The NGIS Money Market Fund PLC, managed by the New Generation Investment Services Limited, NGIS, has posted a significant growth in all indicators.

The fund recorded an appreciable gross investment income of 20.36 percent, translating to a little over GH₵6.8m even though there was marginal increase in interest rates on money market instruments in 2021.

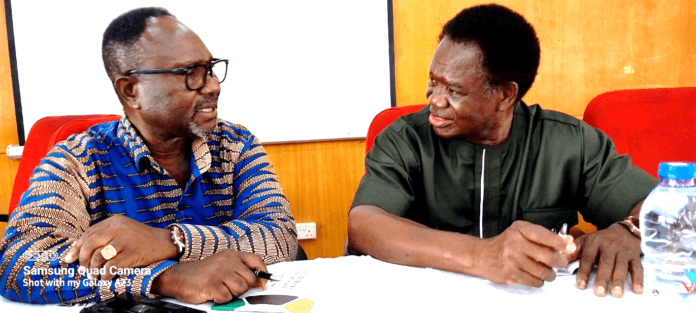

The General Manager of NGIS, Edward Asamoah, in a presentation at the fund’s 3rd Annual General Meeting (AGM) of shareholders held at the SSNIT Conference Hall at Adum in Kumasi, revealed that the operating expenses increased by 34.32 percent from a little over GH₵37,000 in 2020 to almost GH₵50,000 in 2021.

This feat led to a 17.12 percent increment in net investment income from about GH₵400,000 recorded in 2020 to almost GH₵510,000 in 2021. He added that total liabilities for the year stood slightly above GH₵41,000, representing 25.47 percent less than the previous year.

Redemption of shares increased from the previous years of almost GH₵990,000 to approximately GH¢1.5m, representing 60.70 percent while sale of shares increased by 119.77 percent from about GH₵840,000 to a little over GH₵1.8m.

Net Asset Value per share increased from GH₵0.6729 to GH₵0.7770, representing an Annual Yield of 15.47 percent. The overall portfolio of the fund includes cash and cash equivalent of GH₵153,445 (3.43 percent), short-term investments of GH₵1,912,537 (42.72 percent), medium-term investments of GH₵2,150,929 (48.05 percent), and other assets of GH₵259,624 (5.80 percent).

Outlook for 2022

The fund manager noted further that the challenging global economic conditions in 2022 are expected to compound further as the global economy is expected to experience sharp deceleration. To this effect, inflation across most countries has surged as a result of rising commodity prices and higher supply disruptions.

As the world is yet to recover from the COVID-19 pandemic, the slowdown in advanced economies is likely to spill over to emerging markets and developing economies. The slowdown in the growth of the global economy is expected to trickle down to the domestic economy, leading to moderate economic growth amid high inflation, supply bottlenecks and exchange rate uncertainty.

Mr. Asamoah explained that the recent downgrading of Ghana’s creditworthiness by some international rating agencies has increased the country’s woes in securing funding from the international capital market to execute the government’s flagship programmes.

These developments may impact negatively on Ghana’s IMF-support programme, but that notwithstanding, macroeconomic framework that will underpin an agreed IMF-supported programme is expected to present a stronger coordinated monetary and fiscal policy framework that will anchor stability.

He, however, assured shareholders of the fund that as government continues to pursue domestic funding to close the budget deficit gap for 2022, money market interest rates are expected to continue in its upward trajectory, and this will impact positively on the fund’s growth prospects in 2022 since most of the fund’s investment portfolio is in fixed income instruments.

The Chairman of the Board of Directors, Prof. Kwaku Dwumor Kessey, for his part, expressed optimism that the fund is expected to grow higher in 2022 than it was in 2021. This expected growth, he mentioned, would be influenced by the rising money market interest rates as all the fund’s investment portfolio comprises money market and fixed income instruments.

He, therefore, encouraged all shareholders to take advantage of the fund’s positive outlook and buy more shares to increase their holdings and to fully benefit from the fund.

Prof. Kessey assured shareholders that the directors would prudently ensure the safety of their deposits, and work within the regulations binding their work.

“In preparing these statements, the directors have selected suitable accounting policies and then applied them consistently, made judgments and estimates that are reasonable and prudent, and followed International Financial Reporting Standards (IFRS),” he stressed.

“The directors are responsible for ensuring that NGIS Money Market Fund PLC keeps proper accounting records that disclose, with reasonable accuracy, the financial position of the fund. The directors are also responsible for safeguarding the assets of the fund and taking reasonable steps for the prevention and detection of fraud and other irregularities,” he said.