The Ghana Cocoa Board (COCOBOD) has called for scrapping the 35 percent tax on small and medium-scale cocoa processing companies.

The cocoa sector regulator maintained that the tax, known as import duty, is a disincentive to cocoa processing startups and small and medium-scale enterprises (SMEs); and as such, could erode gains in promoting local value addition.

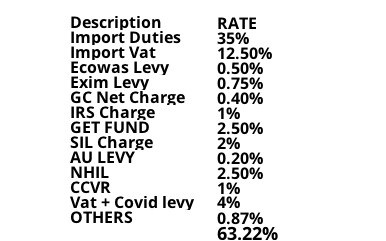

These SMEs produce mainly for the domestic market, and the tax is slapped on them when they purchase raw beans from licenced purchasing companies – even the beans sourced locally. In addition to this, they also pay other taxes at a combined rate of 63 percent.

The tax was introduced for companies operating under the Ghana Free Zones Authority, most of which produce for the export market. However, cocoa processing SMEs which have a chunk of their produce consumed locally are also affected.

Speaking at the 2023 National Chocolate Week launch in Accra, COCOBOD’s deputy Chief Executive, Emmanuel Ray Ankrah, explained that scrapping the tax will enable cocoa processing SMEs to become more viable entities in line with renewed efforts to retain maximum value domestically.

“It is a disincentive to startups, and we need an all-inclusive method to ensure that we do not cripple these entities,” he emphasised.

Mr. Ankrah disclosed discussions have already been initiated with relevant state agencies to review the toll and also take a holistic approach to the tax regime that affects artisanal chocolate processors.

“We believe in reducing the impact of tax on businesses as a way of cushioning them and making them more competitive,” he said.

The Cocoa Value Addition Artisans Association of Ghana (COVAAGH) has about 40 cocoa processing SMEs, playing various roles along the value chain.

The growing number of processors, Mr. Ankrah said, has helped to deepen efforts of employment creation, value addition and an increase in domestic consumption of cocoa products.

“Opportunities also exist for stakeholders including hoteliers, artisanal chocolate makers, caterers and others to take advantage of the season, and other opportunities created by COCOBOD, to make the national campaign and also maximise profit,” he said, while referring to the Valentine season that is marked every February 14.

Indeed, local chocolatiers have been instrumental in the country’s per capita consumption of cocoa from just half a kilogramme in 2017 to nearly 1.0kg currently.

With government’s agenda to increase processing and value addition, Ghana’s processing level currently hovers at around 43 percent, following the continued support government has extended to processors, chocolatiers as well as other ancillary assistance provided through cocoa consumption campaigns.

Currently, two committees – the National Committee for the Promotion of Cocoa Consumption (NCPCC) and COCOBOD African Continental Free Trade (AfCFTA) Cocoa Consumption Committee – have been working hand-in-hand to respectively increase domestic consumption as well as consumption within the AfCFTA market.

The 35 percent tax on processors is therefore seen as a major deterrent to promoting processing and consumption of cocoa products.

Deputy Tourism Minister, Mark Okraku Mantey, said Ghanaian chocolates have become a major product that adds to tourists’ experience in the country.

He said the Ministry of Tourism, Arts and Culture will continue to support the National Chocolate Week celebration in order to tell the Ghanaian story on the global front.

About the 2023 Chocolate Day celebration

This year’s National Chocolate Week celebration is themed ‘Eat cocoa, stay healthy and grow Ghana’.

The week-long event begins on February 9 and will climax on February 14, 2023 – and will entail a Chocolate City Haven at the Tetteh Quarshie Interchange which opens on Saturday February 11, 2023 among other activities.

Key collaborators for the events are COCOBOD, the Tourism Ministry, Ghana Tourism Authority (GTA) and Ministry of Information.