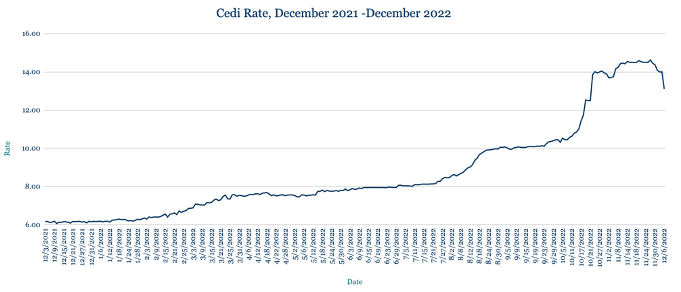

The Cedi strengthened against the dollar, trading at 13.15 from 14 at last week’s close after the government announced a debt exchange programme that will enable domestic bondholders to swap their existing holdings for a set of four new bonds maturing in 2027, 2029, 2032 and 2037. While bondholders won’t be subjected to a haircut on the principal, they will have to accept reduced interest payments, with the debt paying no annual coupon next year, 5% in 2024 and then 10% from 2025 until maturity. Ghana is continuing to negotiate a potential $3bn loan from the IMF, though that will hinge on the country’s ability to improve its debt sustainability—something the domestic bond restructuring will support. We expect the Cedi to gain further ground against the dollar, potentially strengthening to around the 12 level in the near term.

Morocco looks favourite beyond World Cup

With Moroccans paying upwards of $750 a ticket for Saturday’s historic World Cup clash – the first quarter-final for any African country in over a decade – the nation’s football glory offers welcome distraction. Africa’s champion on the pitch faces a slowdown at home, with economic growth slipping to 1.3% this year amid drought, imported inflation and reduced global demand. The Dirham has depreciated by 15% to MAD10.57 from MAD9.21, weighed down by higher food and energy costs. While the effects of persistent inflation, drought and higher commodity prices are likely to keep the Dirham subdued in the short term, we expect a gradual rebound of the Dirham as tourism recovers to pre-Covid levels and investment picks up. Europe is increasingly looking to Morocco for clean energy, with the Netherlands and Germany among countries exploring green hydrogen prospects. Moroccan Energy Transition Minister Leila Benali told Bloomberg this week that final investment decisions are imminent for “at least two competitive industrial projects” in 2023, following discussions about large-scale hydrogen projects with Gautam Adani, Asia’s richest person.

Weaker Naira heading for holiday remittances recovery

The Naira weakened against the dollar, trading at 745 from 729 at last week’s close, with impact fading from the central bank’s intervention in the parallel market and arrests of bureau de change operators. Nigeria’s oil production has rebounded from a recent slump, climbing to 1.6 million barrels per day from 937,000 in September in response to beefed up security efforts from the navy and the police to protect against rampant oil theft. The Independent Petroleum Association of Nigeria has blamed fuel shortages on FX scarcity at the central bank’s official window, which was also exacerbated by the Nigerian National Petroleum Company failing to import enough fuel to meet demand. We expect the Naira to recover somewhat in the coming week or so, helped by diaspora remittances and businesses winding down for the Christmas holidays.

Rand gains as ANC backs Ramaphosa against corruption case

The Rand gained against the dollar, trading at 17.33 from 17.53 at last week’s close, as President Cyril Ramaphosa held on to power with his party’s support. The President fought off calls for his resignation after a report alleged misconduct related to millions of dollars of cash from his Phala Phala game farm. Ramaphosa has challenged the report in court, which he claims is unlawful. The Rand was supported by a moderate global risk-on mood, partially driven by an easing of Covid restrictions in China. Based on current trends, we expect the currency to continue strengthening towards 17 levels.

Egypt Pound dips amid sharpest contraction since 2020

The Pound depreciated marginally against the dollar, trading at 24.60 from 24.56 at last week’s close. The country’s non-oil private sector faced its sharpest contraction since June 2020, with the S&P Global Egypt Purchasing Managers’ Index falling to 45.4 in November from 47.7 a month earlier. Any reading below 50 signals a contraction. The Pound’s depreciation combined with increased raw materials costs and weaker export demand have all contributed to slower activity. That pressure is likely to ease in the medium term as global commodity prices start to decline. However, we expect the Pound to weaken further in the near term due to the economic strains the country is facing.

Kenyan Shilling hits new low before remittances season

The Shilling declined to a fresh dollar low, trading at 122.70/122.90 from 122.20/122.40 at last week’s close amid dollar demand from the energy and manufacturing sectors to make year-end and Christmas orders. Annual inflation eased slightly in November, slowing to 9.5% from 9.6% in October, mainly due to seasonal factors and falling international food prices. Food price inflation slowed to 15.4% from 15.8%, though fuel price inflation accelerated to 13.8% from 11.7% in October. Kenya’s FX reserves increased slightly to $7.07bn from $7.05bn a week earlier. We expect the Shilling to gain support from holiday season remittances, which will help bridge the country’s current account deficit in the wake of a rising import bill.

Ugandan business uptick spurs Shilling gains

The Shilling strengthened against the dollar, trading at 3685 from 3733 at last week’s close as business activity showed improvement for a fourth consecutive month. The Stanbic Bank Uganda Purchasing Managers’ Index rose to 50.9 in November from 50 the previous month as output and new orders expanded. The African Development Bank said it will provide $301m to help fund an upgrade to the country’s ageing rail infrastructure and reduce reliance on road transport for exports and imports in and out of neighbouring Kenya. Against this backdrop, we expect the Shilling to continue strengthening against the dollar in the near term.

Tanzanian growth buoys Shilling outlook

Tanzania’s Shilling was unchanged against the dollar, trading at 2333, in line with last week’s close. Authorities have started rationing water in Dar es Salaam as rains failed to arrive and water levels dropped on the Ruvu river. Millions of livestock have perished and crops have been destroyed by the country’s worst drought in at least 40 years. Tanzania’s economy overall has been expanding, growing by 4.8% in the second quarter, according to the Bank of Tanzania. That growth was propelled by an pickup in construction activity (growing 15.8%), trade and repair (8.3%), and transport and storage (8%). Given stronger economic growth, we expect the Shilling to appreciate marginally against the dollar by the end of the year.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.