Nigeria: Nigerian unions circle back on proposed strike.

Ghana: Petroleum prices expected to increase.

South Africa: Local PMI data and a stronger U.S. dollar put the rand on the back foot.

Egypt: S&P’s PMI declines for Egypt’s non-oil sector.

Kenya: The central bank of Kenya retains the benchmark rate at 10.5%.

Uganda: Uganda’s Inflation declines further to 2.7%.

Tanzania: Shilling remains flat against the U.S. dollar.

XOF Region: Senegal represented by 16 startups at this year’s Bpi Innovation Génération.

XAF Region: Cameroon: increased progress in streamline clearance operations.++

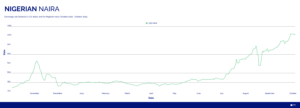

Nigerian Naira (₦)

Compiled by Ikenga Kalu

Last week, the naira lost even further ground against the USD and has finally crossed the dreaded 1000 mark.

The National Labour Union and Trade Union Congress have suspended their decision to go on nationwide strike for the next 30 days after holding a meeting with the Nigerian federal government. Both unions were originally slated to commence the strike on October 3, 2023 but decided on its suspension after reaching a series of agreements with the federal government. The agreements include a suspension of value added tax on diesel for the next six months and the payment of NGN 25,000 to 15 million households and vulnerable pensioners for the next three months.

In the absence of government intervention in the parallel market, we expect continued depreciation of the naira in the coming days as the relatively dismal supply of FX continues to apply pressure on the rates.

Further reading:

Nairametrics — NUC, TUC suspend nationwide strike for 30 days

Ghanaian Cedi (GH¢)

Compiled by Sakina Seidu

The Ghanaian cedi dropped in value from USD/GHS 11.6 to USD/GHS 11.8 in the early part of this week.

The Institute of Economic Studies (IES) alerted Ghanaians of a marginal increase in the price of petroleum products in October after a short period of relative stability. This is as a result of world prices experiencing an upward shift amid increasing interest rates as well as the depreciation of the cedi.

With the improved U.S. dollar yields attracting new investors to the U.S. economy and increased demand for FX in the Ghanaian market, the GHS is expected to continue to lose value against the dollar.

Further reading:

Ghana Web — Cedi jumps to sell at GH¢11.80 to $1

Citi Business News — Prices of petroleum products to rise marginally in October – IES

FX Empire — U.S. Dollar Stays Strong As Treasury Yields Test New Highs

South African Rand (R)

Compiled by Alex Barmuta

The USD/ZAR started the new week trading at 18.8688. The rand moved back above 19.00 by Monday afternoon, and as of Wednesday afternoon, it was trading around 19.20 levels.

Locally, the 1.5% drop on Monday was influenced by Absa Purchasing Managers’ Index (PMI) survey which showed factory activity shrank for the eighth month in a row.

That being said, global markets (including the rand) took a strong hit earlier this week due to a change in expectations from the U.S. economy — as a rise in U.S. bond yields means there is less incentive to hold riskier assets. This comes on the back of a rising expectation for strong growth from the U.S. economy in the third quarter. U.S. job openings data exceeded expectations for August indicating that the labor market remains robust and resilient despite attempts from the Federal Reserve to slow down the economy — this in turn, could fuel further rate hikes this year.

Looking ahead, we can expect the rand to continue trading above the 19.00 handle against the dollar, possibly ranging in the 19.00–19.30 area.

Further reading:

Reuters — South African rand slumps on local PMI data, stronger dollar

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound continued to trade around USD/EGP 30.90 levels over the past week.

Egypt’s non-oil sector contracted in September with S&P Global’s Purchasing Managers’ Index (PMI) declining from 49.2 in August to 48.7 in September. According to data from S&P’s survey the decline was largely attributable to rising inflation and supply chain difficulties. However, strong employment data reveals that companies are still willing to maintain and even increase current staff levels. The last unemployment figure released at the end of Q2 showed unemployment of only 7%.

According to the Egyptian central bank, net international reserves were reported at $34 billion in September. This is below the forecast of $36 billion however it is slightly better than that August reserves which were marginally lower.

The pound is expected to remain trading around USD/EGP 30.90 in the week ahead.

Further reading:

Egypt today – Egypt’s non-oil sector declines due to supply chain challenges and inflation

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling is trading at a new all-time low of USD/KES 148.35/148.65 as it remains under sustained pressure from those buying dollars such as manufacturers and firms in the energy sector. The Monetary Policy Committee met on October 3, 2023 and made the decision to hold the benchmark rate steady amid global uncertainties, inflationary pressures, an increase in international oil prices and a weak global growth outlook. For the second consecutive time the central bank has decided to keep its benchmark interest rate at 10.5% so that it aligns with its ongoing efforts to maintain price stability and support economic growth. We expect the shilling to remain under sustained pressure as the foreign exchange reserves continue to provide adequate cover against short term shocks. The foreign exchange reserves currently stand at USD 6,901 million which is 3.7 months of import cover.

Further reading:

Investing.com — Kenya Central Bank Holds Key Interest Rate Steady Amid Inflation Concerns

Ugandan Shilling (USh)

Compiled by Yadhav Panday

USD/UGX traded at 3,735 on Wednesday, October 4, 2023 down 0.53% from last Friday. Looking ahead, we expect USD/UGX to fall further as employment in Uganda increased for the sixth consecutive month, with firms hiring more staff to handle rising orders and purchasing activity, as well as to deplete backlogs.

Meanwhile, suppliers’ delivery times increased amid reports of shortages, particularly of food products, while inventories increased. In terms of costs, input and output prices continued to rise, owing to higher prices for a variety of goods and services, including cement, food products, metal bars, construction materials, fuel and utilities, and labor costs.

Uganda’s annual inflation rate fell further to 2.7% in September 2023, from 3.5% the previous month. This was the lowest reading since January 2022, as education prices fell (3.8% vs 7.5% in August) and food and non-alcoholic beverages prices fell (5.1% vs 7.7%). Health (1.8% vs 2.2%), information & communication (2.4% vs 3.3%), housing & utilities (3% vs 3.4%), restaurants & accommodation (4.2% vs 5%), and personal care, social protection, and miscellaneous goods (6.6% vs 7.9%) all experienced price decreases.

Further reading:

Capital radio — Uganda’s Inflation declines further to 2.7%

Tanzanian Shilling (TSh)

Compiled by Kristin Van Helsdingen

The Tanzanian shilling remained trading within the same range as it did last week, moving to a high of USD/TZS 2,510 and low of USD/TZS 2,505. The Tanzanian shilling has remained within a tight range against the U.S. dollar and is currently trading at USD/TZS 2,508.

The Dar es Salaam Stock Exchange had a spike in activities during the month of September and with tourism peaking this year, the country has purchased a new airplane and is expecting two more before the end of the year.

With tourism on the rise as well as the continued efforts of the Bank of Tanzania to stabilize the value of the shilling, we can expect the shilling to remain stable against the dollar in the week ahead, trading between USD/TZS 2,504 and 2,510.

Further reading:

AFRICA PRESS – DSE registers substantial surge in market activities

AFRICA PRESS – Optimism high as Tanzania acquires new Boeing 737- MAX9

West African CFA Franc Region (XOF)

Compiled by Yashveer Singh

The ninth edition of Bpi Innovation Génération (BIG) is set to take place on October 5, 2023 in Paris, with Senegal being represented by 16 startups operating in various sectors such as agriculture, crafts, robotics, logistics, energy, and education. BIG, initiated by Bpi France, is a platform for French companies and entrepreneurs to share and exchange ideas, develop their businesses and networks, and explore future challenges and technological trends through nearly 500 conferences and workshops led by over 1,000 speakers.

Alyfa, founded by Racky Daffé, is Senegal’s first toy brand established since 2015, offering Afrocentric educational games that promote cultural diversity and intercultural understanding among children. Alyfa plans to expand its offerings to include interactive entertainment like video games and animations.

Mame Aby Sène, the general director of Der/Fj, believes that events like BIG provide promising startups with the opportunity to build valuable relationships within the French and international ecosystem, contributing to the economic growth of Senegal and making a global impact.

Further reading:

Sikafinance — 16 Senegalese startups selected for Bpi Innovation Generation 2023

Central African CFA Franc Region (XAF)

Compiled by Yashveer Singh

The Cameroon government has made significant progress in its efforts to streamline customs clearance operations. Recently, two important reforms were implemented: the Single Exit Document (SED) and the digital receipt in the Cameroon Customs Information System (Camcis), which were introduced by a Ministry of Finance circular on June 4, 2023.

The Single Exit Document (SED) gathers all essential details — such as service stamp, declaration number, serial number of the receipt, operator’s name or company name, unique identification number, container references, etc. — related to exported items onto a single document.

These reforms are part of a broader initiative to digitize customs procedures across Cameroon’s land, sea, and air borders. The implementation of these reforms will also enable QR code-based controls. Notably, the Camcis system, launched in Cameroon in April 2020, has proven to be effective in revenue collection, surpassing initial forecasts. In 2020, it helped customs collect CFA 750 billion, exceeding the projected CFA 650 billion, as reported by the Minister Delegate for Finance Yaouba Abdoulaye, during a cabinet meeting in April 2021. For 2023, the government’s revenue collection target through Camcis is set at CFA 973.7 billion.

Further reading:

Business In Cameroon — Cameroon reaches new milestone in streamlining clearance operations