Ghana’s financial sector in recent times have witnessed a narrative marked by challenges and shifts in market dynamics. Despite significant reforms in the fund management industry and a sweeping overhaul of the banking sector within the past five years, the assumption that the industry’s turbulent times were behind us has been tested in recent months.

Runaway inflation, the deterioration of public finances, and a sharp depreciation of the currency collectively eroded the notion of guaranteed returns on lending to the government. The resultant panic levels reached generational highs.

Nevertheless, as Ghana charts its recovery path, the evolving investment terrain within the financial sector offers insights into the economy’s state and potential avenues for growth. In this comprehensive analysis, we delve deep into the intricate interplay of data, market forces, and policy shifts, creating a comprehensive portrait of Ghana’s financial sector and its journey toward resurgence.

The year 2022 is poised to be etched as a pivotal point in Ghana’s financial sector history. The sector actively engaged in the Domestic Debt Exchange Programme (DDEP), and while its intent was not to induce unintended consequences, liquidity and solvency risks loomed over the sector, along with huge impairment losses on financial statements of banks.

Ghana’s total public debt reached unsustainable levels in 2022, soaring to GH¢575.7 billion as of November 2022, equivalent to 94.3percent of GDP according to the Bank of Ghana’s Summary of Economic and Financial Data. As the economy teetered on the brink, the government turned to the International Monetary Fund (IMF) for a bailout, however, meeting the IMF’s bailout conditions necessitated a recalibration of Ghana’s existing debts to manageable levels, marking the inception of the DDEP. The unprecedented debt restructuring programme presented a formidable challenge to the financial sector due to its exposure.

Against this backdrop, on December 5, 2022, the Ministry of Finance (MoF) unveiled the DDEP. However, this initiative unfolded amid the headwinds of the Russia-Ukraine conflict and the ongoing aftermath of the COVID-19 pandemic. Hemmed in by these crises and barred from international financial markets, Ghana faced challenges mobilizing external resources to service its maturing debt. As October 2022 approached, the Ghana cedi took the unenviable distinction of being the world’s poorest-performing currency, plagued by the surging demand for the US dollar.

The programme entailed holders of specific Ghanaian government debt instruments voluntarily exchanging them for newly issued bonds. Although presented as optional, investors faced limited alternatives as the tradability of old instruments waned, and their coupon payments grew uncertain. The new bond rates and maturities substantially reduced the value of government securities for investors across the financial market.

Regulators took proactive strides to cushion the DDEP’s blow on the financial sector. Measures included reducing the cash reserve requirement and setting zero-risk weights for the new bonds. Plans to establish a Ghana Financial Stability Fund with budgetary backing and support from development partners aimed to bolster the sector’s solvency and liquidity.

The DDEP’s impact is evident, with an estimated 85percent participation rate translating to a loss of about 55percent in investors’ original bonds’ net present value (NPV). The extent of this loss dominated conversations and narratives surrounding Ghana’s banking industry, especially the solvency of the sector.

Notably, a second round of DDEP is underway as of June 28, 2023, with an eye on restructuring another GH¢123 billion of public debt to fulfill criteria for the IMF ECF programme. The restructuring spans domestic dollar bonds, cocoa bills, and pension funds. This forward-looking approach demonstrates Ghana’s dedication to navigating the complex financial terrain, striving to secure a more stable and resilient economic future.

Domestic bonds were pervasive across Ghana’s financial sector. Pre-DDEP, banks allocated 30 to 50percent of total assets to government securities, with state-owned banks displaying particularly high exposures, given that some years past government had convert loans owed banks into bonds of some quasi-government institutions in the energy and educations sectors. This as well made the sector heavily rely on income from these securities. Notably, the alterations in interest rates and maturity terms stemming from the DDEP have led to a diminished capacity for future cash flow generation from the bonds. Consequently, banks have encountered potential liquidity pressures.

The DDEP’s coupon reductions and maturity extensions spell a decline in asset value to approximately 70percent of par value, profoundly impacting the balance sheets of these institutions, according to the 2023 PwC Ghana Banking Survey Report.

The 2023 Survey Report points to a lack of preparedness among banks for the DDEP. Critical indicators that should have raised alarms about investments in government securities seemed to have been overlooked. Fitch Ratings’ multiple downgrades of Ghana’s issuer default rating (IDR) for long-term local currency (LTLC) and long-term foreign currency (LTFC) debt instruments in 2022 were among these indicators.

Looking back with hindsight, an overwhelming majority (~94percent) of respondent banks in the PwC survey expressed that they should have taken a less substantial position in government securities before the DDEP implementation. A scrutiny of financial statements revealed that by the end of 2022, banks’ government securities holdings averaged 32.7percent of total assets, a drop from 46.2percent in 2021. These figures underscore the direct and substantial influence of the government’s fiscal policy and performance on the banking industry and the resulting impact on the private sector.

The year 2022 witnessed Ghana’s banking industry reporting a staggering net loss of GH¢6.6 billion, reflecting a profound financial decline (a 238percent drop) compared to the prior year, primarily attributed to the DDEP. However, the response to the DDEP from regulators has been proactive.

Data extracted from a PwC survey encompassing 22 universal banks affiliated with the Ghana Association of Banks revealed a staggering rise in net impairment losses on financial assets within the sector. These losses surged from GH¢1.43 billion in 2021 to an astounding GH¢19.5 billion in 2022. This stark increase substantially affected the financial standing of the banking sector, causing a negative ripple effect on its performance metrics.

The repercussions of the DDEP on the banking sector’s performance shows that the earnings assets-to-total assets ratio, which is a key performance indicator, experienced a decline from 65.6percent in the previous year to 60.3percent in 2022.

Furthermore, the sector’s financial performance shifted from a profit of GH¢4.99 billion in 2021 to a loss of GH¢6.02 billion at the close of the 2022 fiscal year. These figures underscore the extent of the challenges faced by the banking industry due to the profound impact of the DDEP.

Despite the challenges, it is noteworthy that the banking industry managed to show some positive momentum in certain areas. Total assets, net interest income, and total operating income in the sector witnessed respective increases of 18.8percent, 26.1percent, and 31.2percent. Key indicators such as return on assets (ROA) and return on equity (ROE) experienced substantial declines of 5.68percent and 48.5percent, respectively, during 2022.

Additionally, both liquidity and solvency were adversely affected by the consequences of the DDEP. It is important to acknowledge, however, that the industry remained in compliance with the minimum capital to risk-weighted assets ratio, despite a marginal dip from 28.07percent to 15.6percent, thanks to regulatory measures introduced by the Bank of Ghana in response to the DDEP.

Navigating the path to recovery

The path to recovery for banks in the first half of 2023 has proven to be less than smooth, given challenging macroeconomic outlook in the near-to-medium term. This anticipation is not unwarranted, given the austerity measures anticipated to accompany the IMF program. The Global Economic Prospects report issued by the World Bank in June 2023 echoes this sentiment, as it revises the 2023 real GDP growth forecast down to 1.6percent from the earlier January projection of 2.7percent. Throughout much of 2023, the prevailing economic headwinds are anticipated to remain formidable.

Notably, the financial reports submitted by banks for the first half of 2023 reflect the persistent effects of the DDEP. This is evident despite a robust rebound in profitability, which followed significant losses incurred at the end of 2022 due to impairments of holdings in Government of Ghana (GoG) bonds.

As of June 2023, the banking industry’s total assets amount to GH¢242.4 billion, indicating a moderated growth rate of 21.2percent, down from 22.8percent in June 2022. Impressively, total deposits have surged by 42.8percent, reaching GH¢187.6 billion in June 2023, compared to GH¢131.3 billion, showcasing a growth of 19.1percent in June 2022. In contrast, total borrowings contracted by 39.1percent to GH¢16.0 billion, a decline from GH¢26.4 billion recorded a year earlier.

The profitability of the banking industry has shown improvement in the first half of 2023. Net interest income has surged by 41.4percent to GH¢9.9 billion, surpassing the 12.4percent increase recorded a year ago. Simultaneously, net fees and commissions have expanded by 30.6percent to GH¢2.2 billion, in comparison to a 27.0percent growth over the same period the previous year.

Consequently, operating income has risen markedly by 46.1percent, surpassing the 22.6percent growth registered in 2022. While the sector has seen increased operational costs, with expenses growing by 44.9percent during the first half, compared to a 22.9percent growth in the same period of 2022, these developments have culminated in a notable 51.2percent increase in pre-tax profits for June 2023.

Moreover, post-tax profits for the industry stand at GH¢4.3 billion, a significant surge from GH¢2.8 billion, marking a robust 51.4percent increase. This impressive profitability performance has translated into a higher return-on-equity of 37.6percent, contrasting with 21.9percent in June 2022, and a superior return-on-assets of 5.5percent, up from 4.6percent in June 2022.

Key indicators of financial stability remain robust overall, supported by the temporary regulatory relaxations granted to banks in response to the DDEP. As of June 2023, the industry’s Capital Adequacy Ratio (CAR) stands at 14.3percent, surpassing the revised prudential minimum of 10percent, albeit lower than the CAR of 19.4percent recorded in June 2022.

The decline in the CAR is attributed to losses from mark-to-market investments related to the DDEP and an increase in the risk-weighted assets of banks. The industry’s NPL (Non-Performing Loan) ratio has worsened to 18.7percent in June 2023 from 14.1percent in June 2022, reflecting heightened loan impairments and elevated credit risks. In contrast, liquidity indicators have shown improvement during the review period.

Resilience and adaptability in focus

Amidst the turmoil sparked by the DDEP launch, the financial sector, particularly banking, has come under intense scrutiny. Engagements between industry players, regulators, and economic managers underscore the sector’s pivotal role in a nation’s socioeconomic fabric.

Recognizing the limited influence over macroeconomic policies, banks acknowledge the need to bolster their internal frameworks to mitigate risks. Reflecting on the DDEP’s lessons, banks must actively infuse resilience and agility into their strategies, focusing on enhancing risk management and operational flexibility, and more importantly remain highly efficient.

Moving forward, banks have signaled the determination to restore the industry’s financial strength post-DDEP. Early 2023 data signals progress, but they are mindful of internal improvements required for robust risk management in the face of future shocks.

Nonetheless, the government must swiftly operationalise the Ghana Financial Stability Fund and ensure prudent macroeconomic management, amid an upcoming general elections in 2024. Maintaining a sustainable debt-to-GDP ratio remains crucial to restoring investor confidence and fueling economic recovery. Finally, ongoing dialogue between the government and the banking sector is seen as crucial, necessitating a collaborative framework beyond regulatory mandates.

In this evolving landscape, banks are poised to undergo transformative changes, armed with the lessons of recent events. The goal in a Post-DDEP financial sector will be to fortify the resilience but also to embrace adaptability, ensuring an enduring role as drivers of socio-economic progress.

Unravelling the landscape of Ghana’s capital market

The Ghanaian capital market, a cornerstone of the nation’s financial stability, has found itself navigating a maze of challenges stemming from macroeconomic fluctuations, inflationary pressures, fiscal vulnerabilities, and heightened uncertainty. In response to these trials, the government has orchestrated a pivotal intervention – the domestic debt exchange programme (DDEP) – to alleviate the strain on debt service, thus enabling the initiation of an austerity drive aimed at bolstering the fiscal landscape.

In the lead-up to the official unveiling of the DDEP on December 5, 2022, the Securities and Exchange Commission (SEC) issued a directive to fund managers, compelling them to embrace the mark-to-market valuation method for investment assets and portfolios in the securities sector. This directive aimed to counter the market panic that had prompted fund managers to grapple with redemption pressures as investors withdrew their funds, disrupting the inflow of fresh deposits.

Market dynamics in primary and secondary market

Both the primary and secondary markets have undergone transformations in trading patterns and investor behaviors. While liquidity control measures implemented by the Bank of Ghana (BOG) have influenced investor appetite, the bond market’s upward trajectory in trading turnover has been buoyed by the government’s relentless pursuit of fiscal consolidation.

The launch of new bonds within the DDEP framework has brought a measure of quietude to the secondary market; however, an uptick in investor confidence in equities has propelled the Ghana Stock Exchange (GSE) Composite Index to unprecedented expansion. The secondary market finds itself in a phase of consolidation as the DDEP reshapes the fixed-income landscape through the introduction of fresh bonds and fine-tuned market dynamics. The incorporation of the mark-to-market (fair valuation) approach by the SEC has ushered in a new era of transparency in investment valuations, instilling investor assurance and fostering informed decision-making.

Trends in the equities market

Following a tumultuous start, the Ghana Stock Exchange (GSE) has powered through the first half of the year, clinching an all-time high market capitalization of GH¢70.24 billion, as investors continue to seek solace in equities. This surge has been propelled by the remarkable performance of the GSE Composite Index (GSE-CI), which notched its second-highest monthly return to date in June 2023, buoyed by impressive showings from listed stocks in the agriculture, distribution, and ICT sectors.

The GSE-CI, a barometer of overall market performance, made a robust leap of 296.7 points, translating to a year-to-date (YtD) gain of 14.9 percent. Moreover, the GSE Financial Stock Index (GSE-FSI) witnessed a 14.6-point uptick during the same month, driven partly by the late resurgence of key stocks within the segment. This resurgence curtailed losses since the start of the year to 17.6 percent, as per GSE data. When compared with H1 2022, the GSE-CI registered an ascent of 10.3 percent, rising from 2,545.48 points to 2,808.03 points. This mirrored a commendable 8.32 percent rise in market capitalization when gauged against the equivalent period in the preceding year.

This marked a turnaround from 2022 when the GSE-CI concluded with a -12.38 percent change, after surging by +43.66 percent the preceding year – leaving it among the continent’s laggards, with investor sentiment mirroring broader economic trends. The upswing in market capitalization can be attributed to heightened investor confidence, propelled by strong performances of listed stocks and the declaration of dividend payment dates by numerous companies.

Nonetheless, trading activity witnessed a noticeable contraction in both volume and value. In comparison to the prior month, trading volume and value dwindled by 87.1 percent and 86.6 percent, respectively. This dip can be traced back to factors including market fluctuations and investor prudence, as profit-taking elements came to the fore. Similarly, the Cedi’s approximately 20 percent depreciation against the US dollar resulted in a -10.1 percent US dollar return for the GSE.

Despite this, market activity is gradually reviving as investors anticipate a post-DDEP market resurgence, although year-to-date volume and value traded have plummeted by 79.0 percent and 68.0 percent, respectively. The average outstanding bids and offers tallied at 0.37 million and 0.78 million shares, respectively. Selling pressures persistently eclipse demand in the equities market.

Numerous companies are eyeing the capital market to raise additional funds through ordinary shares, preference shares, or a hybrid of both. These proposed corporate actions reflect renewed market confidence and are expected to amplify trading activities. MTN Ghana (MTNGH) has already issued additional shares, thereby enhancing market liquidity.

Notably, pension funds have significantly escalated their share trading value, jumping from 3 percent in 2022 to 16 percent in 2023, as they diversify their portfolios into other instruments, including equities and Exchange Traded Funds.

In a noteworthy development, the integration of the GSE and the Botswana Stock Exchange into the African Exchanges Linkage Project (AELP) is set to transpire this year. The AELP, a flagship initiative of the African Securities Exchanges Association (ASEA) and the African Development Bank (AfDB), facilitates cross-border securities trading across African exchanges.

This venture offers substantial prospects for investors and the GSE alike, granting access to augmented liquidity, a broader investor base, and diverse asset classes across participating exchanges. Phase 2 of the project follows the successful inauguration of Phase 1 in December 2022, which connected seven exchanges and over 30 brokers.

Progressions in the fixed income market

At the end of the first half of 2023, the secondary market witnessed a total trade volume of 40 billion, a drop from 124 billion during the same period in 2022 – reflecting a 67.74 percent decline. The secondary market has displayed remarkable responsiveness to broader economic shifts. Activities within the market in H1 2023 have echoed ongoing macroeconomic changes and the ramifications of the domestic debt exchange programme (DDEP), which has exerted temporary pressure on the market.

An in-depth analysis of the Ghana Fixed Income Market’s performance encompasses metrics such as traded volume, outstanding securities, turnover, and contribution to market size. Government securities wield a dominant influence, accounting for a vast majority (99.68 percent) of the market’s size, in stark contrast to corporate securities (0.32 percent). Treasury Bonds and Treasury Bills command a substantial share of the outstanding securities.

Data further discloses the outstanding corporate securities within the Ghana Fixed Income Market. Corporate bonds, totaling GH¢ 12,729.54 million, underscore the market’s magnitude.

The government has indicated it remains committed to engaging market stakeholders and operators to address prevailing challenges and expedite a more rapid recovery than initially anticipated.

Treasury market in H1

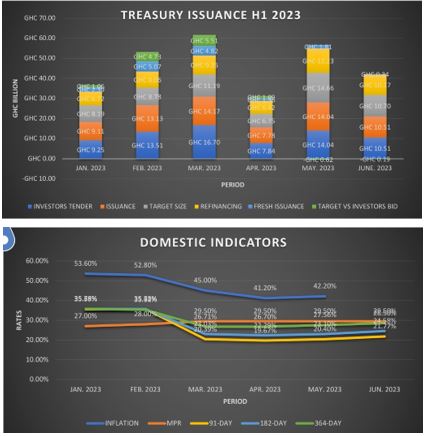

The Treasury successfully issued new short-term debts amounting to GH¢13.64 billion in the first half of 2023 (H1 2023), while GH¢30.55 billion was utilized to refinance maturing debts. Importantly, the Treasury exceeded its financing target for H1 2023 by approximately GH¢12.39 billion, resulting in a total issuance of GH¢44.19 billion during the period, out of the GH¢47.30 billion tendered by investors.

The Treasury adopted a frontloading strategy for its issuance requirement in H1, primarily in the money market. This approach was driven by limited investment options available to investors, particularly in Q1. Consequently, there was a higher demand for short-term securities during the period.

Analysing the issuance data, the B&FT has found that the demand for T-bills experienced a significant surge in Q1 2023. This was primarily due to attractive yield levels and persistent market uncertainties that prompted investors to seek secure investment opportunities. However, it is worth noting that the demand for T-bills eased in Q2.

Specifically, during Q1 2023, the Treasury accepted and issued approximately GH¢36.41 billion across the 91-day to 364-day bills. This issuance was derived from a total investor bid of GH¢39.46 billion, surpassing the target size of GH¢28.16 billion. However, in Q2, the issuance decreased to GH¢32.33 billion from investors’ tender of GH¢32.39 billion. Despite being slightly lower, this amount still exceeded the target size of GH¢32.11 billion.

It is noteworthy to observe that the Treasury’s ability to surpass its financing target, issuing new debts and refinancing maturing debts, reflects investor confidence in the country’s economic prospects and the attractiveness of short-term securities. However, it will be crucial to monitor the market conditions and investment landscape to assess the potential implications of future debt issuances. The Treasury may need to adapt its strategy accordingly to ensure continued success in financing the government’s operations while maintaining stability in the financial market.

Moreover, tighter liquidity conditions in the market could pose challenges for the Treasury in raising the necessary funds through debt issuances. It will be crucial to closely monitor the market dynamics, including liquidity levels, investor sentiment, and the effectiveness of debt management measures, to gauge the Treasury’s ability to navigate these challenges successfully.

Yields sustaining an uptrend

Yields on treasury bills have resumed an upward trend throughout Q2, presenting a significant risk to the government’s debt sustainability. This follows the Treasury’s implementation of cost-cutting measures in Q1-2023 to address escalating treasury yields, reducing bids, and capitalizing on strong demand for bills to lower the cost of borrowing. These efforts resulted in a significant drop in yields during that period.

To provide more context, in Q1-2023, the yield on the 91-day bill decreased from 35.36 percent in Q4-2022 to 19.39 percent. The yield on the 182-day bill declined from 35.98 percent to 21.44 percent, and the yield on the 364-day bill fell from 35.89 percent to 25.66 percent. These decreases in yields were encouraging and reflected the Treasury’s successful attempt to manage borrowing costs.

However, the Treasury failed to sustain this positive momentum as yields resumed an upward trend in Q2-2023. Yields on treasury bill auctions experienced marginal increases as anticipated. The 91-day bill rose by 410 basis points (bps) to 22.97 percent, the 182-day bill increased by 400 bps to 25.44 percent from 21.44 percent. The 364-day bill also jumped by 359 bps to 29.25 percent from 25.66 percent.

These rising borrowing costs for the government due to higher yields on treasury bills add further strain to an already burdened fiscal position. As the cost of government borrowing increases, it becomes increasingly challenging to manage the existing debt burden and fulfill future financial commitments.

Outlook

Market expectations suggest that yields on treasury bills will continue to fluctuate in the near term, with the potential for further increases. However, it is crucial to note that the real return on treasury bills will remain negative until inflation returns to a single-digit figure or drops below 20 percent. The projected range for treasury yields in the near term is around 25 percent to 35 percent.

Despite initial anticipation of a significant drop in treasury yields to a range of 15 percent to 18 percent by the end of Q3-2023, the current trend suggests a persistent rise in yields, even amidst the secured IMF bailout. This poses additional challenges for the government’s financial management and debt sustainability.

In light of these developments, it becomes crucial for the government to reassess its debt management strategies and explore measures to address the rising borrowing costs. It may be necessary to implement policies that attract investors, enhance fiscal discipline, and promote economic growth to alleviate the strain on the government’s financial position.

Dynamics of Ghana’s collective investment scheme sector

Within the Ghanaian capital market, collective investment schemes play a crucial role in offering investors diverse avenues for growth and wealth preservation. Balanced funds, equity funds, fixed-income funds, money market funds, and real estate investment trusts (REITs) represent the spectrum of investment options available. These schemes provide investors with opportunities to tailor their portfolios to match their risk appetites and investment objectives.

As of June 2023, these schemes have demonstrated an array of results across various investment categories, offering a glimpse into the diverse strategies pursued by Ghanaian investors. From equity and fixed income to money market funds, let’s embark on an analytical journey to unveil the intricacies of this dynamic performance.

Equity investment schemes: navigating the ebb and flow

Ghana’s equity investment schemes posted an aggregate YTD return of 7.46percent by June 2023, painting a relatively optimistic picture for equities. Databank EPACK Investment Fund, managed by DAMSEL, stood out as a beacon with an impressive YTD return of 8.78percent. This highlighted the potential rewards of a judiciously structured equity portfolio.

However, Republic Equity Trust and SAS Fortune Fund showcased a stark dichotomy, with YTD returns of 1.01percent and -1.63percent respectively, hinting at the volatility inherent in equities. Heritage Fund from SEM Capital Advisors faced a tougher journey, reporting a YTD loss of -4.30percent, which might be attributable to complex market dynamics.

Fixed income investment schemes: the quest for stability and returns

Fixed income investments gained traction, boasting a YTD return of 15.58percent and affirming the enduring demand for stable income avenues. The InvestCorp Treasury Securities Fund, overseen by InvestCorp AM, led the pack with a remarkable YTD return of 54.98percent, showcasing the allure of the short end government securities in uncertain times.

On the flip side, Sentinel Africa Eurobond Trust, managed by Sentinel AM, grappled with a negative YTD return of -11.32percent, echoing the tumultuous influence of debt operations on bond market shifts. Nimed Lifetime Unit Trust, under Nimed Capital’s stewardship, faced headwinds, recording a significant YTD loss of -15.81percent, reflecting the intricate balancing act between risk and reward, all being influenced by the DDEP.

Money market investment schemes: stability in a sea of uncertainty

The money market funds, synonymous with stability and liquidity, maintained their appeal with an average YTD return of 6.62percent. NGIS Money Market Fund, managed by NGIS, and Stanbic Cash Trust-AMC, guided by SIMS, emerged as frontrunners with YTD returns of 11.28percent and 11.19percent respectively. This signaled investors’ continued reliance on the refuge offered by money market investments amid evolving market dynamics.

Balanced investment schemes: the art of harmonizing growth and stability

Balanced investment schemes, adeptly combining equity and fixed income elements, unveiled an average YTD return of 7.94percent. The Enhanced Equity Beta Fund, curated by Black Star Advisors, showcased a tour de force performance with a remarkable YTD return of 50.07percent, unveiling the potential rewards of a well-balanced strategy. The Bora Balanced Unit Trust, under the guidance of Bora Capital Advisors, contributed to the discourse with a sturdy YTD return of 20.82percent, emphasising the potency of this investment approach.

Real Estate Investment Trusts (REITs): challenges and opportunities

Despite being an attractive avenue for real estate investments, REITs experienced a negative YTD return. This negative performance might be attributed to challenges within the real estate market or specific property-related issues. REITs offer investors exposure to real estate assets without direct ownership, but their performance is influenced by factors such as property values and rental yields.

Ghana’s financial markets: a decade of evolution

Intriguingly, the past decade has borne witness to the collaborative efforts that have fueled the market’s growth. Notably, 2020 witnessed significant milestones within the local equity and bonds market, as recorded by the Ghana Stock Exchange (GSE). Against the backdrop of the pandemic, the Ghana Fixed Income Market (GFIM) made history by breaching a trading volume of 100 million, while the equities market registered its second-highest annual share trading volume.

Navigating uncertainty: the Debt Exchange Program (DDEP) influence

The latter half of 2022 brought with it the enigmatic shadow of the Debt Exchange Program (DDEP), casting its mark on both the equity and fixed-income sectors. Notably, the fixed-income market bore the brunt of this impact, characterized by liquidity concerns and dwindling trading volumes. The uncertainties surrounding the DDEP implementation led to a cautionary stance among investors, especially foreign entities eyeing government bonds. This caution triggered a liquidity crisis, causing a significant drop in trading activity and amplifying the challenge of market fluidity.

Charting the path forward: insights for investors

The insights garnered from the performance of SEC-licensed collective investment schemes offer a diversity of opportunities and challenges, illustrating the interplay between risk and reward within Ghana’s investment landscape. As investors weigh their options, the need for prudence and vigilance remains paramount. The multifaceted nature of investment performance, influenced by a myriad of factors such as market volatility and economic conditions, underscores the importance of expert consultation and tailored strategies.

In this rapidly evolving financial ecosystem, investors should seek to align their investment choices with their individual risk profiles and financial aspirations. With the guidance of financial professionals, they can navigate the complexities, leveraging the strengths of various investment categories to attain their objectives while being resilient in the face of market shifts.

>>>Disclaimer: The content provided here is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult with qualified financial advisors before making investment decisions.