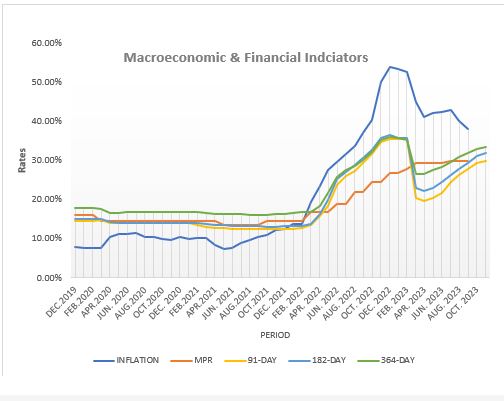

Yields on the spectrum of money market instruments, spanning the 91-day to 364-day Treasury bills (T-bills), appear to be edging toward a probable apex.

This trend emerges amid a backdrop of receding inflation rates, a static monetary policy and the implementation of new pricing directives by the Treasury.

Recent market data reveal a notable shift as yields on Treasury bills experienced a decline, after a consistent ascent lasting 33 weeks, during the November 10, 2023 auctions. The yields for both the 91- and 182-day bills saw a reduction following consecutive weeks of increases, though they sustained elevated levels at 29.84 percent (-13bps w/w) and 31.88 percent (-27bps w/w) respectively.

Similarly, the 364-day bill retreated by 25bps w/w to 33.45 percent – marking its first weekly downturn since June 23.

To address the escalating yields in short-term papers, the issuer introduced price guidance during recent auctions. This initiative, adopted for T-bill auctions by government and Bond Market Specialists (BMSs), commenced on November 3, 2023. The introduction of price guidance aims to align expectations of both the Treasury and investors, potentially offering a means to control yield fluctuations as investors bid within the guided rates.

Reflecting the overall economic climate, headline inflation has decreased for the third consecutive month; dropping to 35.2 percent in October 2023 from 38.1 percent in September 2023. This signals a continued disinflationary trend, diverging from the persistent 40 percent range observed over the previous six months and culminating at 40.1 percent in August 2023. From its peak of 54.1 percent in December 2022, headline inflation has seen a cumulative decline of 18.9 percent.

The monetary policy rate has remained at 30 percent since the July 2023 MPC meetings and is anticipated to persist through the remainder of the year, aligning with the easing inflationary trends.

The November 10, 2023 auction sustained its sixth consecutive oversubscription at 29 percent, attracting bids totalling GH¢4.01billion against the week’s target of GH¢3.11billion. The Treasury accepted and sold GH¢3.90billion, reflecting a bid-cover ratio of 1.03x and adequate funds to settle maturing bills, exceeding 54 percent, marking the highest since March 2023.

Earlier measures by government to curb escalating Treasury yields proved effective in trimming bids toward the end of Q1-2023. This capitalised on robust demand for bills, subsequently lowering the cost of borrowing. Consequently, yields on the 91-day, 182-day and 364-day bills notably declined. However, continued reliance on money market borrowing post-April, coupled with limited external funding, sustained the upward movement in yields as investors sought appropriate compensation against prevailing macroeconomic and fiscal uncertainties.

Projections for this week’s auction anticipate a dip in T-bill rates, attributed to the newly implemented pricing methodology and decline in headline inflation. Moreover, robust participation is expected due to excess liquidity in the banking system and a scarcity of alternative investment options.

Anticipated T-bill maturities in the final quarter indicate a weekly average of approximately GH¢2.56billion, signalling heightened financing requirements for government to refinance these maturities. Despite this, an anticipated easing in headline inflation during Q4-2023 could mitigate the rise in yields. Additionally, securing sufficient financing from entities like the IMF and other donors, a 36-month arrangement under the US$3billion Extended Credit Facility (ECF) – a programme based on the government’s Post COVID-19 Programme for Economic Growth (PC-PEG) – could alleviate government’s refinancing burden on the T-bills market.

In an outlook shared by Databank, expectations lean toward a slower increase in money market yields and a robust bond market in Q4-2023. The market observer foresees a mirrored slowdown in the uptick of Treasury bill yields, aligning with government reliance on money market funds and diminishing inflationary pressures. Despite this reliance, efforts to diversify funding sources are expected to intensify.

The estimated Treasury bill maturities of GH¢34.02billion across the 91-day to 364-day bills represent a 9.72 percent increase from the previous quarter, exerting significant pressure on government’s refinancing needs. Likelihood of the Treasury bolstering its reserves in Q4-2023 against impending domestic debt servicing obligations in Q1-2024 could increase reliance on short-term securities. Nevertheless, softening inflationary pressures are anticipated to decelerate the rise in T-bill yields.

Secondary Market

Although competitive T-bill yields present a near-term risk to the improvement of bond market activity, projections suggest sustained robust trading due to a gradual resurgence in demand from foreign investors.

Analysis of GFIM data for Q3-2023 demonstrates a notable reversal in net-selling activity, underpinned by substantial buying interest from foreign investors. Coupled with improving macroeconomic indicators, this uptick in foreign investor demand, Databank believes, is anticipated to bode well for government bond yields – sustaining a robust trading atmosphere.