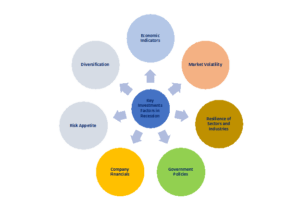

…insights and strategies for successful investing in turbulent times

In times of economic turbulence and uncertainty, investment decisions become even more crucial. Recessions – characterised by shrinking GDP, rising unemployment, and market volatility – pose unique challenges to investors worldwide. However, amid the storm, there are opportunities to be seized and strategies to be employed. This article aims to shed light on factors that affect the art of investing during a recession as well as providing insights and guidance for individuals and institutions looking to safeguard and grow their wealth in challenging times.

Economic indicators

When investing in the midst of economic uncertainty, it is important to assess the overall health of the economy. This will enable investors to ascertain the severity and duration of the economic turbulence. Economic indicators, such as inflation rate, gross domestic product (GDP) growth rate, unemployment rate and consumer sentiments, can give a good indication of the severity and duration of the economic turbulence. Demand-pull inflation decreases during a recession because of reduction in aggregate demand while cost-push inflation increases during a recession because of supply-side shocks.

A decrease in GDP growth rate, increase in unemployment rate and decrease in consumer sentiments shows a severe and prolonged economic downturn. Investment decisions must, therefore, be taken carefully to take advantage of the opportunities the recession presents. GDP growth rate in Ghana, according to the African Development Bank, dropped from 5.4 percent in 2021 to 3.3 percent in 2022, and this is expected to drop further to 1.7 percent in 2023 and make a recovery to 3.0 percent in 2024. This indicates that strategic investments can be made in 2023 to take advantage of the economic recovery projected in 2024.

Market volatility

Market volatility is assessed mainly by observing the fluctuations in the prices of financial assets. In Ghana, the fluctuation in the bonds and treasury bills market in the year 2022 heightened investors’ risk perception. The situation was so serious that the government had to restructure local bonds and currently, there are deliberations ongoing to restructure other financial assets issued by the government. Inasmuch as market volatility presents uncertainty to investors, it also presents the opportunity for long-term investors seeking undervalued financial assets.

Short-term active investors can also take advantage of market mispricing opportunities presented by market swings and make trading gains. It is imperative for investors to be aware of the emotional and behavioural biases market volatility can evoke in them to cloud their judgement and lead; thus, take irrational decisions consequently. It is crucial for investors to be aware of these biases and make decisions based on careful analysis, a well-defined investment plan, and a long-term perspective.

Resilience of sectors and industries

Although a recession affects all sectors of an economy, its impact is greater on some sectors than others. Investors can, therefore, focus their investments on sectors that are less impacted by recession, such as sectors that deal in goods and services that are considered necessities. Such sectors include but not limited to healthcare, utilities and food. Investors can also reduce their investments in sectors that are greatly impacted by recession, such as sectors that deal in discretionary consumer goods and services that are considered as luxury. Investors in the Ghanaian economy must therefore objectively assess the impact of the current economic downturn on various sectors and industries to tailor their investments toward resilient sectors and reduce same in highly impacted sectors.

Government policies

Government policies and company financials are very important factors that investors must pay attention to in their attempt to make investment decisions during recession. Government policies comprise of fiscal and monetary policies of government aimed at overcoming the recession and helping the economy recover. Policies on interest rate, tax incentives and stimulus packages have varied impact on specific economic sectors and industries. Investors must, therefore, focus on economic sectors and industries that are impacted positively by government policies to secure their investments and make adequate returns.

Government policies in specific industries like the relaxation of regulatory standards in the banking sectors as well as monetary policy rate, which is projected by the Bank of Ghana to reduce in the third quarter of the year 2023, will lead to reduction in interest rates, encouraging borrowing. Investors, therefore, need to pay particular attention to sectors and industries which are positively impacted by recovery initiatives of government and tailor their investment needs toward such sectors and industries.

Company financials

Focusing on the impact of government recovery policies on economic sectors and industries also require that investors assess the performance of companies in those sectors and industries which they wish to invest. In doing this, investors must evaluate the financial statements of such companies using trend analysis, vertical analysis, and financial ratio, among others. The revenue growth, debt levels, cash flow and profit margins give an idea of the strength of companies’ balance sheet and the sustainability of business models. Investors can base on these and invest in companies that are positioned to benefit from government’s recession recovery initiatives and those that are resilient to the economic downturn.

Risk appetite

The risk appetite of most investors during a period of recession is more risk-averse due to the uncertain economic outlook. However, it is important that investors assess their risk appetites objectively and align their investment interest with their individual circumstances, financial goals, and risk tolerance. Investors with low-risk appetite lean more toward safe financial assets like bonds and treasury bills rather than riskier investments like speculative stocks. High-risk appetite investors, on the other hand, are inclined to tolerate short-term market fluctuations in exchange for potentially higher long-term returns. They might be willing to maintain or even increase exposure to riskier assets, such as equities or alternative investments, as they believe in the potential for recovery and future growth.

Diversification

Diversification comes in when investors want to manage their risk by investing in diverse financial assets that are not correlated in terms of their response to sensitivity to the economic uncertainty. Diversification by investors can be done across economic sectors, industry and companies to ensure they are not seriously affected by the negative impact of the recession. Diversification helps investors mitigate investment risk and reduce portfolio volatility. Diversification across sectors and industries helps investors to benefit from the recovery of specific sectors and industries when new opportunities emerge in such industries. Liquidity management of investors is also enhanced through diversification in investment that can readily be liquidated when the need for cash arises, particularly for investment into new investment opportunities that may arise during the recession.

Outlook

Considering the current economic turbulence and uncertainty, investment decisions become increasingly critical. A comprehensive assessment of economic indicators, such as inflation rate, GDP growth rate, unemployment rate, and consumer sentiments provide valuable insights into the severity and duration of the economic downturn. By leveraging this information, investors can strategically position themselves to take advantage of the opportunities presented during the recession. Additionally, market volatility should be carefully analysed to identify undervalued assets and capitalise on potential trading gains.

Moreover, sector resilience plays a pivotal role in investment decisions as investors can focus on sectors that are less impacted by the recession while reducing exposure to vulnerable sectors. Government policies and company financials are crucial factors that require thorough evaluation to align investments with the recovery initiatives and sustainable business models. Lastly, risk appetite and diversification strategies should be tailored to individual circumstances, financial goals, and risk tolerance to effectively manage risk and capitalise on emerging opportunities.

The author is an MPhil Finance graduate of the University of Ghana Business School and a member of the Institute of Chartered Accountants, Ghana.