Nigeria: Inflation continues to be a concern in Nigeria.

Ghana: IMF extended funding facility leads to cedi strength.

South Africa: Rand under pressure.

Egypt: Pound remains stable and privatization is on the rise.

Kenya: Moody Investors Service downgrading Kenya’s ratings to B3.

Uganda: The Uganda National Oil Company (UNOC) and DGR Energy Turaco Uganda SMC have paid the Ministry of Energy $2 million in exploration costs.

Tanzania: Shops close in protest over local restrictions.

XOF Region: Senegal raised XOF 38 billion on the securities market.

XAF Region: The central bank sucked up to 100 billion from the banking sector.

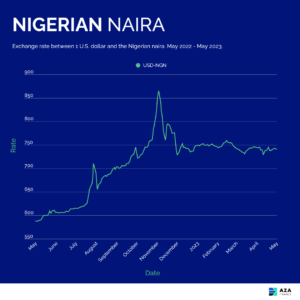

Nigerian Naira (₦)

Compiled by Ikenga Kalu

Over the week, the naira depreciated from USD/NGN 748 to USD/NGN 755 as at the closing price on Friday. The naira breaking past the 750 psychological resistance is testament to the spike in FX demand from importers. Inflation continues to trend upward and was recorded at 22.22% in April, up from 22.04% in March despite multiple interest rate hikes by the Nigerian central bank. The continued upward trend in inflation is due to higher energy prices, fx rate volatility, and the recent nationwide cash crunch experienced in light of the naira redesign. We expect the naira to continue to lose ground against the dollar in the coming days as more naira becomes available to support a pick up in FX demand.

Further reading:

Nairametrics — Nigeria’s inflation rate rises to 22.22% in April 2023 as CBN rate hikes fail to work

Ghanaian Cedi (GH¢)

Compiled by Murega Mungai

The Ghanaian cedi traded at levels of USD/GHS 10.90 on May 17, 2023 after closing out last week at levels of USD/GHS 11.75. The strength in the cedi came after the Minister of State at the Finance Ministry, Mohammed Amin Adam, disclosed that Ghana would receive $1.2 billion U.S. dollars from the International Monetary Fund (IMF). $600 million U.S. dollars will be disbursed within a week and subsequent tranches by December 2023 subject to meeting certain conditions under the programme. Ghana is expected to receive about $3 billion U.S. dollars from an extended credit facility arrangement within three years with approval of the bailout. In the coming days, we project the cedi to remain fairly strong as the market reacts positively to the IMF deal.

Further reading:

Myjoyonline — Cedi gains more grounds, going for ¢11.30; Y-T-D loss is 8.7%

Reuters — Ghana expects first $600 mln tranche from IMF after Wednesday meeting – minister

South African Rand (R)

Compiled by Alex Barmuta

The South African rand closed last week trading at 19.3265 against the U.S. dollar. On Monday the USD/ZAR attempted to recover some ground, however, it was unable to break below the 19.00 level.

Allegations about South Africa sending arms from its Simon’s Town naval base to Russia triggered a rand sell-off, as concerns about economic sanctions emerged. South Africa has so far denied these allegations, however President Cyril Ramaphosa has launched an inquiry into the incident in question — which as per U.S. intelligence sources, took place in December 2022. Further pressure on the rand is driven by continued rotational power cuts, the release of retail sales figures showing that sales fell 1.6% year-on-year in March, and an increase in the unemployment rate in Q1 (to 32.9%). It is worth noting that despite the overall increase in unemployment, the city of Cape Town’s unemployment rate fell from 30% to 26% year-on-year in March, and 0.9% quarter-on-quarter.

Looking ahead, we can expect high levels of volatility in rand pairs. Any news indicating that the Russian arms incident is fading, could lead to some rand strength, leading the USD/ZAR to possibly break below the 19.00 level. On the other hand, if the allegations are proved to be correct, and sanctions are seen as justified, we could see the rand move above the 19.50 level against the U.S. dollar (and possibly beyond).

Further reading:

Business tech — The rand is at a tipping point

Egyptian Pound (EGP)

Compiled by Mitchell Diedrick

The Egyptian pound closed off last week marginally stronger against the U.S. dollar at 30.65 after averaging 30.84 in last week’s trade. It has returned to trading at levels of USD/EGP 30.90 this week.

The Egyptian government seems to be holding firm on its commitment to the IMF on privatization of state-owned entities evident by a partial sale of Telecom Egypt. On Sunday, May 14, 2023 the Egyptian Finance Ministry announced that a 9.5% stake in the company was sold to investors for approximately $122 million U.S. dollars.

Stakes in 2 additional state-owned entities are expected to sell before the end of the financial year in June, 2023. The move shows greater commitment to privatization and reform of the Egyptian economy.

The next interest rate announcement by the Central Bank of Egypt is expected to take place on May 18, 2023. The last hike in March, 2023 was an increase of 2%. The announcement should shed light on expected economic conditions in the region as the central bank seeks to further reduce the current high inflation levels.

In the week ahead we expect the Egyptian pound to remain range bound between USD/EGP 30.95 and 30.80.

Further reading:

Aljazeera – Government sells 9.5% of state-controlled Telecom Egypt

Kenyan Shilling (KSh)

Compiled by Terry Karanja

The Kenyan shilling continues to drop this week and hit a fresh record low of 136.95/137.60— down from last week’s close of 136.65/85 with inflation expected to elevate further.

Moody’s Investors Service downgraded the long-term foreign currency and local currency issuer ratings to B3 from B2 and also lowered local and foreign currency country debt ceilings. This was due to increased liquidity risks faced by the Kenyan government. The global ratings agency placed Kenya on review for further downgrade. The shilling could see some more pressure in the coming week, with the increased FX demand from fuel importers against slower supply of hard currency in the country.

Further reading: