Recently, I came across a quote by Brandon A. Trean that got me thinking. “It’s how we embrace the uncertainty in our lives that leads to the great transformation of our souls.”

Knowing that death is inevitable, how do we deal with life’s uncertainty? How do you leave a legacy for loved ones when you are no more? How do you ensure that the family built over the years does not suffer financially when the unexpected happens? This and many other questions came racing through my mind. Is there a way to safeguard our future so we don’t worry about what could go wrong instead of what can go right?

You may be surprised to know that the solution to all this dilemma is Life Insurance. Allow me to share my findings on the Life Insurance Industry in Ghana. A life insurance policy is essential for those who want to prepare for the unexpected. It serves as a safety net for surviving loved ones who will be directly affected by a loved one’s sudden demise. It protects the future of families for decades.

Background of the Life Insurance industry

According to the 2019 Annual Report of the Ghana Insurance Industry, the number of regulated life insurance companies reduced from 24 in 2018 to 20 in 2019. The industry continued to progress with a total asset base of GH¢5.8billion in 2021 against recorded total assets of GH¢3.85billion in 2019. The sector saw a remarkable growth as premiums grew from GH¢1.6bn in 2019 to GH¢2.5billion at 56 percent. Gross Policy Holder benefits also shot up from a previous GH¢800million in 2019 to GH¢1.29billion in 2021, totalling a 61 percent growth.

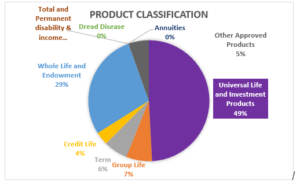

In terms of products, Universal Life and Investment Products contribute 49 percent of total premiums, followed by Whole Life and Endowment Products, with 27 percent in 2021. Group Life proves to be very potential by contributing about 7 percent of premiums in 2021.

Profit made by all the 20 insurance companies constitutes about 6 percent (162,857,002) of Gross Premiums for the period. The question is: Why are so many life insurers not as profitable as they ought to be?

State of insurance penetration in Ghana

Despite the efforts made by the National Insurance Commission (NIC) and the Ghana Insurers Association (GIA) to drive up insurance penetration in Ghana, insurance penetration still lies at 1 percent as of 2018 [NIC, Increasing Insurance Penetration in Ghana, 2018]. This figure excludes health insurance computing.

Insurance penetration in the African continent remains low at 2.28 percent, with Namibia and Lesotho leading with 6.69 percent and 4.76 percent, respectively. Statistics also show that the world average remains at 6.8 percent [Driving Up Africa’s Insurance Penetration, Corneille Karekezi 2017].

The definition of insurance penetration is the ratio of premiums written each year to the Gross Domestic Product (GDP).

What drives low insurance penetration? Are Ghanaians unaware of the benefits of insurance? Is insurance unaffordable or inaccessible to the public? Are individuals uninterested due to preconceived notions? This and many more questions linger as insurers push for a financially inclusive society for all.

Causes of low insurance patronage in Ghana

According to a pilot study conducted by NIC with support from GIZ in 2019, 98 percent of respondents had a general grasp of insurance. About 55 percent of the respondents also had perfect knowledge of insurance. Findings from the study indicate that insurance awareness is not the cause of the low insurance penetration. Bad publicity has been the major contributor to low insurance penetration in Ghana.

Bad publicity leads to a loss of trust. News of unpaid claims and aggrieved customers has contributed to the poor outlook of the sector than the volumes of claims paid annually. According to the Fourth Quarter-Market-Report-Life, 2021, benefit payment by the life insurance industry hit GH¢1.2billion at the close of 2021. This represents an 83 percent growth over the amount paid in 2018. There have been little or no efforts taken to publicise the total number of claims paid annually. It may surprise you to know that the life insurance industry pays an average of GH¢3,540,351.03 daily claims to policyholders.

Despite this, Ghanaian life insurance businesses continue to face service delivery issues, such as customers’ inability to obtain policy schedules and statements, unclear investment returns, challenges with premium collections, and intermediaries [registered tied Agents] not explaining the policy details to customers. Negligence on the part of customers happens when they do not read the terms and conditions at the point of sale. To this end, policy retention has come under scrutiny because of the ongoing challenges within the industry. What must life insurers and the regulator do to turn around the situation?

Solution

One of the many ways to deal with mistrust is by reinforcing the importance of insurance through continuous education, testimonials and innovative products and products accessibility. In so doing, potential customers may second-guess their decision to become secured.

Technological advancement presents the Life Insurance industry with an excellent opportunity to revolutionise insurance delivery. In the era of digitalisation championed by His Excellency the Vice President, Dr. Mahamudu Bawumia, there lies a great opportunity for an improved customer experience for deep Iisurance penetration. As seen in the general insurance sector, NIC’s implementation of the motor insurance database has led to its growth from 19 percent in 2020 to 26 percent in 2021. The value of the business also increased from GH¢566million in 2017 to GH¢2.3billion in 2021.

Let me use this opportunity to share some statistics on Ghana’s digital journey. In 2021, 15 million Ghanaians had access to the Internet. This represented a growth of 6.4 percent. Internet penetration stood at 50 percent as of January 2021. It is also worth mentioning that social media users grew by over 37 percent in 2021 from 2.2 million in 2020 to 8.2 million. The percentage of social media users is equivalent to 26 percent of the population.

What Hollard has done differently

Hollard Ghana has led in this space with its innovative products and unconventional partnership with Vodafone Ghana, Jumia Ghana, and Melcom.

Last year, Hollard Life partnered with Vodafone Ghana to introduce MeBanbo Life Insurance. This affordable life insurance product gives Ghanaians the opportunity to get insured with as little as GH¢1. Customers can sign on to this unique product by dialing USSD short code *269# on Vodaphone. Due to this automation, Ghanaians can now sign up for insurance in the comfort of their homes by choosing what package works for them.

More recently, Hollard partnered with global E-Commerce giants Jumia and Melcom – Ghana’s largest chain of retail department store owners – to increase insurance accessibility. Customers can visit Jumia and Melcom online stores to buy insurance at their convenience. These are some of the opportunity’s technology and digitalisation present for insurers in deepening penetration.

In customer experience, the biggest challenge is the absence of a well-coordinated and integrated approach from sales and distribution, premium collections, policy administration and customer service to address customer needs effectively. Often, customers get frustrated due to the disjointed approach to solving their issues. The result is policy holders cancelling their policies. These challenges, over the years, have resulted in mistrust of insurance companies.

Is an Omnichannel procedure the saviour of the industry?

An opportunity exists for companies to turn this rather adverse situation into a beneficial one. Using an Omnichannel approach toward customer experience is the solution to this.

Omnichannel is a multi-channel procedure that enables life insurers to provide a seamless experience to their users across the value chain from engagement to claims. The user, both internal and external, can use different media, such as face-to-face (branch), contact centre, and digital (mobile, desktop, tablet) to derive a seamless experience. Here are a few benefits of Omnichannel to life insurers.

Life insurers can collect and unify customer data from disparate channels and systems like device IDs, social media, mailing lists, point-of-sale (PoS) systems, loyalty, and referral programmes, etc. Insurers can maintain a 360o view of each policy holder who engages with the business. Using the data collected, life insurers can analyse the customer behaviour, interests, and intent for better product development. The availability of such a system presents a huge opportunity for upselling and cross-selling.

The Omnichannel approach enables insurers to provide their users with the ability to obtain the correct information at any moment. This will aid insurers in making contextual decisions across the value chain and the power of transacting through multiple media.

Benefits of an Omnichannel personalisation

Life insurers will be able to interact with policy holders more directly and efficiently when Omnichannel is personalised. Making it easier to access policy information and increasing transparency while lowering mistrust among potential consumers. Its attendant benefits, such as a reduction in mis-selling, policy cancellations and policy lapses, will be evident to the industry.

In conclusion, I urge all life insurers to take a serious look at automation and digitalisation in every aspect of their businesses. The ‘traditional’ Bancassurance channel is under intense scrutiny because the banks have embraced initialisation, thus limiting interaction with life insurance agents. Ghanaians are becoming more sophisticated and spending more time on their phones and online. Life insurers must consequently begin to reconsider digitalisation if they successfully reach out to the uninsured.

>>>The writer is the Head of Premium Admin at Hollard Life Assurance