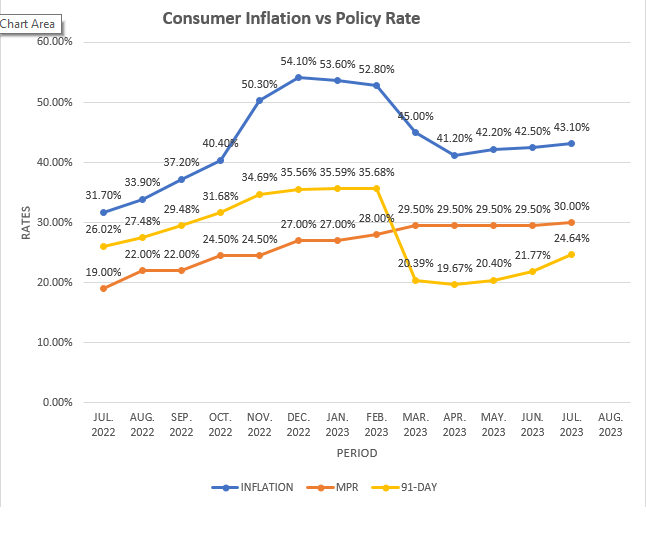

Consumer inflation rose for the third consecutive month to 43.1 percent in July 2023 from 42.50 percent the previous month, according to data from the Ghana Statistical Service (GSS).

After declining consistently from January to April, headline inflation increased in May and June on account of higher food prices, implementation of new tax measures and utility tariff adjustments. Overall, it rose from 41.2 percent in April to 42.2 percent in May, and further to 42.5 percent in June. Underlying measures of inflation all ticked up in May 2023.

The current increase in headline inflation comes on the back of strong food price pressures, which recorded 55 percent – an increase from 54.2 percent, and month-on-month inflation trend of 3.8 percent. However, relative exchange rate stability, stable ex-pump petroleum prices and effective liquidity management by the Bank of Ghana seem to be exerting a moderating influence on non-food prices.

Nonetheless, non-food inflation rose slightly to 33.8 percent in July 2023 from 33.4 percent in the previous month.

In anticipation of higher inflationary pressures, the Bank of Ghana’s Monetary Policy Committee in its last meeting of July 2023 raised the policy rate to 30 percent. Although inflation is expected to decline in the near-term, baseline forecasts indicate a slightly elevated profile in the year ahead.

While this marginal increase marks the third consecutive month, indicating a reversal of the disinflation trend observed earlier this year, experts believe that the inflationary effects are temporary. The pass-through effects of new levies and utility tariff hikes have already impacted general prices.

However, market analysts anticipate that the combined impact of the revenue measures and rising food prices will push headline inflation higher in the near-term.

In the first half of 2023, inflation in Ghana showed signs of easing – dropping from a peak of 54.1 percent in December 2022 to 41.2 percent in April 2023. Meanwhile, inflation increased by 100 basis points in May, reversing the downward trend. The GSS had previously noted a gradual slowdown in the rate of price increases earlier this year, with a significant decrease in inflation from 52.8 percent in February to 45 percent in March.

“While core inflation also increased, businesses’ inflation expectations remained flat at an elevated level. If not contained, this could embed underlying inflationary pressures. Thus, it’s crucial for policy to respond appropriately and decisively to prevent these risks from becoming embedded and derailing the disinflation process,” Governor of the BoG, Dr. Ernest Addison asserted during a media briefing on the Committee’s position.

In the Committee’s assessment, risks to the inflation profile are judged to be elevated – driven by second-round effects of food prices. Inflation persisted at around 42 percent in the second quarter of 2023, despite the elimination of central bank financing in the year’s first six months.

“Ghana’s macroeconomic framework requires decisive tightening from both the fiscal and monetary sides to firmly anchor inflation expectations on a declining path,” he stated at the time.

The rising inflation poses challenges for both fiscal and monetary authorities. Fiscal authorities aim to control rising financing costs to meet IMF programme conditionalities, while the monetary authorities cannot lower interest rates due to high inflation and recent price developments in the real economy.

Inflation for locally produced items rose to 37.5 percent in July 2023 from 35.9 percent, while inflation for imported items increased further to 45.7 percent from an earlier increase of 44.5 percent in the previous month.