field contributed 21.94 million barrels, TEN field produced 5.02 million barrels and Sankofa-Gye Nyame field yielded 8.46 million barrels.

However, this was 9.54 percent lower than the 39.15 million barrels produced in the same period for 2022.

Meanwhile, he said the project’s partners lifted 34.29 million barrels – with the Ghana National Petroleum Corporation lifting 6.65 million barrels on behalf of the state.

Furthermore, he noted that of the of 188,956 thousand standard cubic feet (Mscf) total gas production, 77,876 Mscf was used for power generation and non-power purposes. SGN Field transported 50,743 MMScf, Greater Jubilee Field transported 26,444 MMScf and TEN Field transported 689 MMScf for power generation. The average daily gas export of 285.26 MMScf was slightly below the target of 289.47 MMScf.

It will be recalled that Executive Director-Africa Centre for Energy Policy (ACEP), Benjamin Boakye, called for the regulatory environment to be ‘sanitised’ to attract new investments.

While recounting that Ghana had lost about 20 million barrels (bbls) of oil on a year-to-year basis, he advocated a rethink of the country’s strategy to make more from its oil resources.

Mr. Boakye was speaking in an interview at the back of a recent media engagement in Accra, and observed that the country made some gains in petroleum revenue despite the declining production – projecting that prevailing conditions will not likely allow a repeat of such fortune.

“Last year was an outlier; for this year, the oil prices have been averaging US$75 per barrel. If we are not lucky and production also dips, then it will be a double pain for the country,” he said.

This development, he noted, will have implications for the country’s budget – indicating that the declining oil production has already led to some job losses in the extractive sector.

Consequently, current developments affirm the ACEP boss’ position.

Also, in a brief reaction to current oil and gas developments, Economist and Executive Director-ACT AFRICA, Abdul Karim Mohammed said: “What’s happening with our gas output is that we have not invested in processing capacity to be able to offtake from the producing fields; so, they are either reinjected or flared, and that in turn also increases our CO2 emissions”.

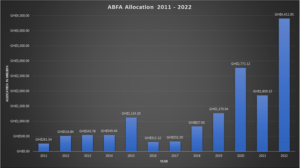

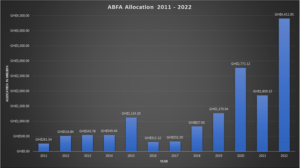

Writer’s construct. Data source: PIAC