Consumer inflation has dropped to 41.2 percent in April 2023 compared to 45 percent in the previous month, according to data released by the Ghana Statistical Service (GSS).

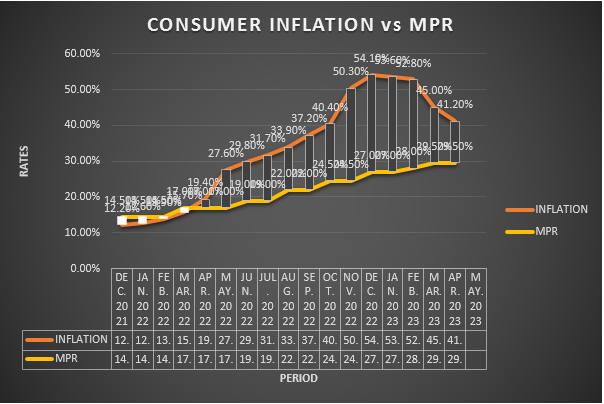

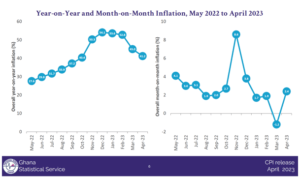

This is the fourth consecutive month – from January to April 2023 – in which the rate has dropped, having peaked at 54.1 percent last December. The rate was 53.6 percent in January, 52.8 percent in February, 45 percent in March and now 41.2 percent in April.

This development suggests a promising downward trend in the prices of goods and services. Nonetheless, between April 2022 and April 2023 there was a 41.2 percent increase in prices relative to March 2023, which had a 45 percent inflation rate.

The data from GSS revealed a gradual slowdown in the rate of price increases. In March 2023 there was a significant decrease in inflation, dropping from 52.8 percent in February 2023 to 45 percent.

Further, between March and April 2023 the rate of price increase slowed from 7.8 percentage points to 3.8 percentage points. On a month-on-month basis, prices of goods and services rose by 2.4 percent in April 2023 – reversing the deflation observed in March when prices decreased by 1.2 percent.

Examining the inflation figures in detail, the Government Statistician, Prof. Samuel Kobbina Annim, noted that food and non-alcoholic beverages were identified as major contributors to the overall inflation rate of 41.2 percent.

Food inflation for April 2023 stood at 48.7 percent while non-food inflation was 35.4 percent, resulting in a difference of 13.3 percentage points. Compared to the previous month, there was a more significant drop in non-food inflation (from 40.6 percent to 35.4 percent) than in food inflation (from 50.8 percent to 48.7 percent).

Among the 13 divisions analysed by GSS, housing, water, electricity, gas and other fuels recorded the highest inflation rate of 59.0 percent in April 2023. This was followed by furnishings, household equipment, and routine household maintenance at 56.3 percent, and food and non-alcoholic beverages at 48.7 percent. The division with lowest rate of inflation was restaurants and accommodation services.

Regionally, the Ashanti Region and Greater Accra Region saw inflation rates lower than the national average of 41.2 percent, with rates of 39.1 percent and 31 percent respectively. On the other hand, Western North Region recorded the highest overall inflation rate of 64.0 percent – driven primarily by food inflation at 78.3 percent in April 2023.

The GSS data also highlighted the different regions’ contribution to the overall inflation rate. Greater Accra Region contributed 16.9 percent, followed by the Ashanti Region at 28.1 percent. The region with the lowest contribution was the North East Region, accounting for only 0.9 percent of the overall inflation.

“Looking at the inflation figures, it is clear that food and non-alcoholic beverages played a significant role in driving the inflation rate. In Western North Region, for instance, fruit and nut products recorded an inflation rate exceeding 150 percent; while live animals and other meat products saw an inflation rate higher than 100 percent,” Prof. Annim said.

He further stated that the latest data provide hope for the economy, as the gradual slowdown in the rate of price increases indicates a positive trend – although certain divisions and regions still face high inflationary pressures.

Providing further guidance to policymakers, the Government Statistician said: “Government and the relevant authorities will need to continue monitoring and implementing appropriate measures to maintain price stability and promote economic growth”.

Monetary policy & market expectations

The market expects this favourable base-effect to impact positively on headline inflation in Q2-2023, driving the disinflationary view in Q2-2023. It is expected that the full impact of higher-base effects will reinforce a further decline of headline inflation in Q2-2023.

“A scenario of a stable local currency performance and stable prices of petroleum products at the pumps would support the view of declining inflation in Q2-2023. Additionally, the central bank’s adherence to zero financing of government’s budget could also support monetary policy effectiveness to help tame and re-anchor inflation expectations,” said Apakan Securities.

“Despite our view of a downtrend in inflation, we remain cautious of possible risk factors in the near-term. Following the increase in Value Added Tax (VAT) by 2.5 percent to 15 percent in the 2023 budget, additional taxes have been proposed by government in April 2023 which include price-sensitive taxes. Furthermore, the tariffs on electricity and water were adjusted upward by 30 percent and 8.3 percent, respectively in Feb-2023.

“Thus, we foresee supply-side risks slowing the disinflationary path’s pace in the months ahead, locking up inflation above the medium target of 8±2% at end of the year,” it stated.