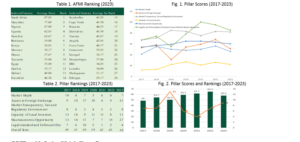

The Absa Africa Financial Markets Index (AFMI) monitors the progress of indexed African nations and highlights the influence of policymakers, regulators, and market participants on the sustainable development of their respective financial markets. The index employs both quantitative and qualitative analysis to rank financial markets based on the following six pillars: market depth, access to foreign exchange, market transparency, tax and regulatory environment, capacity of local investors, macroeconomic environment and transparency, and legal standards and enforceability. The 2023 edition of the index demonstrates a decline in overall scores for the majority of the twenty-eight countries comprising the index, including South Africa, which has been the dominant market since the index’s inception. For Ghana, the decline caused by unfavorable global conditions beyond the control of policymakers is very noticeable.

With a total score of fifty-eight percent, Ghana dropped two positions to ninth in the current edition, falling from seventh to ninth (see Fig. 1). Since 2018, the nation has scored above fifty percent, and its scores have generally increased with the exception of 2019. Similar to the underlying difficulties in 2019, the decline in 2023 is primarily attributable to low access to foreign exchange, the macroeconomic environment, and transparency scores. The country’s debt crisis and the subsequent Domestic Debt Exchange Program in February 2023 weigh heavily on these two pillars. Inflation was exacerbated by currency depreciation, which also contributed to lower indicator and pillar scores.

DDEP and Inflation Weigh Ghana Down

Capital outflows as a result of external factors, such as the tightening of global monetary policy, fears of stagflation, and the Russia-Ukraine war, caused the market capitalization of all AFMI countries to decline further in the 2023 index. This was exacerbated by the depreciation of the majority of African sovereign currencies, which weakened the FX reserves of indexed nations. Ghana’s increasing public debt and sluggish economic growth made debt restructuring an attractive debt sustainability strategy. Prior to the sovereign default, investor sentiment and concerns about the sustainability of public debt led to capital outflows. Significantly, Ghana’s foreign exchange reserves decreased to 0.6 months of imports in 2022 from 2.4 in 2021. This caused a seven-point decline in the Access to Foreign Currency pillar. In February 2023, as anticipated, the nation restructured its domestic debt in response to the aforementioned global headwinds. As part of the domestic debt exchange program, government bonds were restructured in order to reprofile the maturity and coupons. The restructuring negatively impacted the value and turnover of listed Ghanaian government bonds. This occurrence diminished investor confidence in the Ghanaian economy. Unsurprisingly, Ghana saw the steepest decline in outstanding corporate bonds in June, from 1.9 percent of GDP a year earlier to 0.1 percent. As a result, the country’s ranking dropped significantly by four points from the previous year.

In general, indexed economies were stable during the examined time period. However, inflation remains a concern for many African central banks. Ghana, along with eight other nations, had an inflation rate above twenty percent. Inflation remained elevated in 2022, as noted by the Ghanaian central bank, due to both demand pressures and supply shocks. In contrast, the headline inflation rate fell to 38.1 percent in September 2023, after rising to a peak of 54.1 percent in December 2022. The acceleration in inflation was primarily caused by the lagging effects of the sharp depreciation of the currency. Inflation was exacerbated by the rapid depreciation of the cedi, therefore weighing on the 2023 score of sixty.

IOSCO Commitment and ESG Disclosure Boost Ghana

The alignment and enforcement of standard master agreements in Ghana’s financial market contribute to the country’s high Legal Standards and Enforceability score. Since 2020, Ghana has adopted the Global Master Repurchase Agreement (GRMA) and enacted legislation for close-out netting. Even though the Global Master Securities Lending Agreement (GMSLA) is ideal for scoring, its adoption by market participants has not significantly affected scoring. As previously stated, market participants are accustomed to using non-standardized contracts in their transactions. This practice impedes the adoption of GMRA and international investor access. Nonetheless, as a result of its efforts thus far, Ghana ranks in the top five for this pillar with an average score of seventy-eight percent.

In addition to legal opinions for standard master agreements, another indicator considered under the Legal Standards and Enforceability pillar for 2023 is a country’s status as a signatory to the multilateral memorandum of understanding of the International Organization of Securities Commission. The IOSCO Memorandum of Understanding establishes a benchmark for international cooperation and transparency in the enforcement of securities and derivatives laws, which can bolster investor confidence. In September 2022, the Securities and Exchange Commission of Ghana signed MMoU Appendix A. This strategic move significantly increased Ghana’s score.

Market Transparency, Tax and Regulatory Environment has been a consistent high-scoring pillar for Ghana, indicating a transparent and well-regulated investment environment. Adoption of International Financial Reporting Standards (IFRS), availability of human resources to implement IFRS, and subsequent auditing of these processes all contribute significantly to this recognition and ranking. However, the Ghana Stock Exchange’s policy direction in driving environmental, social, and governance (ESG) reporting improved Ghana’s position in the 2023 edition. The GSE’s publication of ESG disclosure guidelines for listed companies and the National Pensions Regulatory Authority’s (NPRA) guidelines for considering environmental, social, and governance factors in investment decisions are steps in the right direction for the country’s pursuit of sustainability-minded investors and investments.