The second Deputy Governor of the Bank of Ghana (BoG), Elsie Addo Awadzi, has emphasised the urgent need for financial institutions to integrate environmental, social and governance (ESG) considerations into their operations.

In a speech read on her behalf at the 2nd edition of the Non-Bank Financial Institutions (NBFIs) Awards and Dinner Night, the deputy-Governor stressed that prioritising tenets of ESG is essential for sustainable economic growth and resilience in the face of current global challenges.

More importantly, she said, financial institutions, especially the NBFIs, must take a positive approach in addressing ESG issues by integrating ESG criteria into investment decisions, promoting responsible lending practices, and ensuring transparent reporting on ESG performance.

She further highlighted the importance of collaboration between financial institutions, regulators and other stakeholders to drive effective ESG integration – saying by sharing best practices and collaborating on initiatives, the sector can collectively work toward a more sustainable and inclusive future.

As the world tackles issues such as climate change, the financial sector has a crucial role to play in driving positive change.

“Prioritising inclusive, sustainable and green finance is essential. These principles not only ensure stability and growth, but also benefit society and the environment. Integrating inclusive financing guarantees equitable participation, while adopting sustainable and green finance practices helps mitigate environmental risks. Embracing these principles will underscore our commitment with a positive global footprint. Moreover, as responsible stewards of the financial landscape, we must integrate environmental, social and governance considerations now,” Ms. Addo Awadzi stated.

Touching on the theme ‘Sustaining the gains of inclusive finance through innovation and technology’, she said capacity-building and skills development have emerged as essential components for equipping employees with the necessary expertise to serve customers effectively.

“Capacity building and skills development are essential to equip employees with the necessary skills to serve customers. Therefore, as we navigate a rapidly evolving landscape, equipping our workforce with the right skills is paramount. This involves continuous training to handle both technical and ethical aspects of their jobs,” she noted.

Collaboration and partnership among traditional institutions, fintechs and other stakeholders, she added, are also pivotal in driving innovation and growth. In addition, consumer education and protection should also be a priority, with a focus on enhancing transparency and preventing fraud.

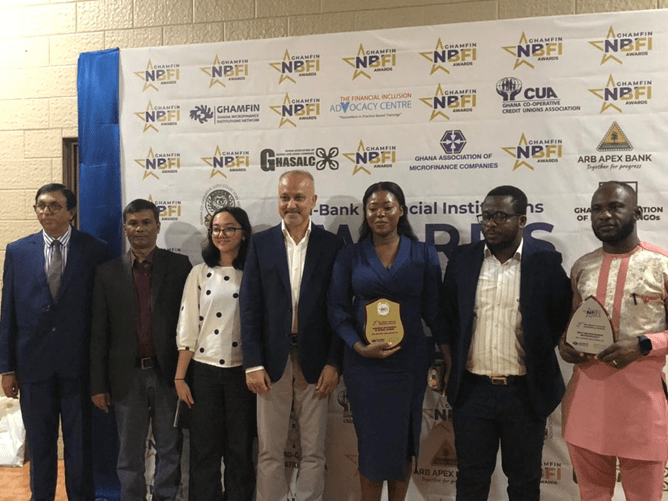

The NBFI Awards

The Executive Director of Ghana Microfinance Institutions Network (GHAMFIN), Yaw Gyamfi, commenting on the event explained that this year’s awards were separated into nine categories – distinguishing NBFIs that have not only achieved industry recognition but also helped their clients to access appropriate products.

The awards scheme has been designed to celebrate the successes of NBFIs in their intermediation roles and activities.

Some of the institutions honoured at the event include: Advans Savings and Loans Limited; ASA Savings and Loans Limited; Atwima Kwanwoma Rural Bank; Fiaseman Rural Bank PLC; Afro-Arab Microfinance Limited; Leverage Microfinance Limited; and Winners Credit Cooperative Union, among others.