Investor sentiment shifted last week as the demand for Treasury bills weakened, resulting in a 20.32 percent under-subscription compared to the weekly target of GH¢3.79billion.

Despite the rise in yields, the Treasury fell short of its GH¢3.60 billion maturities by 16 percent, allotting only GH¢3.02billion across the 91-to-364-day bills – raising questions about government’s ability to refinance its maturities amid the ongoing financial vulnerabilities.

The diminishing interest of investors in Treasury bills has led to a rapid increase in yields. Notably, the 91-day bill saw a 42 basis point rise, reaching 21.69 percent. Similarly, the 182-day bill increased by 102 basis points to 24.97 percent, while the 364-day bill surged by 109 basis points to 28.91 percent.

Looking ahead, the Treasury aims to raise GH¢2.20billion to refinance GH¢2.09billion worth of bills maturing next week across the 91- to 364-day range, with an auction scheduled for Friday, June 23, 2023. However, experts anticipate that yields will continue rising in the near-term to attract investors.

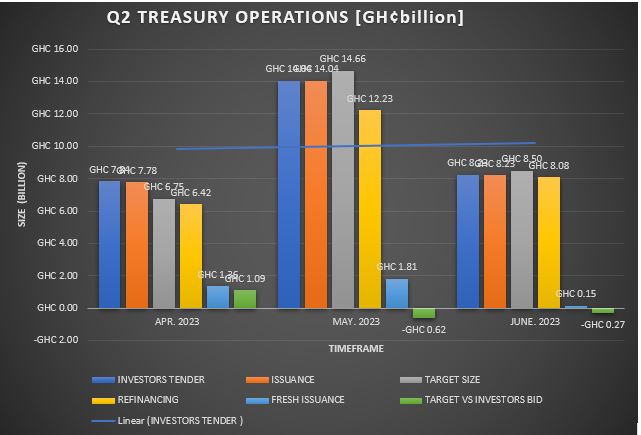

May 2023 experienced a notable shift in demand for Treasury bills on the primary market. It marked the first decline in momentum this year, with a 4.2 percent under-subscription compared to government’s target of GH¢14.66billion. Ongoing effects from the domestic debt exchange programme are believed to have stifled demand for Treasury bills.

Despite under-subscription, the Treasury managed to sell enough bills to cover a face value (FV) of GH¢12.23billion maturing during the month; representing a maturity cover of 1.12x. The refinancing needs in May 2023 were the highest, totalling GH¢12.23billion – followed by GH¢9.35billion in March 2023, GH¢8.06billion in February 2023, and GH¢6.72billion and GH¢6.42billion in January and April respectively.

May 2023 stood out as the month with the highest targetted issuance by the Treasury, aiming to reach GH¢14.66 billion. In comparison, the targets for January to April were GH¢8.19 billion, GH¢8.78 billion, GH¢11.19 billion and GH¢6.75 billion respectively. The rising yields reflect the market’s response to the reduced demand, with the 91-day bill increasing by 94 basis points to 20.80 percent, the 182-day bill rising by 104 basis points to 23.62 percent, and the 364-day bill rising by 76 basis points to 28.02 percent.

Looking forward, analysts anticipate a slight increase in yields as the Treasury seeks to raise sufficient funds to refinance maturities worth GH¢10.18billion due across all bills in June 2023.

In the secondary bond market there was robust activity, with total traded volumes surging from GH¢98.63million to GH¢439.59million. Investors continued to favour new bonds, accounting for 94 percent of the total traded volumes. The most actively traded paper was the Feb-2029 bond with a coupon rate of 8.65 percent, constituting 89 percent of the total traded volumes and clearing at 14.83 percent. The older 3-year bonds also saw considerable trading interest.

The recent decline in demand for Treasury bills, coupled with rising yields, has raised concerns about the Treasury’s ability to meet its debt obligations. The upcoming auction will be closely monitored to determine if this trend persists, with expectations of further increases in yields during the near-term.