This article seeks to 1. To acknowledge that, there is a high attrition rate in the global insurance industry; 2. To acknowledge that, most of the people being affected are those within the sales and marketing or distribution department; 3. How regulated entities will build a robust system to manage the portfolios or accounts of their departed employees, so they don’t lose both the employee and their accounts or businesses.

Attrition can be explained as the departure of employees from the organization for any reason (voluntary or involuntary), including resignation, termination, death or retirement. The effects of attrition in the insurance sector are more cancerous than ever and is not getting any better in the future. If an employee of the Marketing department who is doing well resigns, then there could be a high probability that, he/she has been poached by a competitor and even in retirement they may establish an agency or Brokerage to still manage the portfolios and earn more commissions.

PRELUDE 1 (Developing Countries)

Insurance Business Development employee attrition is becoming a massive problem in the industry today. 83 percent of agents quit within three years, while 30% quit within three months, according to Centric Consulting.” {Solving the insurance industry’s turnover rate.

Providing agents with a good support system, including thorough training and quality leads, can make a difference. By Travis Batiza | August 23, 2019 at 05:00 AM}

All too often, poorly-designed onboard training programs fail to set new agents up for future success, dragging them to one of three fates: I. Either failing to meet their quotas and consequently getting fired, or; II. Feeling unsatisfied with their income and leaving a company on their own accord; III. And most importantly the good ones are being poached by competitors.

When it comes to combating the new industry norm of high staffing and low retention, “insurance recruiters have two options,” according to the PwC 2016 annual top issues report: 1. To hire experienced candidates; 2. Recruit and develop raw talent through effective training programs.”

PRELUDE 2 (Middle-Income Countries)

According to a study of attrition rate in insurance companies VOLUME 5 ISSUE 1, PAGE 277 by Dr Mamta shah.

60 percent of the employees left the insurance sector in less than 1 year; 22 percent of employees remained in the same sector for 1-3 years; 8 percent of employees worked in this sector for 4-6 years; 5 percent of employees remained in the same sector for 10 years and 5 percent has been in the insurance industry for more than 10 years

PRELUDE 3 (Developed Countries)

The average retention rate in the insurance industry is 84 percent, with the top-performing agencies in the 93 percent to 95 percent range. Retaining customers is all about the long-term relationship you build.

It’s no surprise that acquiring new clients is far more expensive than selling to existing ones. The Independent Insurance Agents of Dallas ‘Customer Loyalty And Retention Primer by Lynn Thomas, CompleteMarkets Editor’ point out a couple of key facts to consider:

- First, the insurance industry has the highest customer acquisition costs of any industry.

- Second, it costs seven to nine times more for an insurance agency to attract a new customer than to keep one.

Building a relationship with a new prospect or client can take several months or more. No matter the type of insurance or benefits you sell, you know the importance of strong client relationships. That’s why insurance agents or business developers focus so much on client retention.

The statistics and research above may be different from what is happening exactly in your jurisdiction but certainly have some similarities and maybe the same challenges of high attrition and high acquisition cost among others.

Why is the attrition of agents, marketers and others in the distribution lines a major concern?

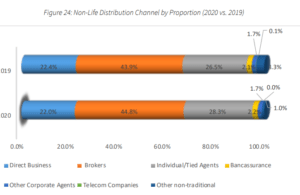

The diagram below is sourced from the 2020 annual report of the National Insurance Commission of Ghana.

A critical study of this diagram divulges the fact that Agents and Marketers are the main sales machinery of the industry. In the non-life sector alone about 50 percent of their sales are done by their marketers (Agents, Sales & Branch Managers) whiles the Life sector did an average of 73 percent between 2019 and 2020 from these same people.

By extension one can easily conclude that attrition by these people from one company to the other will not look funny for the losing company since these guys move with their business in most cases.

Can you imagine the effects of one company successfully poaching the top-performing sales guys to their firms.? This could easily cause

- Reduction of sales

- Low or no profits

- Liquidation among others.

DIAGRAM (A) NON-LIFE DISTRIBUTION

DIAGRAM (B) LIFE DISTRIBUTION

Why insurance companies are unable to effectively manage the businesses of salespeople after their exit

This is basically due to the strategy or systems the companies deploy in managing the business or accounts as they come in.

Many Insurance Companies do not deploy any strategy to curb this challenge until they realize that, the salesperson is leaving the company. It will be too late then if there were no controls from the beginning.

Many companies fail in this direction because;

- There is no strategy for managing the accounts or businesses coming to them.

- They unconsciously use the BOW TIE account management system which gives high bargaining power to the salesperson than the company.

Fig 3

The bow tie system is the traditional system of doing business. By this system, there is only one person (salesperson) who transacts the business between the two companies. Thus, the two companies are coordinated by this person and no one in the insurance company may know the other person, the main contact person from the buying firm. In this case, the insurance agent or marketer may be dealing with the HR, CFO, and CEO among others of the buying company exclusively, therefore, bringing a huge danger if any of the two should leave their post.

Coincidentally many insurance companies are using this system unconsciously and are very likely to hit the rock if that key salesperson vacates his/her post to a competitor.

Now study this bow tie system very well, juxtapose it to what your company is practising and answer for yourself whether you are guilty or not.

How can this understanding help us to solve the above problem (high attrition of sales or marketing officers)

In my opinion, I believe most companies in the Insurance Industry are practising the Bow tie system. This is because salespersons bring the business to insurance companies and do almost everything in terms of customer services, transactions, handling complaints, pushing for claims, and all other things to maintain the business with the company.

The client(insured) on the other hand, has little or no direct link to the insurance company and sometimes may not even know the location of the company but only the salesperson. This exposes the company to an unhealthy dependence on the salesperson for continuing business relationships with their clients.

How can insurance companies have a continuing relationship with their clients when the Sales or Marketing officer is no longer in the picture?

The solution for this challenge is not cast in stone. A combination of factors must be considered in solving this kind of challenge. These factors may include the following but are not limited to. I. First, identify if your company is facing attrition challenges; II. If attritions are happening, what is the effect on the company? and are there any strategies to handle the situation?; III. What is the hierarchical structure of your company and who are your employees; IV. What kind of product or service are you offering i.e., Group, Retail or both and at what TIME; V. Who is your target market?

A good diagnosis of the above questions will help to better understand the situation and prescribe a lasting solution to the problem.

It must be noted that the solution prescribe for a company ‘A’ may not work perfectly for company ‘B’ since their answers to the above 5 questions may be entirely different.

The diamond system of key account management is the most likely solution to this problem. It needs to be adapted to suit the particular structure of the company in question.

Fig4

Diamond Diagram

The Diamond system is just opposite to the bow tie system. This is where the various department of the two companies work with each other. e.g. Marketing Department of the Insurer Company to the Marketing Department of the Insured Company etc. before the main contact seller (Salesperson) meet with the main contact buyer (Buying Firm). The main challenge of this system however is it bureaucratic nature which slows down the speed of work. The Diamond system encourages ‘ORDER TAKER SALES’ making the salesperson here have no or little bargaining power over the business or account. This will therefore mean that the various departments must be a little sales inclined to feed the sales contact person with more business. This is more evident in the B2B arrangement.

The above diagram explains it all.

How do we do this?

The retail space of insurance is mostly dominated by the bow tie system since they have a huge clientele base. This can however be better managed with the Pareto rule of 80/20. In this case, the 20% of the client contributing to the 80% premium target or profit shall be uniquely managed based on the 5 critical questions above.

In group product lines, a cue can be taken from the diamond system together with the answers from the 5 critical questions listed above. Based on the outcome a unique Diamond System can be developed to manage the portfolios of the company. Time is one key thing which will be used to modify the strategy within regular intervals for continuous improvement.

BENEFITS TO COMPANY

- Build stronger, long-lasting relationships with customers

- Encourage customer loyalty

- Improve customer satisfaction

- Help get direct feedback from customers

- Long-term relationship with customers which helps in getting referrals

- Competitive advantage

- It will help check the following:

- Misselling

- Surrender

- Fraudulent business

- Minimizing the errors of inexperienced sales officers etc.

- It reduces the power of the sales officers to the client and helps them to focus.

- Makes the company more profitable

CONCLUSION

Taking into consideration the relative volatility of our industry, especially the high attrition of Agents, Sales Managers, and Branch Managers among others, a company can only boast of retaining its business portfolios or accounts which are the bloodline of the business. The company must be serious about investing in strategies to protect its portfolios to keep the growth of the business in the foreseeable future, especially in this era of pandemics and economic challenges.