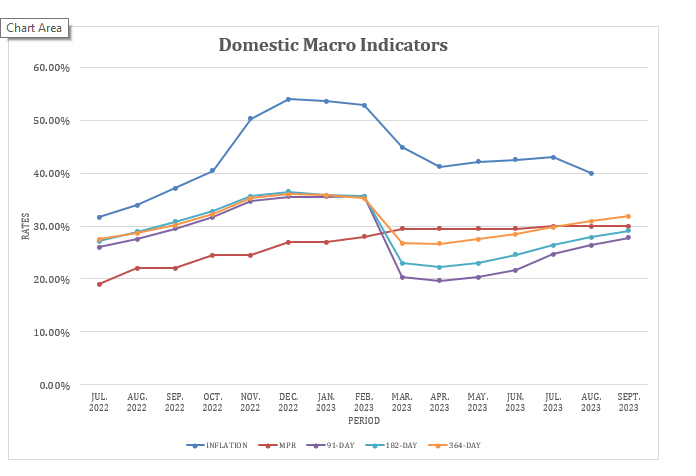

The Bank of Ghana (BoG) Monetary Policy Committee (MPC) has kept the benchmark policy rate unchanged at 30 percent due to the stability observed in the macroeconomy, as indicated by the recent decline in domestic inflation.

The decision was revealed following conclusion of the 114th MPC meeting, where the committee highlighted its commitment to managing inflation and ensuring the economy’s stability.

“While the disinflation process has resumed – which should result in a gradual return to the target band over the medium-term barring unanticipated shocks – rising international crude oil prices and adjustments to utility tariffs remain a risk to the inflation outlook, which will have to be managed through monetary policy vigilance,” the BoG Governor, Dr. Ernest Addison, said during a press briefing.

The MPC insisted that adherence to a tight monetary policy stance and relative stability of the exchange rate have played crucial roles in facilitating the ongoing disinflation process. Since December 2022, headline inflation has seen a substantial cumulative decline of 14 percent as non-food inflation also experienced a notable reduction of nearly 20 percent; demonstrating the central bank’s monetary policies’ effectiveness.

After three consecutive months of upticks since May 2023, headline inflation for August reversed course by easing to 40.1 percent year-on-year, a drop of three percent from July. This marks the lowest inflation print thus far in 2023, with the sharp slowdown in August erasing the increases recorded since May.

All core inflation measures, closely monitored by the central bank, are trending downward, Dr. Addison said – indicating a sustained easing of underlying inflationary pressures. Furthermore, one-year-ahead survey-based inflation expectations appear well-anchored, providing optimism for Ghana’s economic outlook.

The Committee also attributed improving macroeconomic conditions to the policy mix under a three-year Extended Credit Facility (ECF), which it says is beginning to yield positive results.

Rebound

Economic activity is rebounding with the exchange rate achieving moderate stability and foreign exchange reserves improving, which should restore real incomes and purchasing power for the citizens, Dr. Addison noted.

“The first half of 2023 witnessed remarkable growth, and this trend is expected to continue into the third quarter as indicated by the Bank’s July 2023 update of the Composite Index of Economic Activity (CIEA). Ghana’s Purchasing Managers’ Index (PMI) also supports the optimistic growth outlook, reflecting improving business conditions,” he said.

Confidence surveys conducted thus far have also shown continued improvements in business and consumer sentiments, largely influenced by the cedi’s relative stability and resumption of the disinflation process. This boost in confidence is anticipated to persist throughout the remainder of the year, aligning with the overall trend of improving macroeconomic conditions.

The decision to maintain the policy rate at 30 percent underscores the Bank of Ghana’s commitment to preserving economic stability and managing inflation in the face of potential risks. With positive economic indicators and promising growth prospects, Ghana appears well-positioned to continue its journey toward sustained economic prosperity.

The market anticipates that food inflation will moderate in September 2023, aided by the ongoing harvest season. A relatively stable cedi and expected additional foreign exchange inflows, such as US$800million from this year’s COCOBOD debt syndication and a US$600 million disbursement under the IMF ECF post-first programme review, are also projected to impact general price levels positively in the near-term.