The Vice President responsible for Legal and Strategy at the Ghana Fintech and Payments Association, Richard Nunekpeku, has stated that funding to tech-focused start-ups will remain an investment bright spot for the rest of the year, owing to the allure and growth prospects of the market.

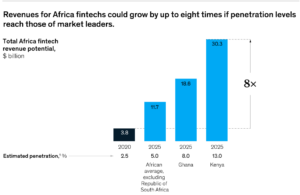

Despite estimates by management consultant Mckinsey and Company that Ghanaian fintech revenues could reach US$18.6-billion by 2025, some analysts had expressed concerns that the broader global economic crunch will have a grave effect on funding to less-established entities in 2023 – particularly those in the fintech space, as investors adopt a more cautionary stance over returns.

However, in an extensive interaction with the B&FT, Mr. Nunekpeku said he expects the recent performance of Ghanaian startups – which raised almost US$400million in 2022 – to be sustained as existing and emerging products continue to address real-life issues; not only locally, but also internationally.

“We see clearly the appetite of investors to continue supporting innovation across the continent, and Ghana is no exception. I anticipate this trend to continue, as we continue to witness new innovation across the board,” he said.

“We have seen that Ghanaian firms are getting out of their shells and expanding into other markets, and hopefully they will only continue to push boundaries further,” he added.

On the domestic scene, 2022 was considered a very successful year with 47 deals valued at over US$400million according to data aggregators, Big Deal Africa.

This amount is nearly eight times more than what the country achieved in 2021. As a result, Ghana was ranked fifth in funding raised on the African continent in 2022.

Fintech-focused

Responding to concerns that funding will be skewed toward emerging areas such as agrictech, regulation techology, healthtech and edutech – with fintechs bearing the brunt, Mr. Nunekpeku – who is Managing Partner at Sustineri Attorneys PRUC, a Start-ups, Small and Medium-sized Businesses (SSMBs)-focused law firm – argued that growth in funding to other sectors will have a multiplier effect on fintechs, as the latter is required for the success of every industry.

“Fintech funding will continue to grow, whether directly or indirectly. As we continue to see growth in these other areas, they will trickle into the fintech ecosystem. Innovation in these other areas is going to be without financial components, as customers will be expected to pay some service fees; and given these innovations are being developed on the back of technology, we are not going to go back to the traditional way of paying for those services. Fintech is still going to play a huge role,” he explained.

Furthermore, he stated that the value afforded by fintechs and their growth potential will ensure funding remains – even as the Ghanaian fintech penetration rate is expected to reach 8 percent by 2025, better than the continental average of 5 percent.

According to McKinsey’s analysis, the financial services industry in Africa has the potential to expand by approximately 10 percent annually; resulting in a market worth of around US$230billion in revenue by 2025, with the country expected to grow at 15 percent annually until 2025.

Already, the transactional solutions provided by fintechs could be 80 percent cheaper compared to those offered by conventional service providers.