The Hundred Years’ War with France was getting intense and King Edward III of England had run out of money to finance it. What would he do? Left with no option, the king turned to the wealthy banking families for loans – at high interest – to finance the war. Not becoming king of France, he was unable to repay this debt. Thus, setting the precedence for the concept of sovereign debt. Since then, there have been sentiments expressed on sovereign (public) debt. A politician would vehemently argue about the numerical accuracy of public debt, with his opponent. However, to an academician, it is just another macroeconomic indicator. Presently, global debt is estimated to reach US$300 trillion in 2022, according to S&P, which is an average debt of US$37,500 per person in the world. To an ordinary man, this estimate begs the question, “Who does the world owe?”

At the recent IMF Spring meeting, two reports were published, i.e., World Economic Outlook (WEO) and Global Financial Stability (GFS) reports, detailing current economic and financial conditions facing the global economy. In one breath, the IMF expressed optimism in global growth, forecasting growth to reach 3.0% in 2024 from an estimated low of 2.8% in 2023; but emphasized the risk posed by core inflation. On the other hand, tighter monetary policies have led to banking instability across the world, with the collapse of SVB, Signature Bank and the takeover of Credit Suisse, a global systemically important bank (G-SIB). What is more? Recent research conducted by the IMF shows that climate and debt crises are highly correlated. Thus, amongst the key challenges discussed at the IMF Spring meeting, was climate finance, as the catalyst to mitigating climate change risks.

Talking about debt, Fitch Ratings in June 2020, reported that most Sub-Saharan African (SSA) countries will be in debt distress. The rating agency forecasted the Debt-to-GDP ratio for 19 SSA countries to hit a whopping 71% by end-2020, citing severe COVID-19 and oil price shock as driving factors. Aside from that, servicing the debt albatross has become expensive owing to exchange rate fluctuations. For instance, the World Bank reported that Nigeria used 96.3% of its revenue to service debt in 2022. True to S&P’s projections, Kenya’s Debt-to-GDP hit 70.4% and is currently considering debt restructuring. By mid-2023, Egypt’s Debt-GDP is projected to reach 92.9%. To climax SSA’s economic distress, Ghana got approval for a US$3 billon extended credit facility (ECF) after restructuring its domestic debt and currently considering another round of restructuring, Senegal has reached a staff-level agreement (SLA) for a US$1.9 billion ECF program, Cote d’Ivoire has secured a US$3.5 billion ECF program and Ethiopia is hinted to be seeking a US$2 billion package, all from the IMF. Interesting times indeed. The genesis of the debt woes was marked by a significant decline in Eurobond issuance, since most SSAs cannot access the international capital market (ICM), from US$14 billion in 2021 to US$6 billion in the first quarter of 2022. Like King Edward III of England, finance ministers of these SSA countries seemed to be out of options and thus resorting to IMF bailouts.

But that is not all. On the back of debt distress, the economic plight of SSA countries appeared bleak as they continue to battle the effect of climate change. Pockets of extreme weather conditions, including cyclones, floods and severe droughts are appearing across the continent. Cyclone Freddy, rated as one of Africa’s deadliest storms, has devasted Malawi, Mozambique, and Madagascar, with death toll reaching over five hundred people. The United Nations indicated that, African countries are spending between 2% to 9% of their budget to respond to climate crisis. “Two heads” they say, “are better than one”. So, in UN’s 55th Session for the Economic Commission for Africa meeting, finance ministers of SSA countries that are saddled with debt and climate crisis, agreed to consider Debt-for-Nature Swap in achieving debt sustainability and building a climate-resilient economy. Is this the “messiah” SSA countries needed?

Debt-for-Nature or Climate Swap: unwrapping the idea.

Trapped between the quagmire of escalating debt obligation and the rapid depletion of rain forests in Latin America, the idea of a Debt-for-Nature swap was birthed by Thomas Lovejoy, then VP of World Wildlife Fund in 1984. The UNDP explains a debt-for-nature swap as an agreement between a nation in debt (debtor) and its creditors, where both parties agree that the repayment of the debt obligation is suspended, reduced, cancelled, or restructured, with the funds committed to achieving environmental conservation and biodiversity objectives. It is viewed as an economic tool that allows a debtor nation to repay its debt in local currency, instead of external currency, based on agreed terms. It fosters debt sustainability, spurs economic growth, and gears a country towards a green economy.

For Debt-for-Climate swap – inspired by debt-for-nature swap – the debt of a country is reduced in exchange for investment in climate change mitigation and adaptation projects. Thus, instead of making interest payments on external debt in a foreign currency, a debtor country channels the payment to fund climate-resilient projects or decarbonize the economy. These instruments reduce the government’s debt burden, thus freeing up fiscal resources to enable the government to be resilient. Countries employing either debt-for-nature or climate, tend to get upgraded in their sovereign credit ratings. It also creates an additional revenue stream for the debtor country.

Three years after its introduction, the first debt-for-nature swap was signed in 1987 between the Bolivian government and Conservation International (CI), a non-profit environmental organization. In the swap transaction, CI bought US$650,000 of Bolivian foreign debt owed to Citicorp for a discounted price of US$100,000. As part of the swap, the Bolivian government established a total of 3.7 million acres forest reserves, which served as habitat for thirteen (13) endangered species.

Debt-for-nature swaps can either be commercial (private) or bilateral (public). Under commercial swaps (aka tripartite or trilateral swaps, due to the involvement of a third party), third party organizations, usually non-governmental organizations or individuals purchase the commercial debt (i.e., government bond) of a country that is traded in the secondary market at a discounted price. The first debt-for-nature swap signed in Bolivia is a typical example of a commercial swap. However, in public debt-for-nature swap, the sovereign debt to be restructured is not traded on the ICM, unlike commercial swap. As the name suggests, the bilateral nature of the swap allows the creditors to forgive a portion of the debt, in exchange for a firm commitment from the debt country to make contributions towards conservation projects. The success of a bilateral swap hinges on the willingness of creditor countries, usually led by the Paris Club. It is the norm for a country to opt for either bilateral or commercial swap, however, there are circumstances where both swaps can be applied.

Trends in debt-for-nature swaps have been tremendous. The agreement has been applied in over thirty countries, and between 1987 and 2015, the value of debt treated under debt-for-nature swap agreement crossed US$2.6 billion worldwide and has funded 1.2 billion environment-related projects. Since its inception, the largest dept swap ever implemented was between Poland and its creditors in 1992, valued at US$580 million. Additionally, over one hundred swaps of this nature have been executed, which included fifty trilateral and about ninety bilateral swaps.

Over the years, it has become apparent that debt swaps (debt-for-nature or debt-for-climate) have become a niche, as the trends continue to nose-dive. Despite the lost in taste for these swaps in recent years, due to Heavily Indebted Poor Countries (HIPC) and Multilateral Debt Relief Initiative (MDRI) programmes by the World Bank, appetite seems to be restored following the historic and largest-ever debt-nature swap done in Ecuador, valued over US$1.5 billion. Will Ecuador’s debt-nature swap set the pace for African countries, particularly in the Sub-Saharan region, to consider?

Should SSA countries consider it?

It is not to say that countries in the SSA region have never considered a debt-nature swap. In fact, as far back as August 1992, 12 countries, which included Ghana, have negotiated for debt-for-nature swap (FV of debt treated: US$1 million). Indeed, there is no straightforward answer to the above question. At any rate, the decision lies in the prerogative powers of the country. The African Development Bank (AfDB) noted that determining the optimal debt solution is based on the country’s goals, needs and debt profile, thus there is no “one size fits all” solution. However, for countries contemplating the idea, there are factors that constrain the application and scalability of debt-for-nature or climate swap in Africa, especially in the SSA region.

Lessons from previous debt-swaps teach that such swaps are associated with high transaction costs and time consuming (up to 4 years, according to the OECD). The procedure involved in structuring a debt-swap deal requires choosing an appropriate project and engaging and coordinating with multi-dimensional stakeholders with varying interests. In a governmental setting with weak administrative capacity, separate institutions must be established, which may run parallel to already existing government machinery. Above all, what if the debtor government becomes reluctant to play its part? Then that mars the essence of the swap. Debt-for-nature or climate swaps require the debtor government to formulate or amend regulatory policies that will ensure efficient allocation or reallocation of proceeds from the swap. However, if the creditors perceive a lack of commitment from the debtor, the expected funds or relief may be stalled. Finally, all these complexities and fragmentations of debt-for-nature or climate swap make monitoring challenging, as it carries its own performance measures.

Considering the above and other supply-side limitations, the Bretton Woods institutions “shy away” from debt-for-nature or climate swaps. For instance, the World Bank admitted that debt-for-nature or climate swaps cannot by themselves solve environmental problems or the adverse effects of climate change. Moreover, the increased application of these swaps as a means of debt treatment will not improve the debt sustainability or creditworthiness of developing countries, and in this case SSA countries.

Bridging debt and climate – the alternatives

For a second, one may think these economic tools, i.e., debt-nature/climate swap can “kill two birds with one stone,” as it reduces the debt albatross of a country, and simultaneously protect the environment or mitigate climate change. On the contrary, previous cases of the application of these economic tools proved that tackling debt and climate separately is more effective, compared to solving both challenges at once.

Thus, instead of championing the scaling up of debt-nature/climate swaps, the Woods institutions proposed a blended approach to addressing both debt and climate change. The IMF suggested combining project-based swaps with policy reforms, such that projects in a country’s mitigation and adaptation plans should be accompanied by policy reforms. For instance, if a country plans to invest (funds from a swap agreement) in renewable energy such as a wind farm, the project should be complemented by a reform in the energy sector that will focus on prioritizing renewable energy power production and consumption.

In cases where it becomes apparent that vanilla debt-nature/climate swaps should be applied, the IMF recommended that funds from swaps could be channeled to funding climate-related expenditures. Additionally, instead of swapping debts for commitments to nature conservation or climate mitigation, the Fund advised that debt-nature/climate swaps should be linked to climate outcomes. This requires the design of KPIs that measure climate outcomes. The Bank also proposed sustainability-linked bonds (SLBs), whose KPIs are hinged on the country’s NDCs. In the long term, this strategy solves the challenge associated with commitment from debtor governments and fosters the development of the ESG and SLB market of the country.

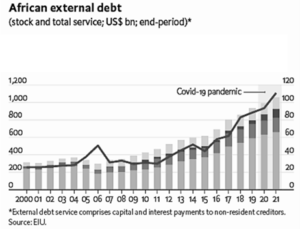

African countries are accumulating debt. The Economist Intelligence Unit (EIU) indicated that the total external debt stock for Africa is over US$ 1 trillion, and its related debt servicing cost has crossed the US$ 100 billion mark in 2021. The debt albatross is weighing the continent. Conversely, no economy is immune to climate vulnerabilities. In pursuing debt sustainability and climate mitigation strategy, it has become imperative for the application of economic tools that drive a green economy and economic prosperity.

True, debt-nature/climate swaps are useful instruments that reduce a country’s debt burden and improve climate change mitigation. However, constraints characterized by debt-nature/climate swaps cannot be ignored. This presents an opportunity for the exploration and development of other instruments, such as sustainability-linked bonds (SLBs) to achieve desired economic growth and build a climate-resilient economy.

The author is enthusiastic about finance, sustainable investment, and big data. The opinion shared in this article, reflects the views of the writer only. Comments and suggestions on this article can be shared via:

M: 0547 300 489

E: [email protected]

LinkedIn: Michael Gameli Dzivenu | Twitter: @iamgameli

References:

Image credit: Forest, Power and Beyond: https://www.power-and-beyond.com/what-is-renewable-energy-definition-types-and-challenges-a-1027368/

Image credit: Debt, Forbes: https://www.forbes.com/sites/christianweller/2021/12/26/debt-is-on-the-rise-increasing-risks-for-many-households/?sh=7d01fd051278

Institute of International Finance (IIF), Global Debt: https://www.iif.com/Products/Global-Debt-Monitor#:~:text=The%20nominal%20USD%20value%20of,still%20above%20pre%2Dpandemic%20levels.

Fitch Ratings, Rising Debt Distress in SSA: https://www.fitchratings.com/research/sovereigns/debt-distress-rising-in-sub-saharan-africa-30-06-2020

AP News, As climate woes worsen, Africa’s economies suffer, UN says: https://apnews.com/article/africa-climate-weather-extremes-economic-losses-b6044de3e5a338ae449fe9c08f35b4f6

AP News, African nations consider swapping debt for climate funding: https://apnews.com/article/debt-climate-finance-extreme-weather-events-b20f70b4b84ac3504d35aa1cd821d3d7

IMF, Public Debt through the Ages: https://www.imf.org/en/Publications/WP/Issues/2019/01/15/Public-Debt-Through-the-Ages-46503

IMF, What is Sovereign Debt: https://www.imf.org/en/Publications/fandd/issues/2022/12/basics-what-is-sovereign-debt

S&P, Global Debt Leverage: Is a Great Reset Coming: https://www.spglobal.com/en/research-insights/featured/special-editorial/look-forward/global-debt-leverage-is-a-great-reset-coming

IMF, Regional Economic Outlook, Sub-Saharan Africa: https://www.imf.org/en/Publications/REO/SSA/Issues/2023/04/14/regional-economic-outlook-for-sub-saharan-africa-april-2023

World Bank, Macro Poverty Outlook for Nigeria, 2023: https://documents1.worldbank.org/curated/en/099501404132315331/pdf/IDU08940d9ab02ff10476e0bde30902ced1fb59f.pdf

Green Finance and Development Center: https://greenfdc.org/wp-content/uploads/2021/01/Yue-2021_Debt-for-nature-swaps-BRI-1.pdf

IMF Working Papers, Debt-For-Climate Swaps, Analysis, Design, and Implementation: https://www.imf.org/en/Publications/WP/Issues/2022/08/11/Debt-for-Climate-Swaps-Analysis-Design-and-Implementation-522184

Reuters, Ecuador seals record debt-for-nature swap with Galapagos bond: https://www.reuters.com/world/americas/ecuador-seals-record-debt-for-nature-swap-with-galapagos-bond-2023-05-09/

African Knowledge Sharing Platform: https://akb.au.int/handle/AKB/86169

Economist Intelligence Unit (EIU), Africa feels the strain from elevated debt: https://country.eiu.com/article.aspx?articleid=982147881&Country=Nigeria&topic=Economy&subtopic=Outlook&subsubtopic=Financial#:~:text=Despite%20the%20rapid%20increase%20in,%2C%20Angola%2C%20Egypt%2C%20Nigeria%2C