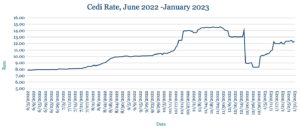

The Cedi gained against the dollar, trading at 12.05 from 12.50 at last week’s close after Ghana’s central bank raised interest rates by less than forecast amid expectations that an emergency $3bn IMF loan deal will be finalised by the end of this quarter. The central bank hiked rates by 100 basis points to 28%, 75 basis points less than market participants had been anticipating. Ghana also this week extended a deadline for local bondholders to accept a debt-exchange deal as part of efforts to restructure its debt to unlock the IMF loan. Ghana also sweetened the deal for investors by reducing the maturity of the new bonds to five years instead of 12. Retirees will also be eligible for a higher coupon rate. We expect the Cedi to stabilise around current levels as further progress is made on the debt swap programme.

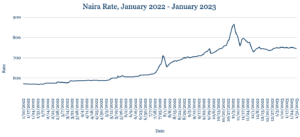

What Nigeria’s election month means for the Naira

Nigerians head to the polls this month amid worsening economic turbulence. Moody’s downgraded the sovereign rating by one level to Caa1—signalling “high credit risk”—and causing a plunge in government bond markets this week. A shortage of new Naira bills is crippling businesses reliant on cash for daily transactions, forcing the central bank to extend its Jan. 31 cut-off for tendering old Naira notes to Feb. 10. Africa’s biggest oil exporting nation faces further waves of petrol shortages, this time the combined result of hoarding by retailers unwilling accept old Naira notes while expecting to sell above official subsidized rates viewed as unsustainable post-election.

Among the three candidates most likely to replace President Muhammadu Buhari, all are establishment men: two are former state governors – Bola Ahmed Tinubu and Peter Obi – and the other, Atiku Abubakar, is a former vice president. But while Tinubu and Abubakar are positioning along traditional tribal lines, Obi is presenting himself as the most radically market-friendly candidate. Obi has been vocal about eliminating the country’s multiple exchange rates and reducing fuel subsidies. Effectively, this would mean devaluation in the short term at least.

Realistically, the Naira looks set for depreciation whichever candidate wins, with potentially worse results in the event of any delay to the election through disruption or violence (voting was delayed by a week at the last election in 2019). Even with a smooth election process, the economy will be in a state of limbo for several months, with Buhari’s replacement taking office about a month after the inauguration ceremony, which is slated for the end of May.

While the Naira has strengthened marginally over the past week, hitting 746 from 748 at last Friday’s close, this has been caused by the shortages of new notes temporarily limiting parallel market activity. This effect can be expected hold the Naira stable around current levels until the new bills go into full circulation, after which we anticipate a return to gradual depreciation as normal demand for FX returns.

Rand slides amid looming state of emergency

The Rand weakened against the dollar, trading at 17.43 from 17.20 at last week’s close as the country’s energy crisis continues. South Africa’s government said it is seeking legal advice on declaring a national state of emergency, with ongoing power cuts hampering economic progress and crushing investor confidence. The central bank said the power cuts will likely reduce economic growth by 2 percentage points this year. The government last imposed a state of emergency in 2020 during the Covid-19 pandemic. With the US Federal Reserve hiking rates this week by 25 basis points, in line with market expectations, we expect worsening domestic sentiment to be balanced by the broader global risk outlook in the week ahead.

Egypt Pound nears record low despite inflows

The Pound depreciated against the dollar, trading at 30.20 from 29.89 at last week’s close, edging towards the record low 30.50 hit last month. The country continues to struggle with high inflation rates—accelerating to 21.9% in December, well outside the central bank’s target range of 5-9%. Egypt’s move to let its currency float more freely as part of conditions to secure an IMF loan deal has helped revive foreign inflows. Net foreign assets increased for a second month, rising EGP47.28bn in December, though the balance remains a deficit of EGP494.3bn. With the central bank’s new hands-off approach, we expect gradual depreciation to continue in near term.

Record low for Kenyan Shilling as reserves sink

The Shilling dropped to a fresh low against the dollar, trading at 124.40/124.60 from 124.10/124.30 at last week’s close as FX demand continues to outstrip supply. The central bank’s efforts to prevent a steeper decline has resulted in foreign currency reserves hitting the lowest level in more than seven years, at just over $7bn—enough for 3.92 months of import cover. The central bank kept interest rates on hold at 8.75% this week, expressing confidence that inflation will decline in the near term. That follows government measures to allow duty-free imports of key food items such as maize, rice and sugar to tame rising prices. Inflation eased to 9% in January from 9.1% in December. While the Shilling could see a boost later this year as Kenya is set to receive at least $700m in disbursements from the IMF and the World Bank by the end of June, in the more immediate term we expect further weakness for the currency.

Uganda inflation rise leaves Shilling under pressure

The Shilling was little changed against the dollar, trading marginally stronger at 3683 from 3686 at last week’s close. Uganda’s annual inflation rate increased in January to 10.4% compared to 10.2% a month earlier. Food and non-alcoholic beverages continued to see the fastest price rises, though they accelerated at a slightly slower pace in January (22.9% compared to 23% in December). Furnishings and household equipment also saw a slight easing, though they accounted for the second fastest price increases in January (13.4% compared to 14.3% in December). We expect these inflationary pressures to chip away at the Shilling in the weeks ahead.

Tanzanian exports surge led by Zanzibar

The Shilling was steady against the dollar, trading at 2338—in line with last week’s close. Exports of manufactured goods increased by almost 16% from mainland Tanzania last year, with Zanzibar reporting a 36.6% increase, according to the Tanzanian Revenue Authority and the Bank of Tanzania. President Samia Suluhu Hassan spent much of last month overseas seeking investment in the country’s agriculture value chain, including talks with Swiss agribusiness Syngenta Agro at the World Economic Forum in Davos. Given the prospects of increased investment, we expect the Shilling to remain stable against the dollar in the week ahead.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.