Cross the street to a well-furnished convenience store and notice that behind the counter are numerous products with a ‘made-in-China’ label. Walk back to the living room and take a panoramic view. It is likely that over half of the electronic gadgets are sourced from Chinese companies. Indeed, China is everywhere – and it has come to us in many ways. This phenomenon is not different for arenas of funding in Africa, as China continues to meet the continent’s investment needs in no small way.

Between 2000 and 2014, China initiated an unprecedented wave of investment in Africa. In fact, a staggering 3,485 projects worth a whopping US$273.6billion were recorded during this period. That’s a lot of zeros! The primary beneficiaries of these investments were Kenya, Ethiopia, Ghana and DR Congo, receiving inflows of around US$12.1billion.

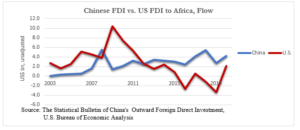

Within the same period (i.e., 2013) something remarkable happened that changed the economic landscape of Africa forever. China overtook the United States as the region’s largest equity investor in foreign direct investment (see figure below).

It was a pivotal shift that would pave the way for the Asian giant to further cement its economic footprint. After 2017, China continued to pour investment into Africa; filling the void left largely by other development partners, especially the United States.

China’s investment in Africa has sparked debate, as critics denounce it as a modern manifestation of colonialism. However, the reality says something different.

China’s move in Africa has been met with criticism. Related investments have been described as a new type of colonialism, with loan facilities seen as debt-trap diplomacy. These narratives do not constitute an exhaustive list, as other emerging descriptions have strangely made their way into several research works and prominent news outlets. If not political patronage, then it is an elite capture. Some even argue that Chinese investments do not only make ethnic identities more salient but also encourage local corruption.

On the margins of these criticisms are also issues of unintended consequences, particularly the impact on localised crime. These issues have led to protests and tensions between Chinese investors and local communities.

Reality Check

While there are concerns about Africa’s debt sustainability, environmental impact and localized crime, a nuanced and even-handed analysis of the issues highlights a more complex reality than what these criticisms suggest. This is especially true since China is now the easy target for all these people trying to get their point across.

To begin with, localised crime – including environmental degradation, are not exclusive to Chinese investment in Africa. These issues are clearly amplified in many parts of the world, so singling out China on this matter can be viewed as a case of ‘selective amnesia’

It is imperative to foster cooperation and dialogue among Chinese investors, African governments and local communities. Furthermore, Chinese investment has brought significant benefits to Africa which cannot be ignored. Recognising and acknowledging these gains is crucial rather than simply dismissing them. Yes, there are challenges – but “the baby should not be thrown out with the bathwater”. Similarly, we should neither “toss the celebration with the hindrances” nor “scour the Teflon when washing the pan”.

It is imperative to draw attention to the fact that China is seriously filling the continent’s infrastructure gap, and the benefits cannot be understated. Developing vital infrastructure like railways, ports and roads has created thousands of jobs and stimulated economic growth in many African countries.

For instance, the Mombasa-Nairobi Standard Gauge Railway in Kenya, funded by China, has considerably decreased transportation expenses and enhanced trade between Kenya and China. Another notable instance is construction of the Addis Ababa-Djibouti Railway in Ethiopia. This railway establishes a vital connection between landlocked Ethiopia and the port of Djibouti, supporting the growth of Ethiopia’s burgeoning economy.

What makes Chinese investment irresistible to African countries?

Well, it’s a perfect blend of freedom and opportunity. China’s demand-driven approach empowers African nations to shape their own destiny, pursuing development at their own pace. With an eye on infrastructure and accessible financing, China emerges as a vibrant alternative to traditional Western investors.

The non-interference policy ensures these nations can grow without external meddling, while diversified partnerships open doors to exciting new possibilities. Add a dash of cutting-edge technology and local job creation, and you have a recipe for transformative growth. African countries are seizing the moment, embracing China’s investments to propel them toward a brighter, more connected future.

It seems refreshing to conclude on an investment model that appears to work perfectly well for Africa-China relations. In reading the paragraphs above, one can hardly shake-off the impression that Chinese investments present substantial and better opportunities for Africa. Indeed, there are valid concerns and it is okay to grapple with the issue’s complexity. However, one thing is clear: Africa needs a nuanced and collaborative approach that leverages the strengths of all stakeholders. This will ensure that respective countries receive the investment they need to thrive, while also promoting sustainable and inclusive development. The stakes may be high, but the potential rewards are higher. It is time to move beyond the rhetoric of criticism and competition and forge a brighter future for Africa – one that is powered by collaboration and innovation.

As we reach our conclusion, it’s clear that the Africa-China investment model is a breath of fresh air – breathing life into partnerships and opportunities. Chinese investments paint a promising picture for African nations, showcasing a world of possibilities. While legitimate concerns exist, it’s essential to dive head-first into the complexities and embrace the challenge. Africa’s future hinges on a collaborative approach, uniting the strengths of every stakeholder. By so doing, countries will secure the investments needed to flourish; thus fostering sustainable and inclusive development.

The stakes may be high, but the rewards are monumental. It’s time to break free from the chains of criticism and competition, and stride toward an African renaissance fuelled by collaboration and innovation.

Dr. Ankrah is a Senior Research Fellow, Africa-China Centre for Policy and Advisory; and a Lecturer, Ghana Communication Technology University.