The country urgently needs to enhance its framework for monitoring and tracking remittances if it is to fully capitalise on the growing influx of inward payments to spur growth.

The existing system for overseeing remittances is fraught with challenges – such as obtaining accurate migration data and coordinating the efforts of regulatory agencies, money transfer companies (MTCs) and fintech firms, says a study titled ‘Balance of Payments (BoPs) and Inward Remittances Compilation and Analysis Issues: The Case of Ghana from 2016-2022’, jointly authored by financial analysts Dr. Richmond Atuahene, K.B Frimpong and Isaac Kofi Agyei.

With these critical issues at the heart of the research, the authors highlighted inbound remittances’ role in bolstering foreign exchange reserves – surpassing even traditional exports like cocoa and gold over the past decade. They argue that discrepancies in the value of inbound remittances persistently undermine the national economy.

These remittances, they contend, are a reliable and sustainable source of foreign exchange earnings that should not be underestimated.

“The inadequacy of practical compilation guidance concerns compilers, who as a result often produce data which are less credible than other balance of payment components… international remittances, which represent the largest source of external finance for Ghana – surpassing cocoa and gold over the past few years – could have been significantly used to mitigate the local currency’s persistent depreciation against major trading currencies,” a section of the paper highlights.

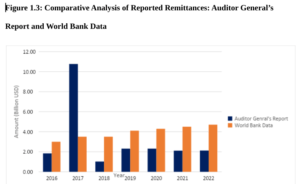

This longstanding issue is well-documented. For example, in 2015 the World Bank reported that Ghana received an estimated US$2.1billion in remittances. However, the Bank of Ghana (BoG) data for the same year indicated that migrant remittances were nearly US$5billion.

Despite fluctuations and challenges posed by the pandemic, Ghana has seen a consistent increase in remittances and currently ranks as the second-largest remittance recipient in sub-Saharan Africa.

In 2021, remittances totalled US$4.5billion, constituting 5.9 percent of the country’s GDP, and this figure climbed to US$4.7billion in 2022 according to the World Bank.

The authors also pointed out several obstacles encountered in the compilation and analysis of remittances stemming from a multitude of channels – non-compliance issues, the absence of proper frameworks, limited capacity for data compilation, regulatory changes and deficiencies in data quality.

The paper notes that a primary concern relates to the diverse channels used for remittance transfers, which make it difficult to accurately account for the total amount in the country’s balance of payments statistics… possibly leading to an underestimation of the actual remittances flow.

Non-compliance with regulations by digital technology infrastructure companies, including mobile money and fintech firms, presents another challenge. Their failure to comply with regulations complicates the task of regulating these entities and reporting remittances data accurately, contributing to divergent data-reporting practices which further complicate the compilation of remittances data.

In 2021, the central bank issued guidelines for payment service providers such as Money Transfer Operators (MTOs) and Fintech companies, outlining how they should handle foreign funds. These guidelines required them to maintain two separate accounts; one for receiving remittances and another for handling local transactions. However, the guidelines did not specify the need for a special account to reimburse foreign banks – resulting in issues with tracking and recording foreign currency inflows from 2019 to 2022.

As a consequence, the BoG failed to benefit from foreign currencies; as MTOs and Fintech companies retained foreign funds in accounts with foreign banks, making it challenging to track overseas funds flowing into the country.

In many developing countries, including Ghana, the absence of a suitable framework for harnessing the potential of remittances for economic growth and development remains a significant obstacle. Additionally, the high costs associated with formal remittance channels often prompt remitters to resort to informal ones – further complicating data collection.

The limited capacity of developing countries to compile Balance of Payments (BoP) statistics accurately is another concern, leading to disparities between national and international data. These disparities arise from differences in compilation methods and resource constraints for data collection.

Furthermore, regulatory changes in the international remittance sector, particularly the influx of fintech companies, have not always aligned with existing regulations. This has contributed to discrepancies between World Bank data and Ghana’s own remittances data. The growing demand for safer, more secure and quicker international money transfers is pushing the adoption of digital currencies – further altering the landscape.

The proliferation of various remittance channels, each with its unique characteristics, presents a challenge for the BoG in accurately capturing remittance statistics. Informal sources and unregistered or unlicenced money transfer businesses complicate tracking efforts.

Weaknesses in the country’s remittance data represent a significant issue, potentially leading to discrepancies in reported figures. The absence of practical compilation guidance and the categorisation of certain financial transfers – such as money invested in foreign bank accounts as investments rather than remittances – can also impact data accuracy, posing yet another challenge in the field of remittance analysis.

To address these challenges, the authors propose a series of practical policy recommendations. These include enhancing data collection processes to align with international standards; replenishing the BoG’s Nostro Accounts with foreign exchange; and conducting external audits of MTCs and fintech companies to ensure compliance with the Foreign Exchange Act 2006 (Act 723).

“The Bank of Ghana must strengthen its procedures and processes for capturing global inward remittance data collection and analysis, including assessing the World Bank’s yearly remittance aggregates to improve remittance data. The Bank of Ghana should also adopt specific practical guidance on data sources and compilation methods to address the discrepancies between Bank of Ghana data and World Bank inward remittance data,” the paper recommended.

“The Ministry of Finance and Bank of Ghana must ensure that MTCs and Fintech companies involved in international remittances reimburse the Bank of Ghana’s Nostro Accounts or authorised dealer commercial banks with all foreign exchange components accrued, in compliance with Foreign Exchange Act 2006 Act 723.

“Foreign exchange from international remittances could help reduce the current account deficit and stabilise the local currency against major trading currencies like the US dollar, euro and UK pound sterling. The Bank of Ghana should be prepared to reconcile the Nostro Accounts of all MTC and Fintech companies. Furthermore, the Bank of Ghana should commission international audit firms to conduct forensic audits on all MTC and Fintech companies,” the paper added.

Furthermore, the paper underscored the importance of conducting comprehensive surveys to assess the scale of remittances and labour migration, enabling authorities to devise strategies for maximising the benefits of remittances while minimising negative consequences.

“The Ministry of Finance, Minister of Foreign Affairs and Regional Integration and Bank of Ghana, together with their development partners like the World Bank, need to arrive at a judgment as to whether or not remittances are likely to be a permanent phenomenon in Ghana’s Balance of Payments (BoPs),” it advised.