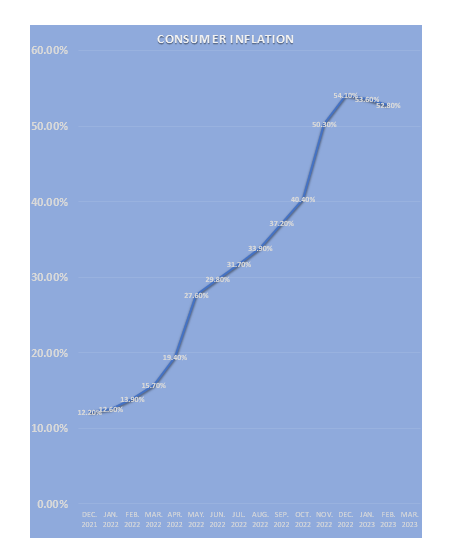

Consumer inflation has further declined to 52.8 percent in February 2023 from 53.6 percent the previous month, easing price pressures since January 2023.

Inflation peaked around 54.1 percent in December, 2022, accelerating for 19 consecutive months, according to data from the Ghana Statistical Service (GSS). The February 2023 inflation declined by 0.8 percentage points. Nonetheless, the rate still sits at around 5.28x of the Bank of Ghana’s upper policy target of 10 percent.

“We have sustained the reversal that started last month from the upward increases in inflation. It will be recalled that in January 2023, we had had a reversal in the upward trend from 54.1 percent in December 2022 to 53.6 percent for January 2023. So, we have sustained the reversal in the upward trend in inflation rate that we recorded in greater part of 2021 and 2022,” the Government Statistician, Prof. Samuel Kobina Annim, said.

Food inflation declined to 59.1 percent from 61 percent in January 2023, while non-food inflation remained the same at 47.9 percent for February 2023.

“The reduction we are recording is driven relatively more by the stability we are seeing from a food perspective relative to a non-food,” the government statistician said.

Month-on-month basis, inflation between January 2023 and February 2023 was 1.9 percent, increasing from the 1.7 percent. Food inflation declined to 2 percent from 2.8 percent the previous month while non-food inflation increased to 1.7 percent from 0.8 percent last January.

Inflation for locally produced items also declined to 49 percent from 50 percent in the previous month as imported items inflation also declined from 62.5 percent to 62.3 percent. The overall decline in inflation is a positive sign for the economy as the central bank will be looking to build on this momentum through its policy actions.

While commenting on the share of inflation across the various division, the government statistician indicated that the top three drivers of inflation during the period were food and non-alcoholic beverages leading by 48.1 percent from 46 percent logged the previous month, followed by transport at 14.1 percent, with housing, water electricity, gas and other fuels declining to 13.6 percent from 15.7 percent in January.

Further to this, across the 13 divisions of inflation, the GSS also noted that out of the top five divisions leading to the current inflationary record, the leading four are from the non-food group. These include transport, logging 70.3 percent; followed by furnishings and household equipment, which logged 69.8 percent. Housing, water electricity, gas and other fuels recorded 69.6 percent; personal care, social protection and miscellaneous goods and services registered 62.5 percent; and lastly, food and non-Alcoholic beverages logged 59.1 percent.

MPC actions

In an effort to drive inflation on a downward path, the Monetary Policy Committee (MPC) of the Bank of Ghana further raised the policy rate by 100 basis points to 28 percent from 27 percent.

The recent inflation record could influence the MPC’s decision which is expected later this month.

During 2022, the central bank cumulatively increased the benchmark policy rate by 1250 basis points to 27 percent – the highest rate in almost two decades as the MPC remains resolute in its stance, at least, through Q1-2023 until inflation shows signs of moderation and the implementation of other available monetary tools to control the money supply to rein in inflation.

MPC’s concern is to moderate liquidity in the system in order to underpin macroeconomic adjustments taking place to drive inflation on a downward path. Although the central bank expects inflation to peak in Q1-2023, the bank expects to bring inflation back to the medium-term inflation target band of 8±2 percent in the next four year, amid the International Monetary Funds (IMF) programme.

The MPC believes that these measures will help restore fiscal and debt sustainability and bring down inflation as well as help stabilise the currency.