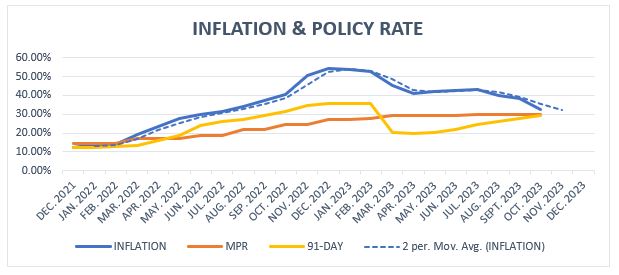

Headline inflation rate recorded a third consecutive decrease, falling to 35.2 percent in October 2023 from 38.1 percent in September 2023, as per data released by the Ghana Statistical Service (GSS). This latest figure represents a 2.9 percentage point drop from September 2023.

This downward trend signifies the continued disinflation process, moving away from the 40 percent range that persisted for six months and ending at 40.1 percent in August 2023.

The process of disinflation began when inflation dropped from 43.1 percent in July 2023 to 40.1 percent in August, defying market expectations. In the first half of 2023, inflation showed signs of easing – starting at a peak of 54.1 percent in December 2022 and reaching 41.2 percent in April 2023. However, there was a brief increase of 100 basis points in May, momentarily interrupting the downward trajectory.

Since its peak at 54.1 percent in December 2022, headline inflation has declined by a cumulative 18.9 percent. Both non-food and food inflation have notably decreased, by nearly 22.2 percent and 16.2 percent respectively, further emphasising the disinflation trend.

Market observers anticipate the ongoing disinflation process continuing through Q4-23, despite emerging upside risks. This expectation is supported by current macroeconomic and structural reforms, particularly the front-loaded fiscal tightening, debt reforms and the memorandum on zero-deficit financing. Consequently, the Monetary Policy Committee (MPC) is expected to maintain the policy rate at 30 percent during November’s 2023 MPC meeting.

GCB Capital, in its review of September inflation data suggested: “The MPC could maintain a rate-neutral decision through Jan-24 to anchor the disinflation process, and the monetary policy stance could pivot by March 2024 if the inflation outlook improves sufficiently. Again, we expect that nominal interest rates will continue the northward trek through the quarter, but at a slower pace as the negative real return gap closes”.

Segments of inflation data

In October 2023, both Food and Non-food inflation dropped for the third consecutive month. Food inflation stood at 44.8 percent, marking the second-lowest figure over the last 13 months. Meanwhile, Non-food inflation was recorded at 27.7 percent; representing the lowest figure in the past 13 months. Notably, steeper declines were observed for food inflation compared to non-food inflation.

Furthermore, among the divisions four recorded inflation rates higher than the national average of 35.2 percent. These were Alcoholic beverages, tobacco and narcotics (45.7 percent); Personal care, social protection and miscellaneous goods and services (45.0 percent); Food and Non-Alcoholic Beverages (44.8 percent); and Furnishings, household equipment and routine household (40.9 percent). On the other hand, Insurance and Financial Services recorded the lowest rate of inflation at 5.5 percent.

Additionally, Restaurants and Accommodation Services recorded the highest month-on-month rate of inflation at 3.2 percent, while food inflation recorded the lowest at 0.1 percent. Seven of the 13 divisions recorded rates higher than the national monthly inflation of 0.6 percent. These divisions include Restaurants and Accommodation Services (3.2 percent); Education Services (2.2 percent); Alcoholic Beverages, Tobacco, and Narcotics (1.3 percent); Recreation Sport and Culture (1.2 percent); Housing, Water, Electricity, Gas and other Fuels (1.1 percent); Clothing and Footwear (0.8 percent); and Information and Communication (0.8 percent).

A closer inspection of the inflation figures reveals that locally produced items experienced a decline in inflation, from 37.3 percent in September 2023 to 34.4 percent in October 2023, while the inflation rate for imported items decreased from 39.9 percent in September 2023 to 37 percent in October 2023.

Monetary policy action

Following the 114th MPC meeting, Dr. Ernest Addison, Bank of Ghana (BoG) Governor, highlighted the role of tight monetary policy and relative exchange rate stability in contributing to the ongoing disinflation process during a media briefing on the Monetary Policy Committee’s stance on inflation dynamics. He emphasised the committee’s readiness to respond appropriately should inflation deviate from expectation.

The earlier surge in inflation since May 2023, which eased in August 2023 to 40.1 percent, can be attributed to a combination of factors – including the impact of new revenue interventions, upward adjustments in utility tariffs and the continued rise of food prices. Although initial effects of the revenue measures may be waning, the persistent increase in food prices remains a key driver of inflation, partially offsetting the favourable base effect observed since May 2023.

Over the three months ending in July 2023, elevated food costs emerged as a significant driver of inflation, posing challenges for both consumers and policymakers. However, there is optimism for potential relief in Q4-2023, as experts anticipate the major staple crop harvesting season in August and September to alleviate these pressures.