The International Air Transport Association (IATA) has released data for February 2023 global air cargo markets showing that air cargo demand rose above pre-pandemic levels.

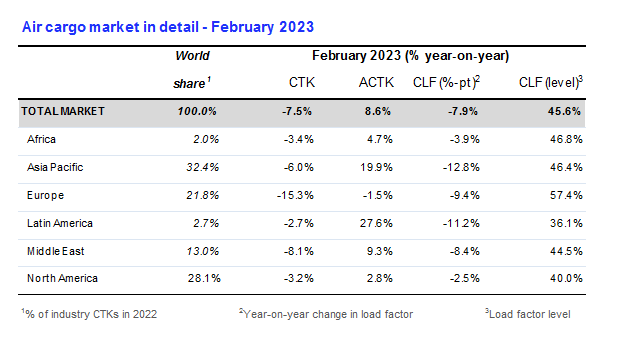

- Global demand, measured in cargo tonne-kilometres (CTKs*), fell 7.5% compared to February 2022 (-8.3% for international operations). This was half the rate of annual decline seen in the previous two months (-14.9% and -15.3% respectively). February demand for air cargo was 2.9% higher than pre-pandemic levels (February 2019) – the first time it has surpassed pre-pandemic levels in eight months.

- Capacity (measured in available cargo tonne-kilometres, ACTK) was up 8.6% compared to February 2022. The strong uptick in ACTKs reflects the addition of belly-capacity as the passenger side of the business continues to recover. International belly-capacity grew by 57.0% in February year-over-year, reaching 75.1% of the 2019 (pre-pandemic) capacity.

- Several factors in the operating environment should be noted:

- The global new export orders component of the manufacturing PMI, a leading indicator of cargo demand, continued to increase in February. China’s PMI level surpassed the critical 50-mark, indicating that demand for manufactured goods from the world’s largest export economy is growing.

- Global goods trade decreased by 1.5% in January; this was a slower rate of decline than the previous month’s -3.3%.

- The Consumer Price Index for G7 countries decreased from 6.7% in January to 6.4% in February. Inflation in producer (input) prices reduced by 2.2 percentage points to 9.6% in December (last available data).

”The story of air cargo in February is one of slowing declines. Year-on-year demand fell by 7.5%. That’s half the rate of decline experienced in January. This shifting of gears was sufficient to boost the overall industry into positive territory (+2.9%) compared to pre-pandemic levels. An optimistic eye could see the start of an improvement trend that leads to market stabilisation and a return to more normal demand patterns after dramatic ups-and-downs in recent years,” said Willie Walsh, IATA’s Director General.

February regional performance

Asia-Pacific airlines saw their air cargo volumes decrease by 6.0% in February 2023 compared to the same month in 2022. This was a significant improvement in performance compared to January (-19.0%). Airlines in the region benefitted from China’s reopening, which saw restrictions lifted and economic activities resumed. Available capacity in the region increased by 19.9% compared to February 2022, as more and more belly-capacity came online from the passenger side of the business.

North American carriers posted a 3.2% decrease in cargo volumes in February 2023 compared to the same month in 2022. This was a solid improvement in performance compared to January (-8.7%). Notably, the region saw a significant increase in international demand in February, which boosted its market share in international cargo traffic to beyond pre-pandemic levels (21.7% in Feb 2023 versus 18.2% in Feb 2019). Capacity increased 2.8% compared to February 2022.

European carriers saw the weakest performance of all regions, with a 15.3% decrease in cargo volumes in February 2023 compared to the same month in 2022. This was an improvement in performance compared to January (-20.4%). Airlines in the region continue to be most affected by the war in Ukraine. Capacity decreased 1.5% in February 2023 compared to February 2022.

Middle Eastern carriers experienced an 8.1% year-on-year decrease in cargo volumes in February 2023. This was a slight improvement to the previous month (-11.8%). Capacity increased 9.3% compared to February 2022.

Latin American carriers reported a 2.7% decrease in cargo volumes in February 2023 compared to February 2022. This was a drop in performance compared to January which saw a 4.6% increase. Capacity in February was up 27.6% compared to the same month in 2022.

African airlines saw cargo volumes decrease by 3.4% in February 2023 compared to February 2022. This was an improvement in performance compared to the previous month (-9.5%). Notably, the Africa to Asia route area experienced significant cargo demand growth in February, up 39.5% year-on-year. Capacity was 4.7% above February 2022 levels.