The Nzema Manle Rural Bank Limited at Aiyinase in the Ellembelle istrict of the Western Region has posted some remarkable growth in all operational indicators in the 2021 year under review.

The bank has recorded a post-tax profit of GH₵632,039 representing 14% growth in the 2021 year under review, as against GH₵553,427 recorded in 2020.

Total Assets of the bank during the 2021 year under review stood at approximately GH₵61.2million as compared to about GH₵55million recorded in 2020, representing 11.33% growth.

The Board of Directors’s Chairman announced these and more at the bank’s 39th Annual General Meeting (AGM) of shareholders held last Saturday.

Macroeconomic Environment

According to him, the Ghanaian economy recovered strongly from the COVID-related economic downturn in 2020 – as evidenced by the provisional 2021 National Accounts Statistics published by Ghana Statistical Services (GSS) in April 2022.

Overall, real GDP for 2021 grew strongly by 5.4% in 2021 compared to the 0.5% recorded in 2020. Non-oil real GDP growth also increased, to 6.9% compared with the 1% recorded in 2020.

According to the GSS, end-period December 2021 inflation was 11%; a slight increase from the 10.6% of 2020. The cedi also depreciated against major currencies during the 2021 financial year.

Operational Performance

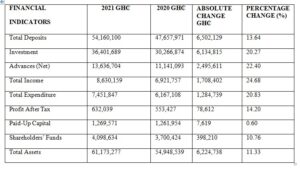

In spite of the challenging macroeconomic environment coupled with other domestic operational challenges that pertained during the reviewed year, the bank managed to pull yet another impressive operational performance in all financial indicators for 2021, as indicated in the table below.

Operational performance of the bank in the year 2021

Dividend

The Board has approved a final dividend of GH₵0.0073 per share, totalling GH₵101,403 after two years of complying with a regulatory directive to suspend dividend payment.

Corporate Social Responsibility

The bank continues to initiate and support projects under its corporate social responsibility programmes with the aim of giving back to society. For the year 2021, a total of GH¢45,044 was spent on social programmes for local communities; with the education sector receiving a significant portion of the total value spent under CSR.

This is largely due to the bank’s commitment to improving the educational opportunities and facilities for people within the communities in which it operates.

Human Capital Development

To ensure efficiency in the performance of duties, the bank organised a series of training and workshops for both directors and staff; and as well, most of the staff members also undertook various programmes of study in higher institutions of learning to upgrade themselves. This, the Board believes, will positively affect productivity.

Future Outlook

The Board Chairman anticipates a better business future outlook – considering the opening-up of borders among the ECOWAS countries after their closure following the COVID-19 pandemic, businesses and trading should soon pick up across West Africa.

However, the war between Russia and Ukraine, passage of the E-levy Act, rising inflation, rising fuel prices and exchange rate depreciation are likely to affect economic activities in the country during the short- to medium-term.

The bank’s Chief Executive Officer, Mr. Thomas Quayson, in an interview with B&FT said the bank will continue investing in the people in order to ensure they have the right talent at all times to support achievement of the bank’s goals, improve efficiency of operation, and deliver superior value to its stakeholders.

He further assured the bank’s esteemed shareholders that management will always remain focused on realising their ambition of penetrating the market irrespective of the very stiff competition in their operational territories, primarily to consolidate a positive impact in rural banking.

While he acknowledges the local and national economic challenges resulting from the raging Russia/Ukraine war and COVID-19 pandemic, he stressed that the bank’s Board and Management will always remain confident in their ability to continue rising to the occasion and achieve better operational results in 2022 and beyond.