A well-functioning and vibrant mortgage market is a necessary requirement for developing a sustainable housing sector that delivers decent and affordable housing to individuals and households. While Ghana’s housing sector holds a lot of promise in spearheading the socio-economic transformation of the country, its contribution to the economy is hampered by a lack of affordable mortgages. Notwithstanding the rising housing deficit, real estate developers continue to face severe offtake risks due to the inability of end-users to obtain affordable mortgage financing.

There are several challenges that hinder the growth of the mortgage market in Ghana. These have been examined extensively and include high cost of credit, lack of access to long-term funds, poor legal and regulatory environment, low incomes, and high house prices. The cumulative effect of these challenges is that most households do not qualify to access mortgage loans to purchase even the cheapest house on the market. The Centre for Affordable Housing Finance in Africa (CAHF), in its 2019 Yearbook, found that only 9.4 percent of urban households could afford the cheapest house – estimated to cost about US$20,000 – under prevailing market financing conditions. Unfortunately, the recent sharp rise in interest rates and the depreciation of the cedi have exacerbated the affordability challenges.

To reduce the cost of local currency mortgage offered by banks, the National Housing and Mortgage Fund (NHMF), in partnership with some selected local banks, introduced a pilot scheme to offer cedi mortgage products at affordable interest rates to public sector workers. Under the scheme, NHMF offers funds at a concessionary rate of 2 percent to be matched by participating banks at the 91-day Treasury bill rate, plus 300 basis points. The goal was to enable the participating banks to write local currency mortgages at no more than 12 percent interest rate. However, rising interest rates on Treasury bills have pushed the rate on mortgage loans under the scheme to about 18 percent. This relatively higher interest rate and the sharp increases in house prices due to the high rate of inflation have significantly reduced the affordability of the mortgages. So far, the scheme has delivered 296 mortgages; and despite its initial successes, the scheme has yet to move beyond the pilot phase due largely to funding constraints.

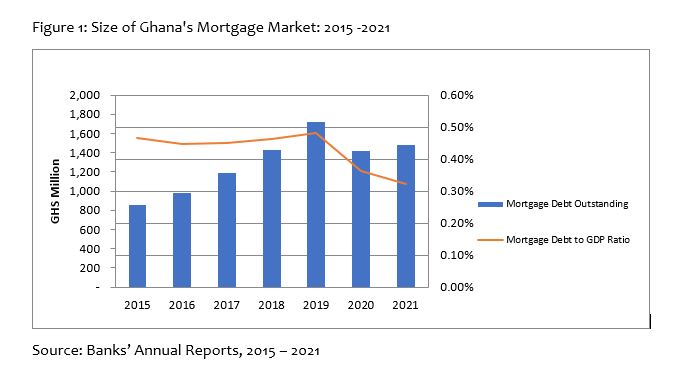

Ghana’s mortgage market remains underdeveloped, with a very low mortgage debt to GDP ratio of just about 0.32 percent as at the end of 2021. The total outstanding mortgage debt as at the end of 2021 was only about GH¢1.5billion (US$246million). Figure 1 shows the total mortgage debt outstanding and the mortgage debt to GDP ratio for the period 2015 – 2021. Out of the 23 universal banks, only 6 offer mortgage products based on review of annual reports of all the financial institutions. In the near term, the outlook for the mortgage market is negative, driven largely by the current high levels of interest rates – a situation that is likely to persist for the rest of this year. In the medium term, however, the outlook looks positive. The significant reduction in the coupons on Government Bonds as a result of the Domestic Debt Exchange Program (DDEP) is expected to cause a downward shift in the yield curve and lead to reduction in mortgage interest rates. Also, the three-year IMF programme is likely to stabilise the macroeconomic environment and create fiscal space for the government to initiate interventions in the housing sector, including the expansion of NHMF affordable mortgage scheme. It is expected that these developments will stimulate demand for housing and improve the business environment for real estate developers.

Source: Banks’ Annual Reports, 2015 – 2021

The author is a Senior Lecturer, Department of Land Economy, KNUST